From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Trends Up Despite Trade Headwinds

Asia’s steel market shows overall positive activity despite growing trade tensions. Indian steel demand faces headwinds due to safeguard duties, as reported in “India’s safeguard duty on steel imports to ‘severely hurt’ domestic automobile industry” and “India’s DGTR recommends safeguard duty for three years on imports of certain flat steel products.” These news articles cannot be directly linked to the observed activity changes at the selected steel plants but highlight potential market shifts within India. The overall mean plant activity in Asia remains robust, with some plants showing consistent high activity levels.

Measured Activity Overview

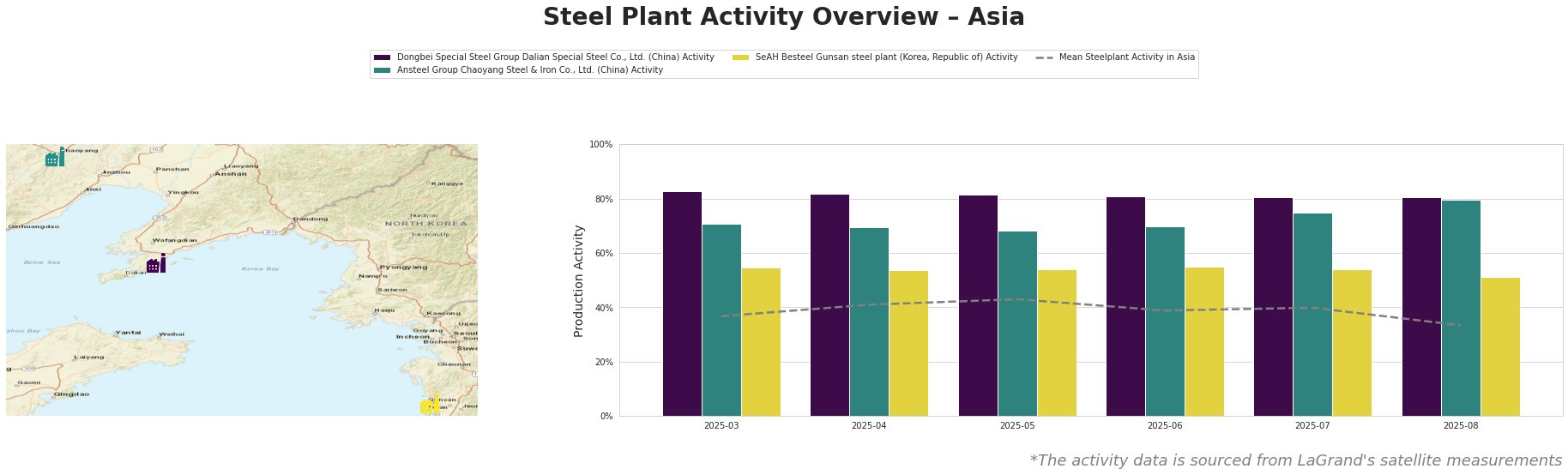

The mean steel plant activity in Asia fluctuated between 33% and 43% from March to August 2025, showing an overall stable trend. August saw a dip to 33%. Dongbei Special Steel Group Dalian Special Steel Co., Ltd. consistently operated at high activity levels (above 80%). Ansteel Group Chaoyang Steel & Iron Co., Ltd. showed a steady increase from 71% in March to 80% in August. SeAH Besteel Gunsan steel plant showed consistent activity levels, ranging from 51% to 55%, with a slight decrease to 51% in August.

Steel Plant Analysis

Dongbei Special Steel Group Dalian Special Steel Co., Ltd., an integrated steel plant with a crude steel capacity of 1.54 million tonnes and producing stainless steel bars and wires, has maintained a consistently high activity level around 81%-83% throughout the observed period. No direct link to the provided news articles can be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., another integrated steel plant with a crude steel capacity of 2.1 million tonnes focused on steel plate and pipe, shows a significant increase in activity from 71% in March to 80% in August. This plant’s increase occurred even as the mean steel plant activity in Asia decreased. No direct link to the provided news articles can be established.

SeAH Besteel Gunsan steel plant, an electric arc furnace (EAF)-based plant with a crude steel capacity of 2.1 million tonnes, specializes in special steel and auto parts. Its activity remained relatively stable between 51% and 55%. The slight drop to 51% in August does not appear to correlate directly with any specific news item provided, but the plant’s focus on automotive steel means it could be indirectly affected by the issues described in “India’s safeguard duty on steel imports to ‘severely hurt’ domestic automobile industry.”

Evaluated Market Implications

The planned US tariffs on steel and semiconductor chip imports, as reported in “US plans tariffs on steel and semiconductor chip imports,” along with the expansion of Section 232 tariffs in “Trump administration adds to Section 232 steel-derivatives list” and “US adds more derivative steel items to Section 232,” are primarily focused on the US market, but could create some potential disruption in global steel flows. While the provided articles highlight that steel used for automotive parts would be affected by the tariffs, the satellite data does not clearly confirm any correlation.

Procurement Actions:

- Monitor Indian Steel Market: Given the implementation of safeguard duties as indicated in “India’s safeguard duty on steel imports to ‘severely hurt’ domestic automobile industry” and “India’s DGTR recommends safeguard duty for three years on imports of certain flat steel products,” buyers should closely monitor domestic steel prices in India and consider diversifying their sourcing strategies to mitigate potential cost increases.

- Assess US Tariff Impact: Steel buyers exposed to US tariffs should conduct a detailed assessment of their supply chains in light of the news articles such as “US plans tariffs on steel and semiconductor chip imports,” “Trump administration adds to Section 232 steel-derivatives list” and “US adds more derivative steel items to Section 232“. Analyze the potential impact on input costs and explore strategies for mitigating the effects, such as negotiating with suppliers or adjusting product specifications to minimize tariff exposure.