From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Output Dips in July; Regional Plant Activity Diverges Amid Price Fluctuations

China’s steel sector shows signs of contraction coupled with regional activity shifts. According to “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” and “China reduces steel output for the third month in a row,” crude steel production has fallen, reflecting seasonal adjustments and planned cuts. While “MOC: Average rebar prices in China down 0.7 percent in August 4-10” indicates price decreases in finished steel, no direct connection can be established between these price fluctuations and specific plant activity levels at this time.

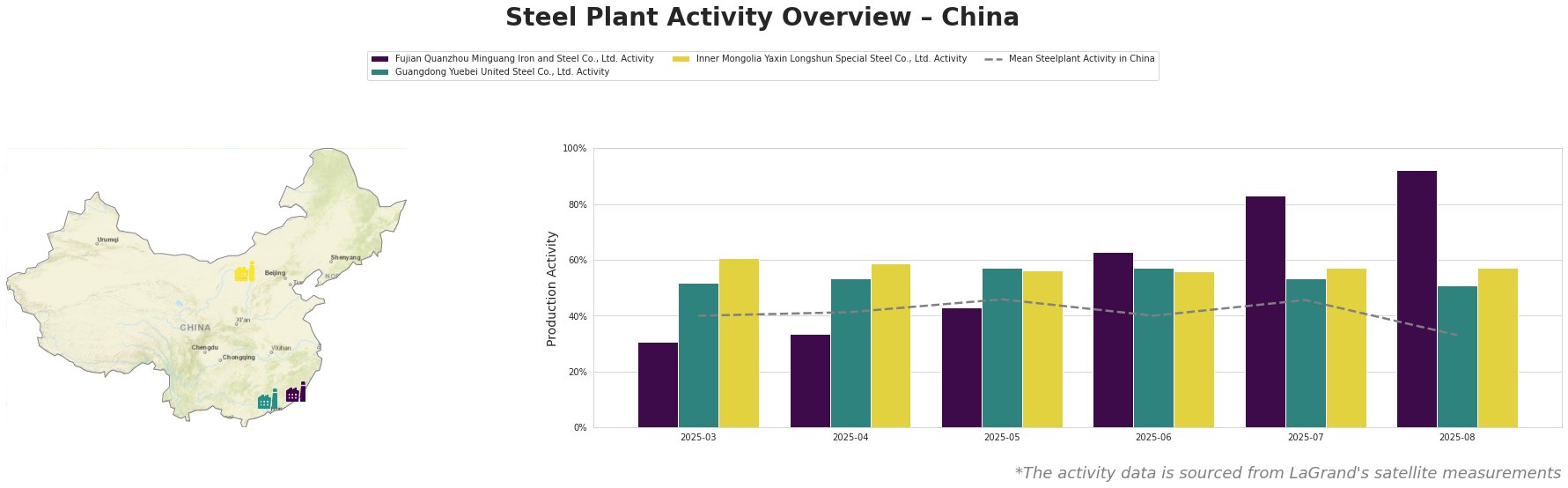

The mean steel plant activity in China shows volatility, dropping to 33.0% in August after peaking at 46.0% in May and July, indicating fluctuating production levels. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. contrasts this trend, showing a significant activity increase from 31.0% in March to 92.0% in August. Guangdong Yuebei United Steel Co., Ltd. activity remains relatively stable, fluctuating between 51.0% and 57.0%. Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. shows steady activity, varying slightly between 56.0% and 61.0%. The sharp increase in activity at Fujian Quanzhou Minguang Iron and Steel Co., Ltd. does not appear to directly correlate with the cited news articles detailing overall production decreases.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a 2.55 million tonne per annum (ttpa) BOF-based integrated steel plant in Fujian province producing finished rolled products like rebar, has dramatically increased activity levels. Its activity surged from 31.0% in March to 92.0% in August. This surge seems contrary to the national trend of decreasing steel output described in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” and “China reduces steel output for the third month in a row,” and no direct connection can be established between this specific plant’s activity and the news articles.

Guangdong Yuebei United Steel Co., Ltd., with a 2.0 million ttpa capacity, primarily produces rebar for building and infrastructure using integrated BF and EAF processes. The plant’s activity has remained relatively consistent, fluctuating between 51.0% and 57.0% from March to August. This stable trend does not directly reflect the national production cuts detailed in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July,” nor is a direct connection evident.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., an integrated BF/BOF plant producing 2.0 million ttpa of special steel products like high-strength rebar, shows stable activity levels between 56.0% and 61.0% throughout the observed period. Similar to Guangdong Yuebei, no direct correlation can be drawn between its activity and the news articles indicating overall steel production decline.

The observed decrease in overall Chinese steel output coupled with decreasing Rebar prices, as reported in “MOC: Average rebar prices in China down 0.7 percent in August 4-10,” suggests a weakening demand scenario, even as plant-level activity varies substantially. Given that Fujian Quanzhou Minguang Iron and Steel Co., Ltd. is significantly ramping up production, while national output falls, steel buyers should be aware of a possible supply glut in the regional Rebar market and should negotiate contracts accordingly in the Fujian province. Steel buyers sourcing from Guangdong Yuebei United Steel Co., Ltd. and Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. can expect continued stable supply from these specific plants. Due to potential production cuts indicated in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July,” steel buyers should closely monitor production forecasts for September and beyond, particularly in the Beijing-Tianjin-Hebei region.