From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Plummets: Production Cuts Deepen Amidst Weak Demand

Steel production in Europe is facing significant headwinds, as evidenced by declining output in key regions. The recent news article “German crude steel output down 12.1 percent in January-July 2025” underscores this trend, highlighting a substantial year-to-date decrease. The “Steel production in Sweden decreased in the first half of the year“, further corroborates this decline. Satellite data provides supporting evidence of fluctuating plant activity.

Measured Activity Overview

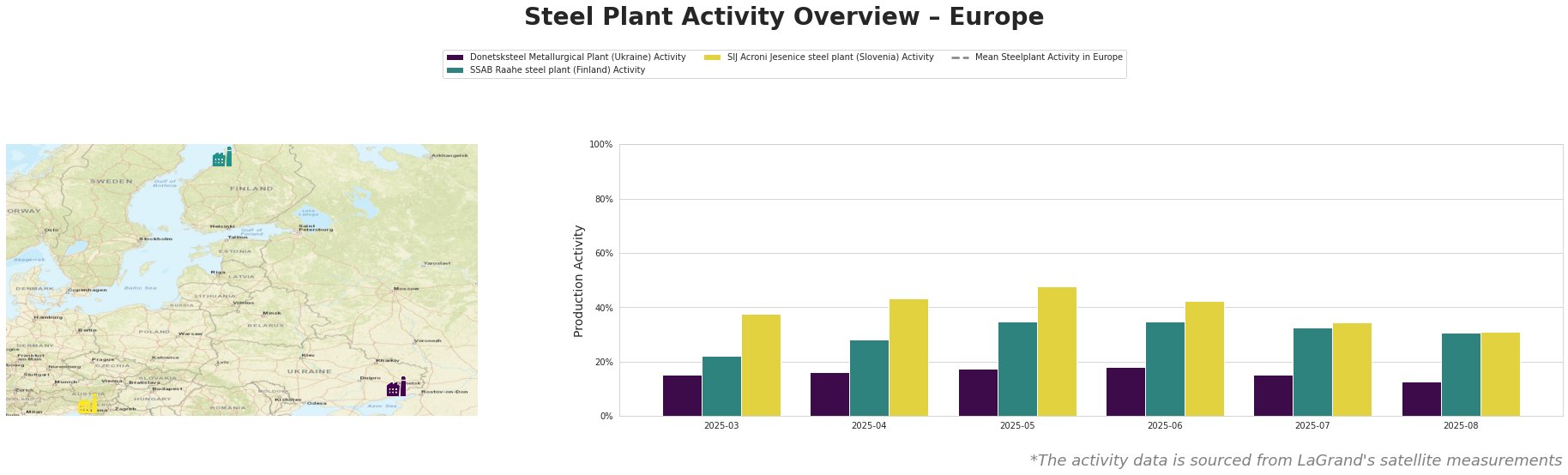

The mean steel plant activity in Europe experienced fluctuations, peaking in May and July before dropping to one of the lowest levels in August.

Donetsksteel Metallurgical Plant shows a general decline over the observed period, decreasing to 13.0% in August, below the plant’s average activity levels in prior months and considerably below the European mean.

SSAB Raahe steel plant also experienced a decline, from a peak of 35.0% in May and June to 31.0% in August. This aligns with the news from “Swedish steel production drops in first half-year” and “Steel production in Sweden decreased in the first half of the year“, which reports SSAB production cuts due to weak European performance, despite not establishing a direct connection between the two declines.

SIJ Acroni Jesenice steel plant activity mirrors the trend, decreasing to 31.0% in August from a high of 48.0% in May. No direct connection to specific news articles could be established regarding SIJ Acroni Jesenice steel plant.

Plant Information

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated (BF) processes. Despite its Responsible Steel Certification, the plant’s activity has generally declined, culminating in a low of 13.0% activity in August. This may reflect ongoing regional instability; however, no specific news connects directly to this observation.

SSAB Raahe steel plant in Finland, an integrated BF/BOF producer with a capacity of 2.6 million tonnes of crude steel, saw its activity decrease from 35.0% in May and June to 31.0% in August. This plant manufactures semi-finished and finished rolled products, including hot-rolled coils and billets. The observed decline in activity is consistent with the broader trend of reduced Swedish steel production reported in “Steel production in Sweden decreased in the first half of the year” and “Swedish steel production drops in first half-year“, where SSAB is planning European production cuts, although a definitive causal link cannot be established solely from this data. The plant is scheduled to transition away from BOF-BF production and towards EAF production by 2030.

SIJ Acroni Jesenice steel plant in Slovenia, an EAF-based producer of 726,000 tonnes of crude steel, experienced a decline in activity, dropping to 31.0% in August from a high of 48.0% in May. The plant focuses on flat-rolled products, plates, and hot- and cold-rolled steel for the building, infrastructure, and machinery sectors. No direct link between the activity decline and any of the provided news articles could be established.

Evaluated Market Implications

The combined impact of decreased German and Swedish steel production, as explicitly reported in “German crude steel output down 12.1 percent in January-July 2025“, “Steel production in Sweden decreased in the first half of the year” and “Swedish steel production drops in first half-year“, along with declining activity observed at SSAB Raahe, indicates potential supply disruptions, particularly in hot-rolled and coiled products.

Recommended Procurement Actions:

* Steel buyers should closely monitor inventory levels of hot-rolled and coiled products sourced from SSAB and German producers, and proactively engage with alternative suppliers to mitigate potential shortfalls explicitly indicated by the observed drops in production volumes and plant activity levels, as confirmed by the listed news reports.

* For steel analysts, continuously cross-reference production cut announcements with satellite-observed activity at major European plants for an improved and faster understanding of real-time market dynamics and their immediate effects.