From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Rising European Prices and Mixed Activity Signal Procurement Opportunities

Oceania’s steel market presents a mixed picture. While no direct link can be established between activity at Oceania’s steel plants and rising prices in Europe, as reported in “Steel rebar prices strengthen in Northern Europe as mills revise extras” and “European HRC prices steady amid muted trading; mills keep pushing for higher offers“, the observed fluctuations in regional plant activity levels warrant close monitoring for potential local impacts. The article “European HRC steel prices are rising as factories offer higher prices” further reinforces the upward price pressure in Europe.

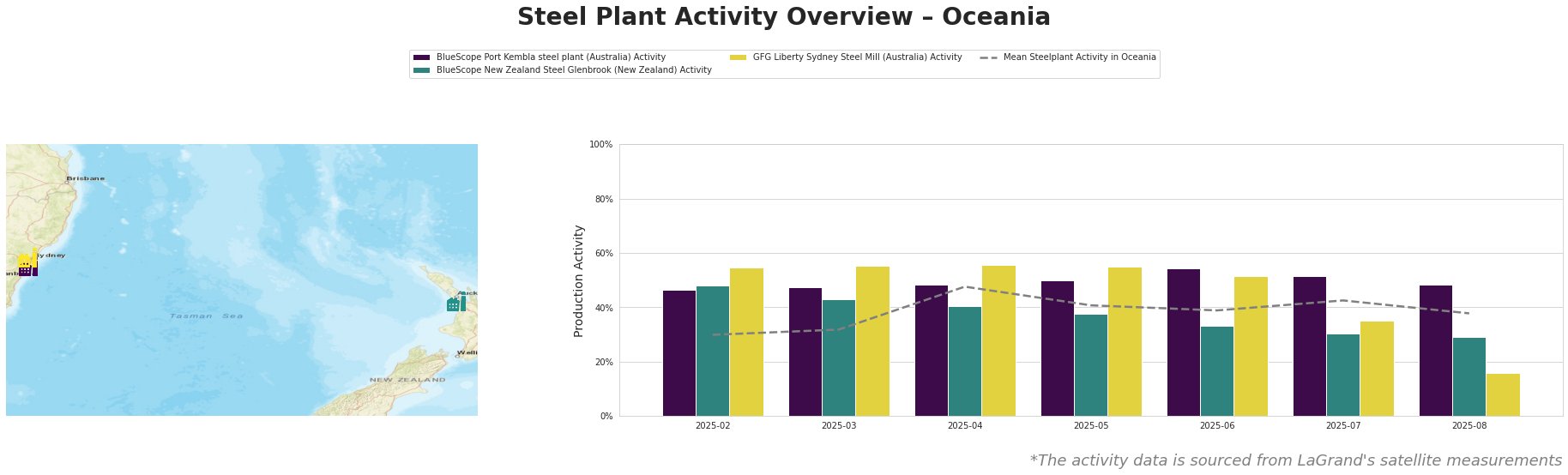

The average steel plant activity in Oceania peaked in April at 48% before declining to 38% in August. BlueScope Port Kembla steel plant in Australia, a major integrated BF/BOF producer of slab, hot rolled coil and plate with a crude steel capacity of 3.2 million tonnes per annum (ttpa), showed relative stability in its activity levels, ranging from 46% to 54% during the observed period, ending at 48% in August. No direct correlation can be established between this stable activity and the European price increases reported in “Steel rebar prices strengthen in Northern Europe as mills revise extras“, “European HRC prices steady amid muted trading; mills keep pushing for higher offers” and “European HRC steel prices are rising as factories offer higher prices“.

BlueScope New Zealand Steel Glenbrook, an integrated DRI/BOF plant producing 650,000 ttpa of crude steel, experienced a steady decline in activity from 48% in February to a low of 29% in August. This decrease does not directly relate to the European price increases mentioned above based on available information.

GFG Liberty Sydney Steel Mill, an EAF-based producer of 750,000 ttpa of long products including reinforcing bar, saw a significant drop in activity from 55% in May to 16% in August. This considerable decrease in activity at GFG Liberty Sydney Steel Mill does not directly relate to the European price increases mentioned above based on available information.

Evaluated Market Implications:

While no direct link can be established, the European price increases reported in “Steel rebar prices strengthen in Northern Europe as mills revise extras“, “European HRC prices steady amid muted trading; mills keep pushing for higher offers” and “European HRC steel prices are rising as factories offer higher prices” may eventually impact global steel markets, including Oceania. The simultaneous activity reduction in Oceania at two of the three observed plants could exacerbate the effects of global price increases should they reach Oceania. The significant drop in activity at GFG Liberty Sydney Steel Mill warrants close monitoring by buyers relying on reinforcing bar and other long products from this mill.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor spot prices for steel long products, especially reinforcing bar, in the Australian market due to the significant activity drop at GFG Liberty Sydney Steel Mill. Consider diversifying suppliers or securing longer-term contracts to mitigate potential supply disruptions.

- Market Analysts: Further investigate the reasons behind the activity reduction at GFG Liberty Sydney Steel Mill to assess the potential for prolonged supply constraints in the Australian long products market. Monitor the impact of European price increases on import prices into Oceania.