From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMalaysian Steel Market: Stable Production Amidst EU Trade Concerns – August 2025

Malaysia’s steel market maintains stable production despite external pressures. Activity at key plants remains relatively consistent, with potential implications for Malaysian exports to the EU, given the concerns raised in “German steel industry is calling for comprehensive EU trade measures to address global overcapacity” and “German steel industry calls for stronger EU steel trade defense against Asian overcapacity.” While these articles focus on Asian overcapacity and potential EU trade measures, no immediate disruption to Malaysian domestic production is observed.

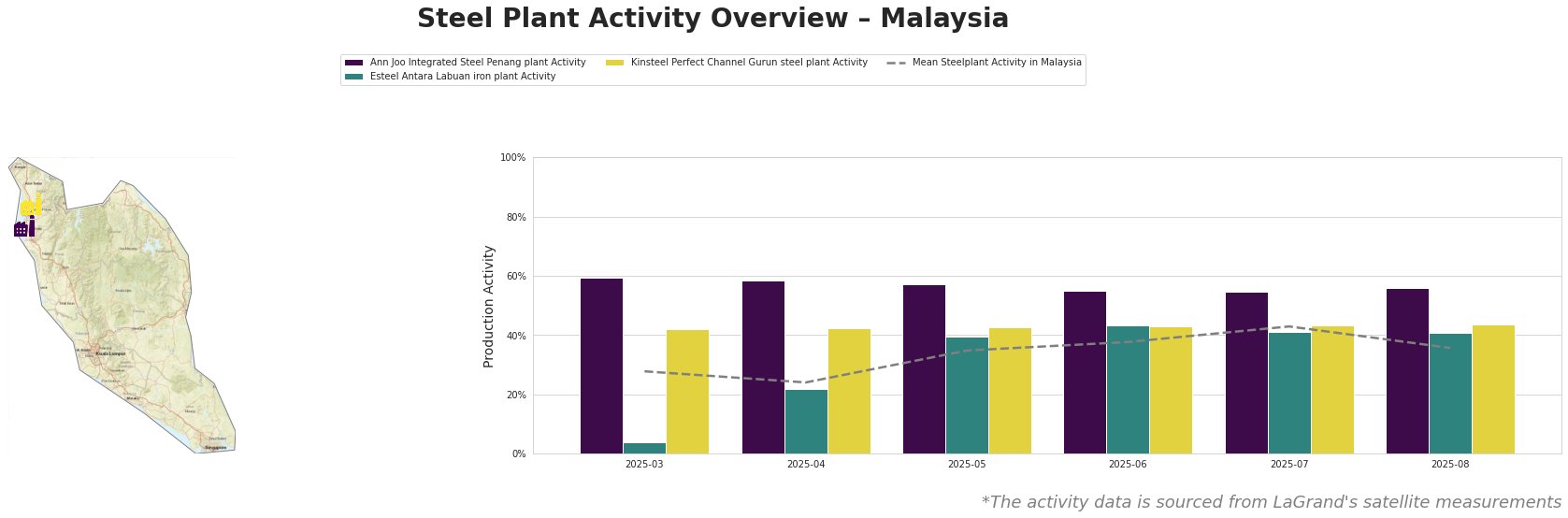

The average steel plant activity in Malaysia peaked in July at 43% and decreased to 36% in August.

Ann Joo Integrated Steel Penang plant, an integrated BF and EAF-based plant with a 500kt crude steel capacity, showed relatively stable activity, ranging from 55% to 59% between March and August. The plant focuses on crude and semi-finished products for the building and infrastructure sectors. There is no immediate correlation between its consistent activity and the EU trade concerns raised in “German steel industry is calling for comprehensive EU trade measures to address global overcapacity“.

Esteel Antara Labuan iron plant, a DRI-based ironmaking facility with a 900kt iron capacity, displayed variable activity. Activity increased from 4% in March to 43% in June before dropping back to 41% in August. This plant produces HBI (DRI). No direct connection can be established between the observed activity fluctuations and the EU trade-related news articles.

Kinsteel Perfect Channel Gurun steel plant, an EAF-based steel plant with a 500kt crude steel capacity, had the most stable activity, fluctuating narrowly between 42% and 44% from March to August. This plant produces semi-finished and finished rolled products. There is no immediate correlation between the plant’s stable activity and the EU trade concerns.

Given the German steel industry’s call for stricter import limits, duties, and origin rules in “German steel industry is calling for comprehensive EU trade measures to address global overcapacity“, Malaysian steel buyers and market analysts should:

- Monitor EU Trade Policy Developments: Closely track any upcoming EU trade policy changes, especially regarding import quotas and tariffs on steel products.

- Diversify Export Markets: Explore alternative export destinations besides the EU to mitigate potential risks associated with increased EU trade barriers.

- Assess Supply Chain Vulnerabilities: Evaluate potential disruptions to raw material sourcing due to global trade shifts and proactively seek alternative suppliers.

- Focus on High-Value Products: Consider shifting towards higher-value steel products that are less likely to be impacted by broad trade restrictions.