From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Soars on Exports, Despite Inventory Rise: Activity Surge at Coastal Plants

China’s steel market presents a very positive outlook, driven by a substantial increase in exports, especially of semi-finished steel and stainless steel. This trend is highlighted by the news articles “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025” and “China’s stainless steel exports up 5.1 percent in January-July 2025“. While “Stocks of main finished steel products in China up 5.0 percent in mid-Aug 2025” indicates rising inventories, activity data reveals heightened production at specific coastal plants, suggesting a focus on export markets. However, no direct relationship can be established between the article “Top 10 global steel producers in July 2025 – Worldsteel data” and the activity data of the plants.

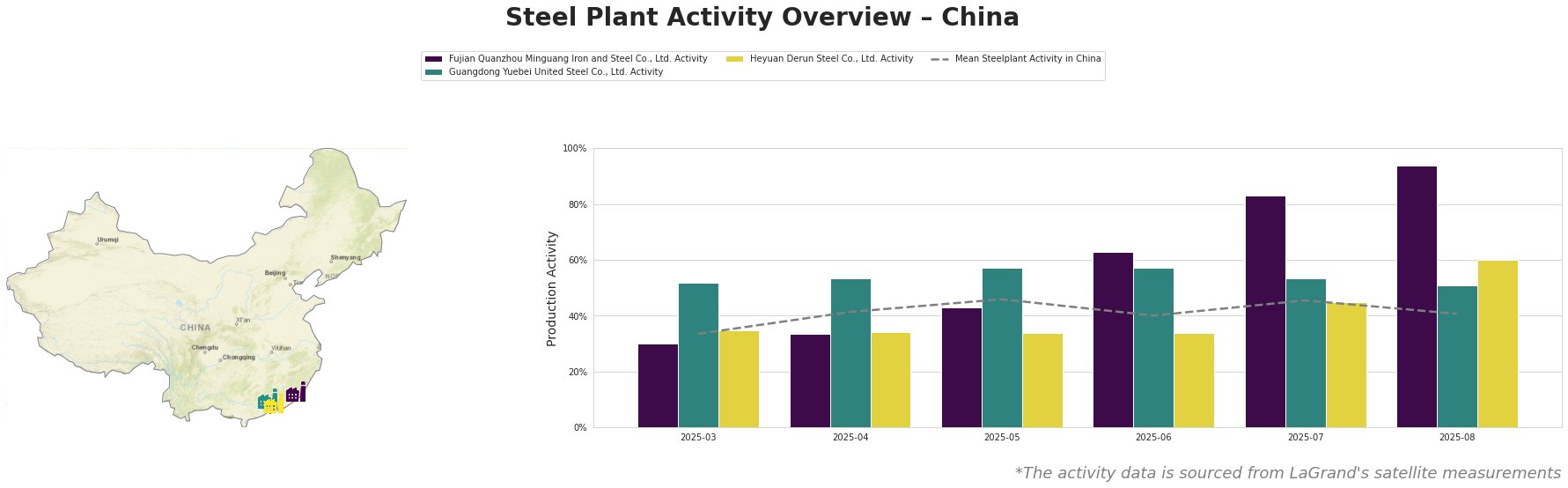

The mean steel plant activity in China fluctuated, peaking at 46% in May and July. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. shows a significant upward trend, reaching 94% activity in August, substantially above the national average. Guangdong Yuebei United Steel Co., Ltd.’s activity remained relatively stable between 51% and 57%. Heyuan Derun Steel Co., Ltd. experienced the lowest activity initially at 34% for three months, with an increase to 60% in August.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-BOF producer in Fujian with a crude steel capacity of 2.55 million tons, produces finished rolled products like round bar and wire rod. Its activity surged dramatically, from 30% in March to 94% in August. This escalation potentially aligns with the increased semi-finished steel exports reported in “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025,” as BOF-based mills often supply semi-finished products.

Guangdong Yuebei United Steel Co., Ltd., another integrated BF-BOF producer in Guangdong with a crude steel capacity of 2 million tons, primarily produces rebar for building and infrastructure. Its activity has been relatively stable, ranging between 51% and 57%. While not directly correlated to the export news, the stable high production suggests consistent domestic demand for rebar.

Heyuan Derun Steel Co., Ltd., an EAF-based producer in Guangdong with a crude steel capacity of 1.2 million tons producing hot rolled rebar and billet, increased its activity from a low of 34% for three months to 60% in August. The firm also produces semi-finished products. This increase may be related to “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025,” which has elevated the production of semi-finished products.

The surge in activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd., coinciding with the rise in semi-finished steel exports, suggests that coastal steel plants are capitalizing on export opportunities. The inventory increase reported in “Stocks of main finished steel products in China up 5.0 percent in mid-Aug 2025” might not indicate a softening of the market, but a strategic build-up of inventories for export. Given the very positive export outlook and high coastal mill activity, steel buyers should:

- Prioritize securing supply contracts with mills demonstrating high production and export focus, particularly those like Fujian Quanzhou Minguang Iron and Steel Co., Ltd., given the reported surge in semi-finished steel exports reported in “Sharp Increase in China’s Semi-Finished Steel Exports in Jan.–July 2025“

- Closely monitor inventory levels reported by CISA, and consider potential price volatility if inventories continue to climb while coastal production remains high reported in “Stocks of main finished steel products in China up 5.0 percent in mid-Aug 2025“.

- Factor in potential longer lead times from coastal mills due to export demand.