From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Production Cuts and Falling Output Signal Continued Downturn

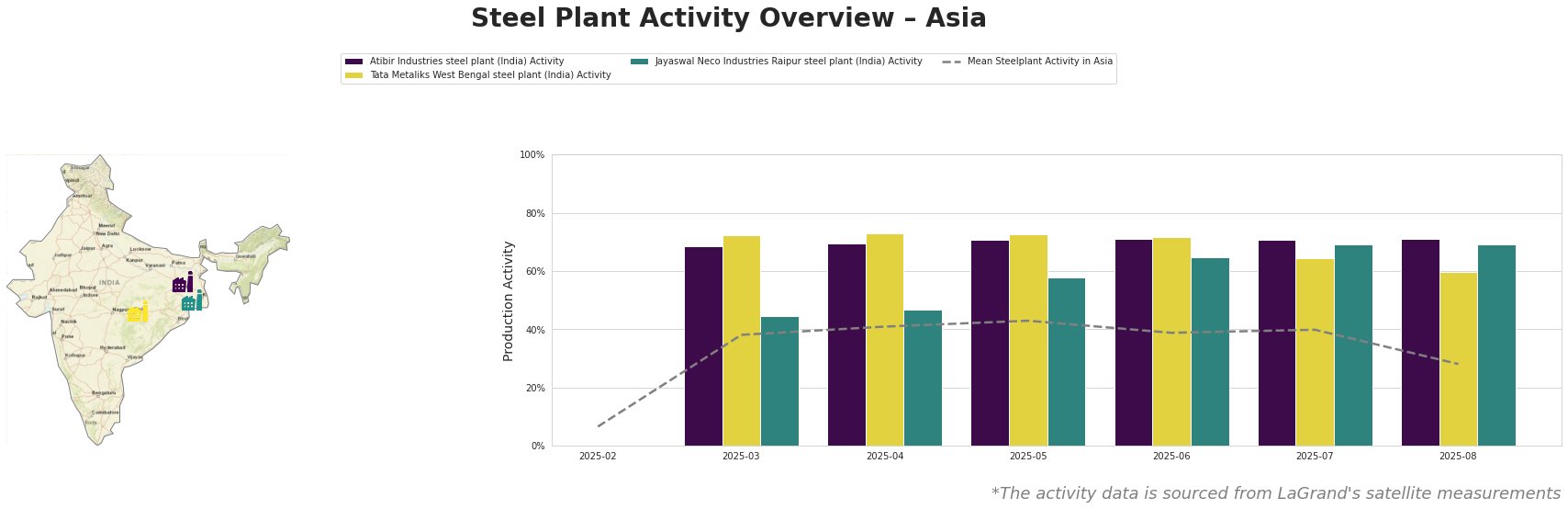

In Asia, steel production is facing a downturn, primarily driven by production cuts in China. News articles titled “China’s Crude Steel Output Falls Below 80 Million mt in July, down 3.1% in Jan-July” and “China reduces steel output for the third month in a row” directly explain observed changes. The satellite data shows a recent drop in average plant activity that potentially aligns with the reported production cuts.

From March to May, the mean steel plant activity in Asia shows a slight increase, peaking at 43.0%. However, there is a notable decrease to 28% in August. Atibir Industries’ activity remains stable at 71% from May to August, significantly above the Asian average, while Tata Metaliks saw a drop from 73% in May to 60% in August. Jayaswal Neco Industries shows a steady activity level at around 60-70%, also above the Asian average. The overall decrease in activity could potentially reflect the production cuts mentioned in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July“.

Atibir Industries, located in Jharkhand, India, operates as an integrated steel plant using BF and BOF technologies with a crude steel capacity of 600 ttpa. Satellite data shows a stable activity level at 71% from May to August. No direct link could be established between the stable activity levels at Atibir Industries and the reported Chinese production cuts.

Tata Metaliks, situated in West Bengal, India, possesses a BF-based integrated steel plant with a crude steel capacity of 255 ttpa. The satellite data indicates a decrease in activity from 73% in May to 60% in August. While a reduction in activity is observed, a direct correlation with the “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” or “China reduces steel output for the third month in a row” articles cannot be explicitly established based on the provided information.

Jayaswal Neco Industries, located in Chhattisgarh, India, operates an integrated steel plant utilizing both BF and DRI processes, with a crude steel capacity of 1200 ttpa. Satellite-observed activity levels from May to August have been consistently high at approximately 60-70%. No direct link could be established between the stable activity levels at Jayaswal Neco Industries and the reported Chinese production cuts.

The news articles “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July“, “China reduces steel output for the third month in a row“, and the observed overall decline in Asian plant activity suggest potential supply disruptions. Based on these developments, steel buyers should:

- Prioritize securing contracts with Indian suppliers like Atibir Industries and Jayaswal Neco Industries, which maintained high and stable production activity throughout the observed period, to mitigate potential supply shortages stemming from Chinese production cuts.

- Closely monitor the output and pricing of Tata Metaliks, given its recent decline in activity, and consider diversifying supply sources to avoid over-reliance.

- Track iron ore price fluctuations as reported in “China’s iron ore output down 5.4 percent in January-July 2025“, to anticipate cost increases related to raw material constraints amid production adjustments. Specifically the recent price increases in July could indicate challenges in ore availability.