From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Government Intervention and Stable EU Steel Output Signal Opportunity Amidst Uncertainty

The European steel market presents a mixed picture. In the UK, government intervention in the steel sector is evident, as highlighted by news articles such as “UK government seizes Liberty Speciality Steel UK to protect jobs“, “The UK government is preparing to acquire its third largest steel mill.“, “U.K. Government to Take Partial Control of Liberty Steel“, “UK government considers taking over Liberty Speciality Steel UK“, and “The UK government is preparing to take over its third-largest steel plant“. These developments, however, do not appear to have had an immediate impact on overall European steel plant activity levels based on satellite-observed data. There is no direct correlation between the UK Government interventions and the monthly aggregated activities of the observed EU steel plants.

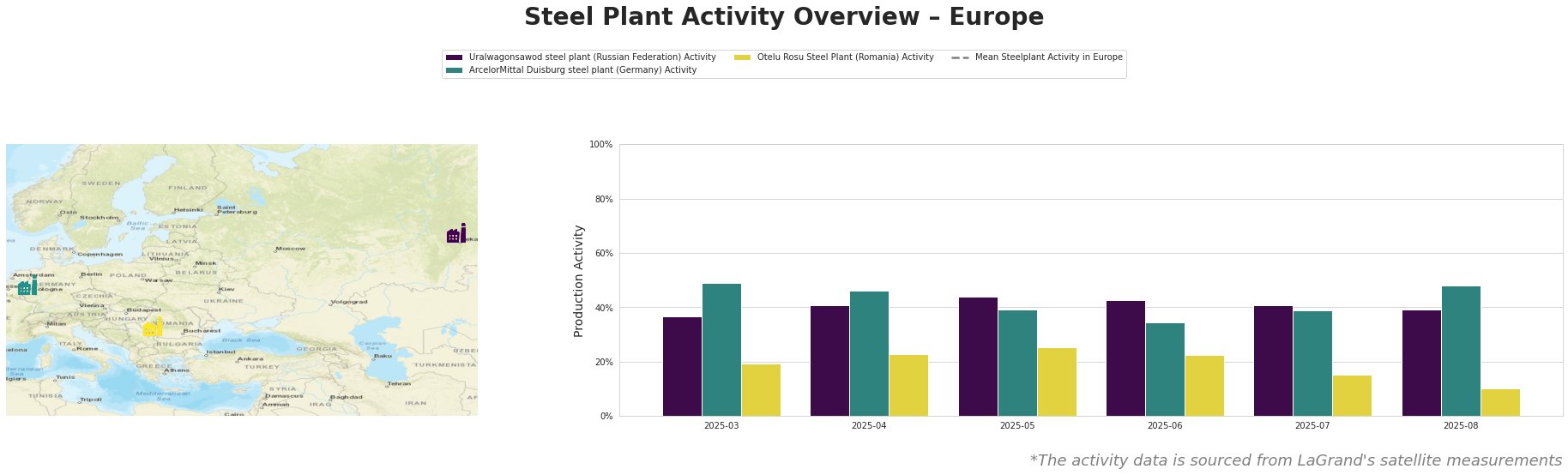

The Mean Steelplant Activity in Europe shows a general upward trend from March to May, peaking in May, followed by a slight decrease in June before rising again to similar high levels in July and August.

Uralwagonsawod steel plant activity shows a relatively stable trend, fluctuating between 37% and 44% with a minor decrease to 39% in August. Given the plant’s focus on the defense sector, activity levels are likely influenced by factors unrelated to the European market conditions, and no direct connection to the provided news articles can be established.

ArcelorMittal Duisburg, a major European producer with a 1300 ttpa BOF capacity, shows variable activity. Activity decreased from 49% in March to 34% in June, then increased to 48% in August. Given that ArcelorMittal Duisburg uses BOF technology, the temporary government intervention at Liberty Speciality Steel UK which utilizes an Electric Arc Furnace (EAF) as reported in “The UK government is preparing to acquire its third largest steel mill.” is unlikely to directly impact this plant’s operations.

Otelu Rosu Steel Plant, relying on EAF technology, exhibited a declining trend from 19% in March to 10% in August. This decline is notable, however no direct connection to the provided news articles can be established.

The UK government’s intervention in Liberty Steel, specifically “UK government seizes Liberty Speciality Steel UK to protect jobs“, aims to stabilize production, suggesting that supply disruptions stemming directly from this plant closure are unlikely in the near term.

Evaluated Market Implications:

Despite the UK government intervention at Liberty Steel, overall European steel production levels appear stable. However, buyers should note potential impacts on specialty steel grades produced by Liberty Speciality Steel UK and consider diversifying their supply base for these products. Considering the steady activity and wide product range of ArcelorMittal Duisburg, buyers might leverage this plant’s relatively stable output. Closely monitoring developments in the UK steel sector and continuously assessing their supply chain resilience is paramount. Furthermore, keep in mind the long-term decline of activity at Otelu Rosu Steel Plant and consider the potential supply chain disruptions that could occur.