From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Trade Tensions & Plant Activity Shifts Signal Potential Supply Adjustments

Asia’s steel market faces a complex landscape influenced by international trade dynamics and fluctuating plant activity. The cancellation of trade talks between the US and India, as reported in “Trumps US-Zölle im Liveticker: Handelsgespräche zwischen USA und Indien Ende August abgesagt,” adds uncertainty. While the satellite data doesn’t directly correlate with this specific announcement, it highlights production adjustments within the region that may be indirectly related.

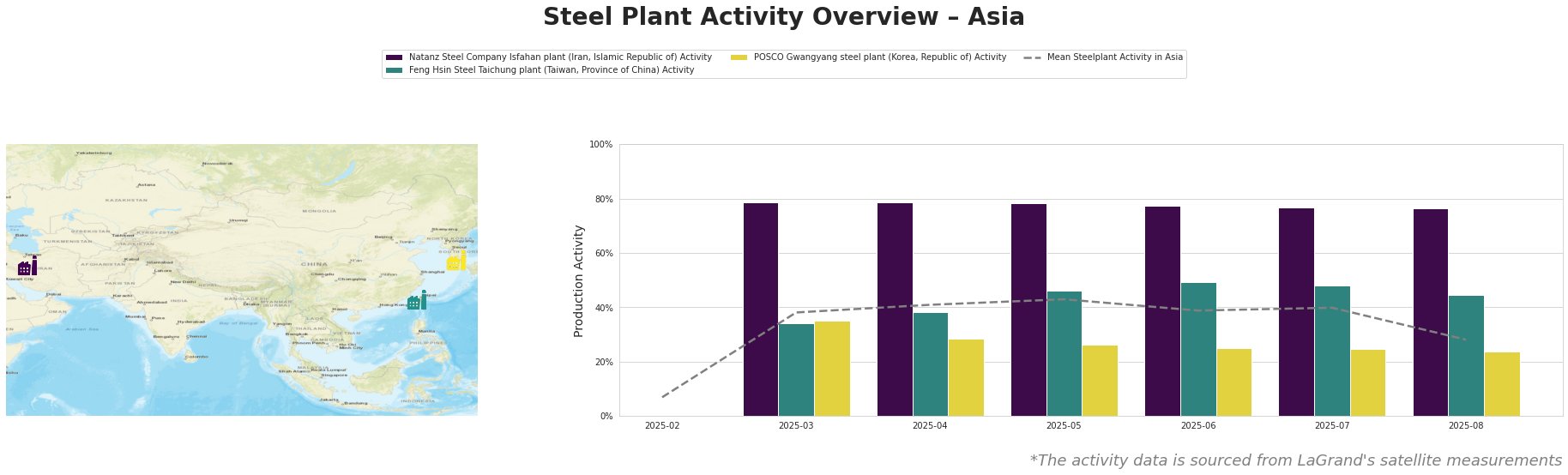

The data reveals a significant drop in average steel plant activity across Asia in August 2025, falling to 28% from a high of 43% in May. While the Natanz Steel Company in Iran maintained a relatively high activity level around 77%, both Feng Hsin Steel in Taiwan and POSCO in South Korea experienced consistent declines over the observed period.

Natanz Steel Company Isfahan plant (Iran, Islamic Republic of): This plant, with a 1 million tonne per annum (ttpa) EAF-based crude steel capacity and 1.5 million ttpa DRI capacity, has consistently operated at high activity levels (around 77%) between March and August 2025. This stability contrasts with the regional trend and suggests a focus on supplying domestic or regional markets less affected by the issues raised in “Trumps US-Zölle im Liveticker: Handelsgespräche zwischen USA und Indien Ende August abgesagt.” No direct connection between the news articles and the plant’s activity level could be established.

Feng Hsin Steel Taichung plant (Taiwan, Province of China): This EAF-based plant, boasting a 1.2 million ttpa crude steel capacity, shows a gradual decrease in activity from 49% in June to 45% in August 2025. This reduction could be influenced by regional demand fluctuations or shifting raw material costs, but no direct link to the provided news articles can be confirmed.

POSCO Gwangyang steel plant (Korea, Republic of): As a major integrated steel producer with a 23 million ttpa BOF-based crude steel capacity, POSCO Gwangyang experienced a continuous decline in activity from 35% in March to 24% in August 2025. This significant reduction potentially reflects broader shifts in international demand for finished rolled products targeted at the automotive, building and transport sectors, as well as supply chain adjustments, but no direct relationship can be established with the provided news articles.

Given the overall drop in average steel plant activity and the trade uncertainties highlighted by the news articles, steel buyers should:

- Prioritize supply chain diversification: Actively explore alternative sources for steel, particularly for products traditionally sourced from POSCO Gwangyang, to mitigate potential supply disruptions. The consistent, high-activity levels from Natanz Steel, which is regionally isolated, indicates they may not be a suitable source for buyers outside the immediate region.

- Monitor regional price fluctuations: Closely track price movements in the Asian steel market, especially for finished rolled products, and be prepared to adjust procurement strategies based on evolving market dynamics.

- Evaluate inventory levels: Assess current inventory levels and consider increasing stock of critical steel grades to buffer against potential supply shortages, factoring in the observed decreases in activity from Feng Hsin Steel.