From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Shows Mixed Signals: Pig Iron Exports Surge Amidst Production Declines

Ukraine’s steel sector presents a complex picture. While “Ukraine increased its pig iron exports by 55% year-on-year in January-July,” overall steel production figures indicate a decline. According to “Ukraine ranked 23rd among 70 countries in steel production in July,” Ukraine’s July steel output decreased by 18.1% year-over-year. While increased pig iron exports are a good indicator for the need to produce steel, no direct relationship between activity and these trends can be explicitly established based on the news titles. “Global steel production fell by 1.3% y/y in July” also highlights a broader international downturn. “Ukraine reduced iron ore exports by 8% y/y in January-July” indicates input shifts as well. Finally, “Ukraine’s ferroalloy industry exported 63.5 thousand tons of products in January-July” shows increasing exports in Ferroalloys for the observed period.

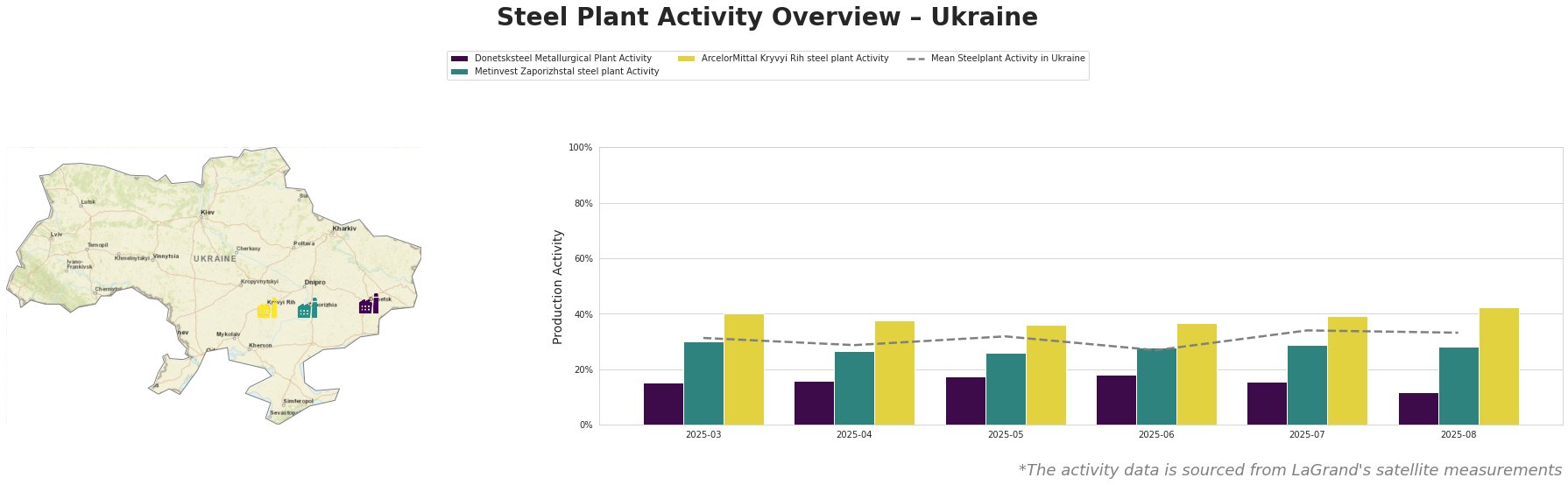

The mean steel plant activity in Ukraine fluctuated, reaching a low of 27.0% in June and a peak of 34.0% in July, before slightly decreasing to 33.0% in August.

Donetsksteel Metallurgical Plant consistently operated below the national average. Its activity peaked at 18.0% in June but dropped significantly to 12.0% in August, the lowest among the observed plants. This decline doesn’t show an explicitly obvious direct link to provided news titles.

Metinvest Zaporizhstal steel plant’s activity remained relatively stable, fluctuating between 26.0% and 30.0%. It generally tracked close to the national average. No direct connection between Metinvest Zaporizhstal and the provided news titles could be explicitly established.

ArcelorMittal Kryvyi Rih steel plant consistently exhibited the highest activity levels among the observed plants, peaking at 42.0% in August. This level exceeds the national average. No direct link with the news about overall Ukrainian steel production decline can be explicitly established from news titles alone, but the plant seemingly bucks the overall trend based on activity measurements.

Donetsksteel Metallurgical Plant, located in Donetsk, primarily produces pig iron using integrated (BF) processes. While certified by ResponsibleSteel, its activity has been consistently below average, and experienced a notable decrease to 12% in August. The plant’s reliance on BF and EAF processes potentially makes it vulnerable to fluctuations in met coal and iron ore availability. The activity decline in August does not have an explicit connection to the provided news articles.

Metinvest Zaporizhstal steel plant in Zaporizhzhia, also an integrated BF producer, focuses on finished rolled products for sectors like automotive and steel packaging. Its activity has been relatively stable, hovering around the national average, suggesting resilience despite the broader production decline. While there are plans for a new BOF, the plant currently uses OHF. No direct connection to the news can be explicitly established.

ArcelorMittal Kryvyi Rih steel plant, a major integrated BF producer in Dnipropetrovsk, manufactures semi-finished and finished rolled products for building and infrastructure. It has the highest and most consistently increasing activity levels, peaking at 42.0% in August, exceeding the national average. “Ukraine reduced iron ore exports by 8% y/y in January-July” and its own iron ore sourcing could explain its stability and growth.

Evaluated Market Implications:

The divergence in activity levels between ArcelorMittal Kryvyi Rih and Donetsksteel Metallurgical Plant suggests potential regional supply imbalances. The overall decline in Ukrainian steel production coupled with increased pig iron exports implies a potential shift towards exporting raw materials rather than finished steel products.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor the output of Donetsksteel Metallurgical Plant due to its declining activity and the potential for supply disruptions. Diversify sourcing to include ArcelorMittal Kryvyi Rih and imported steel, particularly for finished rolled products.

- Market Analysts: Track the correlation between pig iron export volumes and finished steel production to assess the long-term impact on Ukraine’s steel industry. Monitor the performance of ArcelorMittal Kryvyi Rih as a bellwether for the overall health of the sector.

Closely scrutinize iron ore export data in conjunction with domestic steel production to refine supply chain forecasts.