From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Reacts to Taranto Shift and Danieli Expansion: Positive Outlook Maintained

Italy’s steel sector exhibits strong activity amidst strategic realignments. The Taranto steel mill is undergoing significant restructuring, while Danieli is expanding its capabilities. While the news articles, “End of steel monoculture proposed for Taranto mill,” and “Danieli takes stake in Novastilmec” point to industry shifts, direct connections to observed plant activity levels are not immediately apparent in the provided satellite data, emphasizing the need for closer monitoring of plant-level responses to these broader changes.

Here’s a summary of recent activity:

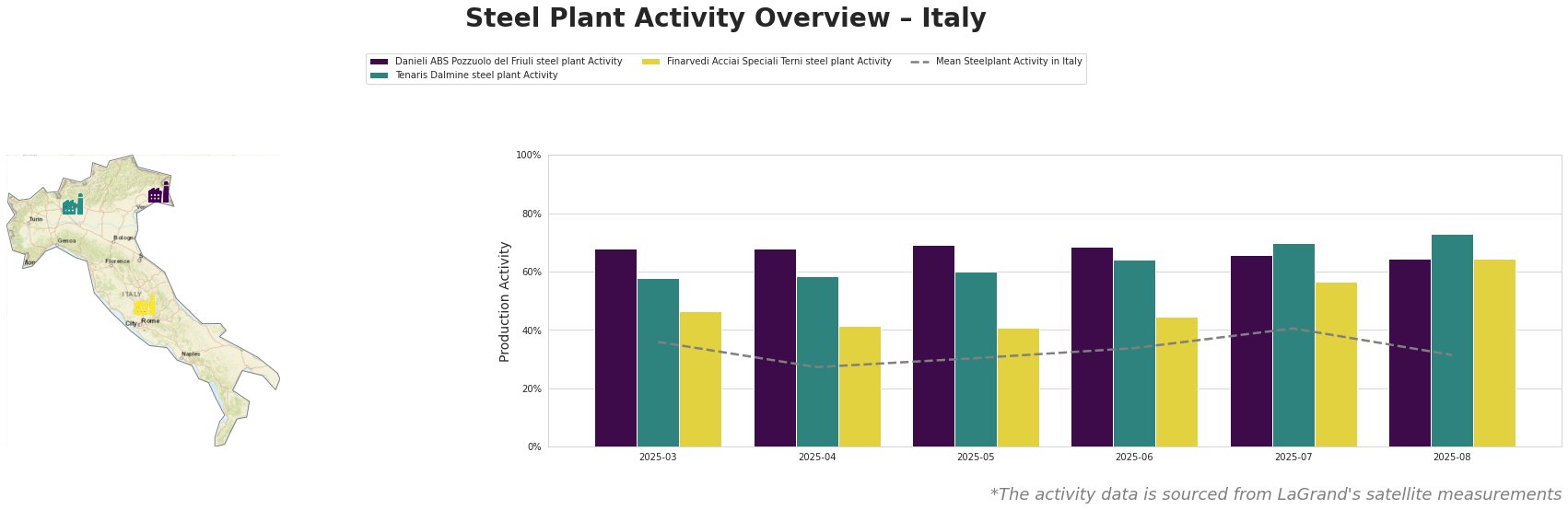

Across Italy, the average steel plant activity saw a peak in July (41%), followed by a notable decrease in August (31%). Danieli ABS Pozzuolo del Friuli showed consistently high activity (64-69%) but experienced a slight dip in August. Tenaris Dalmine exhibited a steady increase, reaching its peak activity in August (73%). Finarvedi Acciai Speciali Terni saw a moderate increase in activity, peaking in August (64%).

Danieli ABS Pozzuolo del Friuli steel plant: This plant, located in the Province of Udine, primarily utilizes EAF technology with a crude steel capacity of 1,100 thousand tonnes per annum (ttpa). It produces a range of products, including blooms, billets, and rolled products, serving sectors like automotive and construction. Activity remained high but decreased slightly from 69% in May to 64% in August. Given Danieli’s recent investment in Novastilmec, as highlighted in the article “Danieli takes stake in Novastilmec,” this slight dip does not appear related, as the plant focuses on crude and semi-finished products, rather than the downstream processing lines Novastilmec specializes in. No immediate connection can be established between the observed activity and the news articles.

Tenaris Dalmine steel plant: Situated in the Province of Bergamo, this plant also relies on EAF technology, with a crude steel capacity of 700 ttpa. It focuses on semi-finished and finished rolled products, including tubes and pipes, catering to the automotive and energy sectors. Activity increased steadily, reaching 73% in August, the highest among the observed plants. This increase does not appear directly linked to any specific news events.

Finarvedi Acciai Speciali Terni steel plant: Located in the Province of Terni, this plant uses EAF technology and has a crude steel capacity of 1,450 ttpa. It produces a variety of products, including hot-rolled coils and stainless steel sheets, serving sectors like automotive and construction. Its activity increased significantly, reaching 64% in August. Similar to other plants, no immediate connection can be established with the provided news articles.

While overall sentiment remains positive, the planned transition at Acciaierie d’Italia (ADI) in Taranto, as reported in “End of steel monoculture proposed for Taranto mill,” introduces a degree of uncertainty. Procurement professionals should:

- Monitor spot market prices closely: The proposed diversification at Taranto could temporarily reduce regional steel supply, potentially impacting prices.

- Strengthen relationships with alternative suppliers: Diversifying the supply base will mitigate risks associated with potential disruptions at Taranto. Given Danieli’s strong financial performance and strategic investments, they represent a reliable alternative, particularly for specialized steel products.

- Factor in potential logistics adjustments: If production shifts away from Taranto, logistics costs may increase depending on the location of alternative suppliers. Contracts may need revisiting.