From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Export Surge Drives Production Adjustments – August 2025

China’s steel market presents a mixed picture as production adjustments occur amidst rising exports. “China reduces steel output for the third month in a row” indicates a slowdown in production, while “China’s Rebar Exports Rise 52.4% in January–July 2025” and “China’s steel sheet/plate exports up 2.3 percent in January-July” highlight a significant increase in exports. While a direct causal link between the overall production decrease and the activity levels of individual plants observed via satellite cannot be conclusively established from these news articles alone, the export data provides context for regional production shifts.

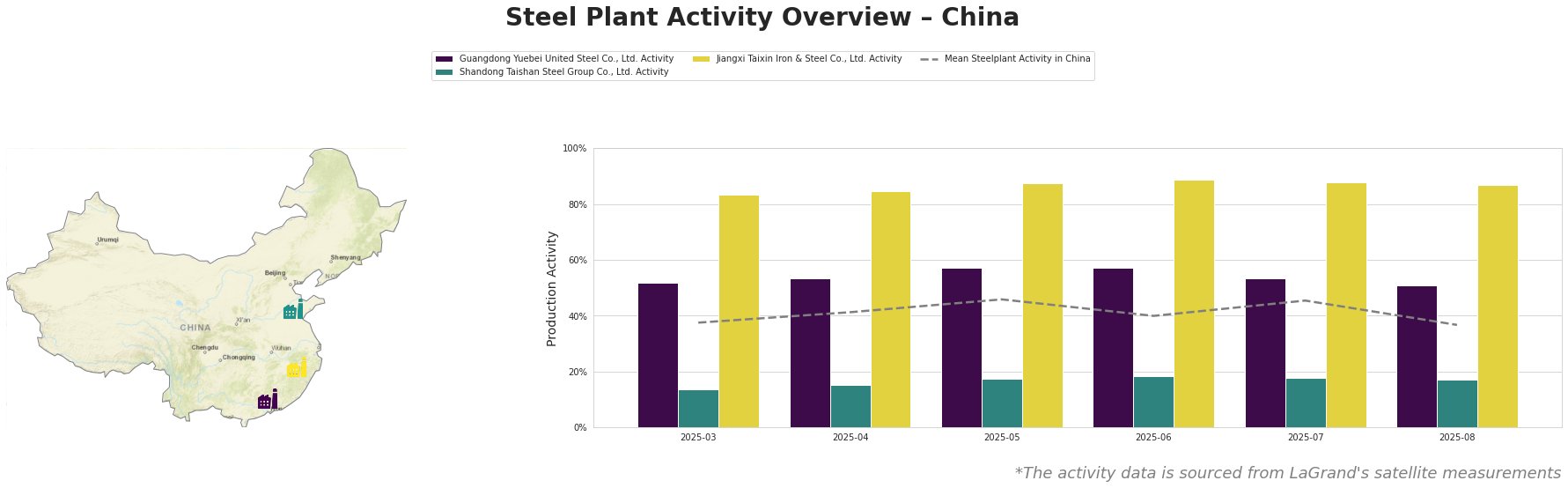

The mean steel plant activity in China peaked in May at 46.0% and then dropped to 37.0% in August. Guangdong Yuebei United Steel Co., Ltd. saw its activity peak in May-June (57.0%) and then decrease to 51.0% in August. Shandong Taishan Steel Group Co., Ltd. Shows a steady increase from March to June (14.0 to 19.0%) followed by a slight decline to 17.0% in August. Jiangxi Taixin Iron & Steel Co., Ltd. operated at high activity levels, peaking in June at 89.0% before slightly decreasing to 87.0% in August.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with a crude steel capacity of 2,000 ttpa, focuses on rebar production, primarily serving the building and infrastructure sectors. Satellite data shows activity peaking in May-June at 57% before declining to 51% in August. The export surge in rebar as highlighted in “China’s Rebar Exports Rise 52.4% in January–July 2025” could be contributing to the sustained, relatively high activity levels at Guangdong Yuebei despite the overall production decreases reported in “China reduces steel output for the third month in a row”.

Shandong Taishan Steel Group Co., Ltd., with a crude steel capacity of 5,000 ttpa, produces hot rolled coil, cold rolled coil, and stainless steel. Activity levels steadily increased from March to June before a slight decline in July and August. No direct connection can be established between the activity levels of this plant and the specific news articles provided.

Jiangxi Taixin Iron & Steel Co., Ltd., primarily focused on electric steelmaking with a crude steel capacity of 1,000 ttpa, produces wire and rod. It consistently exhibited high activity levels, suggesting strong demand for its specific product lines, as no direct connection can be established between its plant activity and the news articles provided.

The overall decrease in Chinese steel production coupled with increased exports, particularly in rebar and sheet/plate, suggests a strategic shift towards prioritizing exports, potentially influenced by US tariffs as mentioned in “China’s steel sheet/plate exports up 2.3 percent in January-July”. Considering this, steel buyers should proactively engage with suppliers like Guangdong Yuebei United Steel Co., Ltd. to secure rebar contracts, as this plant’s output is likely geared towards fulfilling export demand. Market analysts should closely monitor inventory levels and price fluctuations in the rebar and sheet/plate markets, anticipating potential supply constraints within China due to increased export activity.