From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine War Uncertainty Clouds European Steel; Plant Activity Mixed

In Europe, steel market sentiment remains neutral amid uncertainty surrounding the ongoing war in Ukraine. This report analyzes recent steel plant activity in light of geopolitical developments, as described in news articles such as “‘President of peace’: Trump tapped for Nobel Prize amid talks to end Russia-Ukraine war” and “‘We’ll see what happens’: Trump ends week of Ukraine-Russia talks on a more tentative note“. While activity changes have been observed at key steel plants, a direct causal relationship to these specific articles cannot be definitively established.

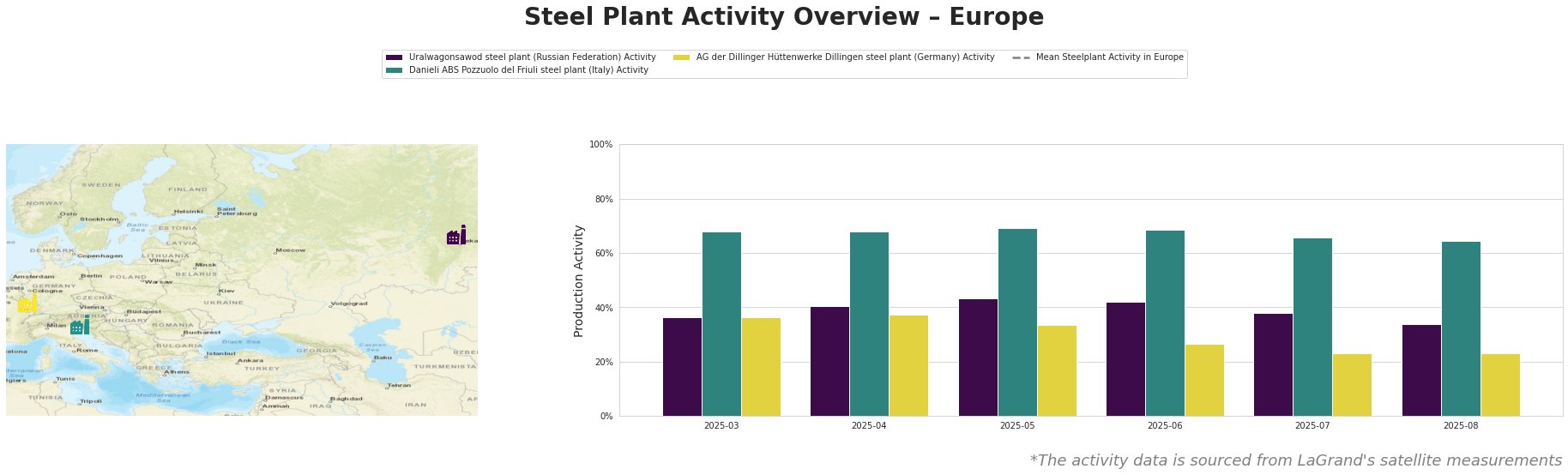

The average steel plant activity in Europe fluctuated significantly between March and August 2025. Individual plant activity varied, with some showing more stable trends than the mean.

Uralwagonsawod steel plant (Russian Federation): This plant, primarily serving the defense sector, experienced a gradual increase in activity from March (36%) to May (43%), followed by a decrease to 34% by August. Given the plant’s focus on the defense sector and location in Russia, this fluctuation potentially reflects the evolving dynamics of the conflict in Ukraine, as discussed in “‘We’ll see what happens’: Trump ends week of Ukraine-Russia talks on a more tentative note,” although a direct correlation is not verifiable based solely on the provided information.

Danieli ABS Pozzuolo del Friuli steel plant (Italy): This EAF-based plant, with a crude steel capacity of 1.1 million tonnes per annum, showed relatively stable activity. Activity peaked in May at 69%, declining gradually to 64% in August. While the plant holds ResponsibleSteel certification and serves diverse sectors, the slight decrease does not have a direct connection to the provided news articles regarding the Ukraine war.

AG der Dillinger Hüttenwerke Dillingen steel plant (Germany): This integrated BF-BOF steel plant, with a crude steel capacity of 2.76 million tonnes per annum, experienced a steady decline in activity from 36% in March to 23% in both July and August. This decline contrasts with the overall European mean activity and may reflect broader economic headwinds in Europe, but no direct link to the named news articles regarding the Ukraine war or the Trump administration’s foreign policy can be established.

The developments discussed in articles such as “Ukraine-Gipfel in Washington: Die dritte Demütigung für Europa” suggest potential shifts in the geopolitical landscape that could impact long-term steel demand and trade flows.

Given the uncertainty surrounding the resolution of the conflict in Ukraine, and the fluctuating activity at Uralwagonsawod, steel buyers should diversify their sourcing strategies to mitigate potential supply disruptions from Russian steel producers. Specifically, buyers who currently source specialty steels from Uralwagonsawod for defense applications should identify and qualify alternative suppliers. The neutral market sentiment does not warrant aggressive procurement strategies, but rather a cautious approach focused on supply chain resilience.