From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Reacts to Trump’s Tariff Plans: Mexico Production Surges as US Falters

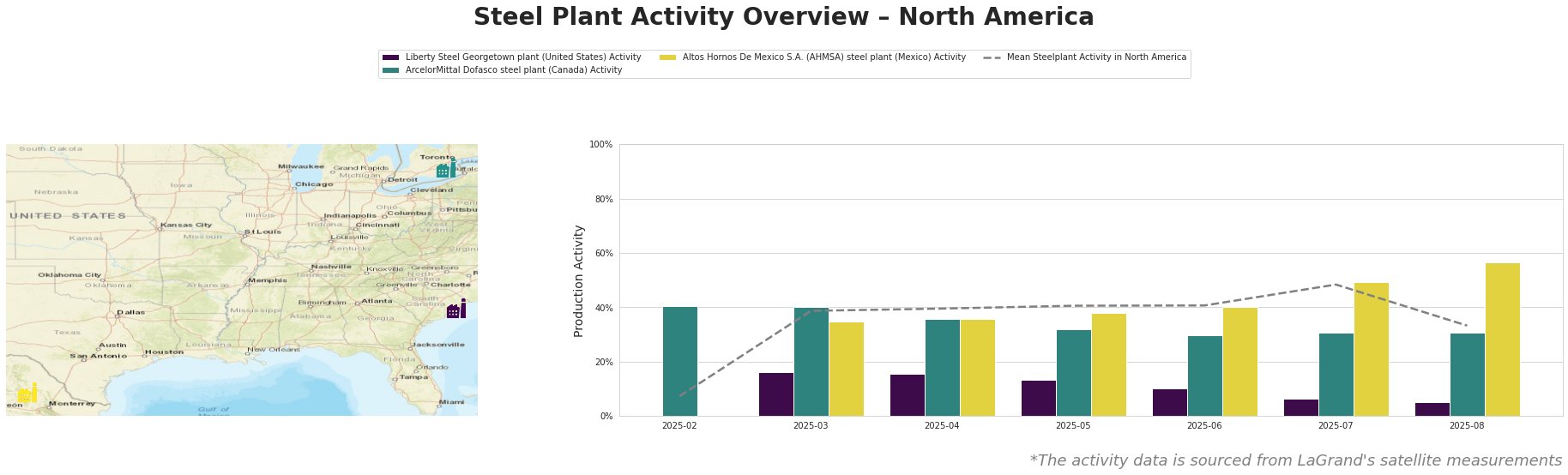

North America’s steel market is bracing for shifts driven by potential new tariffs. The Trump administration’s announcement detailed in “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips” appears to be impacting production activity unevenly across the region. Satellite data reveals significant activity fluctuations, but a definitive link to the tariff announcements is not always possible without further information.

The mean steel plant activity in North America peaked in July 2025 at 48%, then dropped significantly to 33% in August. Liberty Steel Georgetown plant experienced a steady decline, reaching a low of 5% activity in August. ArcelorMittal Dofasco steel plant showed a fluctuating, but ultimately stable trend around the 30-40% activity range. In contrast, Altos Hornos De Mexico S.A. saw a significant increase, reaching its peak activity of 57% in August.

Liberty Steel Georgetown, a 908 ttpa EAF-based plant producing semi-finished and finished rolled products, has experienced a consistent decline in activity, plummeting to just 5% in August. This decline is particularly notable, but its direct relationship to articles like “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips” is not explicitly evident from the provided information. Further investigation is required to confirm if the decrease is in anticipation of tariffs, a response to other market factors, or plant-specific issues.

ArcelorMittal Dofasco, a major integrated steel producer in Canada with a 4050 ttpa capacity using BF, BOF, and EAF technologies, maintained a relatively stable activity level around 30-40% over the observed period. As the plant is based in Canada and produces products for the automotive industry, the impact of articles such as “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips” isn’t immediately clear from the provided information.

Altos Hornos De Mexico S.A. (AHMSA), a large integrated steel plant in Mexico with a 5500 ttpa capacity using BF, BOF, and EAF processes, sharply increased its activity, reaching 57% in August. With “Weitere Produkte betroffen: USA weiten Einfuhrzölle auf Stahl und Aluminium aus – Fortschritte bei China-Gesprächen“, the article mentions the expansion of US import tarrifs on steel and alluminium. As this plant is based in Mexico, the increase in activiy could be in anticipation of increased US demand due to the new tarrifs mentioned in articles like “Trump to Announce Tariffs on Steel Imports in Coming Weeks” and “Trump Reaffirms Plans to Impose Tariffs on Steel and Semiconductor Chips“, but further investigation would be required.

Evaluated Market Implications:

The observed increase in activity at Altos Hornos De Mexico S.A. coupled with potential US tariffs on steel as reported in “Trump to Announce Tariffs on Steel Imports in Coming Weeks” suggests a possible shift in steel supply dynamics.

- Procurement Actions: Steel buyers should closely monitor the implementation and scope of the tariffs. Consider diversifying steel sourcing to include Mexican suppliers to mitigate potential price increases due to tariffs on other imports. Given the news of “Report: Trump Plans to Set 50% Copper Tariff“, which might affect steel production costs, consider hedging strategies to protect against raw material price volatility.