From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge Despite Trade Concerns: Plant Activity High, Japan Seeks AD Loophole Closure

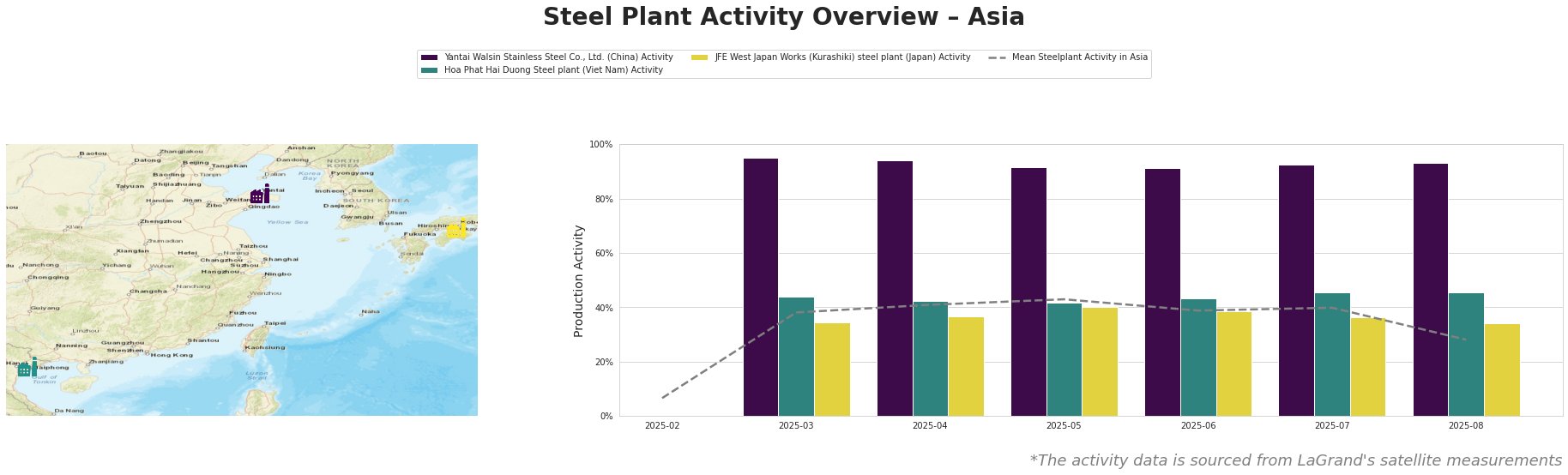

Asia’s steel market shows strong activity despite growing trade friction. Japan is actively pursuing measures to counter anti-dumping duty avoidance, as highlighted in “Japan’s steel industry urges Tokyo to close AD loophole“. Satellite data reveals elevated plant activity, particularly at Yantai Walsin, although a direct causal link between the Japanese policy push and activity levels is not explicitly evident.

Monthly Activity Trends:

Observed steel plant activity across Asia demonstrates a fluctuating trend, peaking in May 2025 at 43% before declining to 28% by August. Yantai Walsin consistently operated at significantly higher levels than the Asian mean, consistently exceeding 90% activity from March to August 2025. Hoa Phat Hai Duong’s activity shows a steady, albeit moderate, increase, reaching 46% in August. JFE West Japan Works (Kurashiki) displays a more stable activity level, fluctuating between 34% and 40%. The sharp overall drop in mean activity in August is not directly linked to specific developments reported in the provided news articles and is likely due to other market factors.

Yantai Walsin Stainless Steel Co., Ltd., located in Shandong, China, is an electric arc furnace (EAF) based plant with a crude steel capacity of 1.4 million tonnes, specializing in stainless steel products including billets, coils, bars, and sheets. The plant has maintained a very high activity level throughout the monitored period, consistently above 90%, with a slight dip to 91% in June followed by a rebound. While the news article “Japan’s steel industry urges Tokyo to close AD loophole” mentions concerns about Chinese exporters, no direct evidence links this policy pressure to Yantai Walsin’s production activity.

Hoa Phat Hai Duong Steel plant, situated in Hai Duong, Viet Nam, operates with integrated blast furnace (BF) and basic oxygen furnace (BOF) technology, boasting a crude steel capacity of 2.5 million tonnes, producing construction steel, hot rolled coil, and other finished rolled products. The plant’s activity increased gradually from 44% in March to 46% in August. No direct relationship between the observed activity levels at Hoa Phat Hai Duong and the provided news articles can be established.

JFE West Japan Works (Kurashiki) steel plant, located in the Chūgoku region of Japan, is an integrated steel plant with a crude steel capacity of 10 million tonnes, utilizing both BF and BOF processes, producing a wide range of products from hot rolled sheets to UOE pipes. The plant’s activity has been relatively stable, fluctuating between 34% and 40% during the observed period. While Japan’s steel industry is actively addressing anti-dumping loopholes as described in “Japan’s steel industry urges Tokyo to close AD loophole“, there is no explicit indication that this has directly impacted the activity levels at the JFE Kurashiki plant.

Given the high and stable activity at Yantai Walsin coupled with Japan’s effort to curb potential dumping activities described in “Japan’s steel industry urges Tokyo to close AD loophole“, steel buyers should:

- Secure inventory: Given the potential for future trade restrictions affecting Chinese exports to Japan, procurement professionals relying on these supply chains should consider securing additional inventory of stainless steel products to mitigate risks from potential supply disruptions.

- Diversify Sourcing: Buyers dependent on JFE West Japan Works for specific product lines should monitor policy changes closely to anticipate and proactively manage potential risks and consider alternative sourcing options to mitigate potential disruptions caused by policy shifts within the Japanese market.