From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine War Uncertainty Weighs on European Steel: Activity Declines Amidst Peace Talk Hesitation

European steel market sentiment is negative as geopolitical uncertainty impacts production. Declining activity at several key plants correlates with ongoing tensions and fluctuating hopes for a resolution to the conflict in Ukraine. This is influenced by news such as “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?” and “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” which highlight the fragile nature of potential peace negotiations. No direct connection to plant activity was possible based on “Gold Wavers as Traders Look to Jackson Hole and Ukraine Talks“.

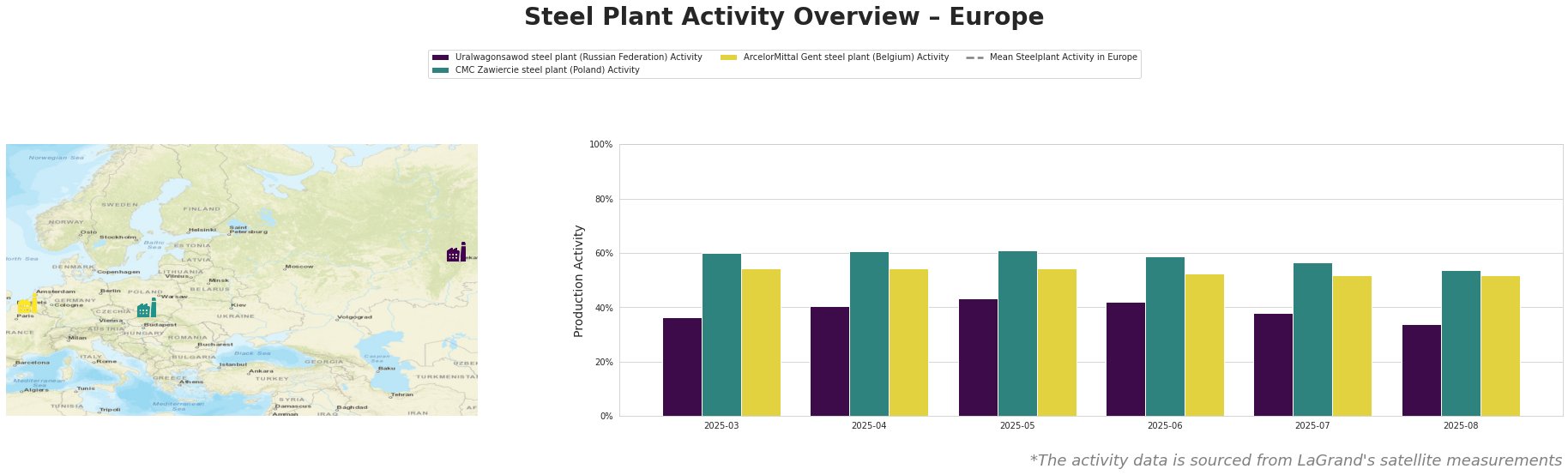

Across the observed period, mean steel plant activity in Europe shows volatility, ranging from approximately 15.2 trillion to 20.3 trillion, without a clear upward or downward trend. The Uralwagonsawod steel plant’s activity peaked in May at 43% and declined to 34% by August. CMC Zawiercie steel plant shows less volatility. Its activity peaked in April and May at 61%, and then generally decreased to 54% in August. ArcelorMittal Gent steel plant showed the least volatility. It remains stable at 54% until June when it decreases to 52%, where it remains until August.

Uralwagonsawod, a steel plant based in Rostov, Russian Federation, sees its activity drop from 43% in May to 34% in August. Given its reported ties to the defense sector, this decline may correlate with uncertainty surrounding the Ukraine war, as reported in “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?” and “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war.”

CMC Zawiercie, a Polish steel plant with an EAF-based production of 1.7 million tonnes per annum, primarily serving the automotive, building, and energy sectors, experienced a slight decrease in activity from 61% in April/May to 54% in August. Given this steel plant is located in Poland, we see no clear evidence to directly link this decrease to either of the provided news articles.

ArcelorMittal Gent, a major integrated BF-BOF steel plant in Belgium with a 5 million tonnes per annum capacity, shows a consistent activity level, hovering around 52-54%. There’s no significant change directly attributable to the news articles provided.

The activity reduction at Uralwagonsawod, coupled with the ongoing uncertainty reflected in the news articles, signals potential supply disruptions, especially for steel products used in defense. Steel buyers should closely monitor developments in the Ukraine peace talks and explore diversifying their supply chains to mitigate risks associated with relying on Russian steel. Given the slight decrease at CMC Zawiercie and its lack of an explicit link to the news, buyers may want to monitor activity and supply chain optionality but would not need immediate action. With ArcelorMittal activity being relatively stable, buyers can assume stable supply for this plant.