From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market: Rebar and HRC Prices Rise Amidst Fluctuating Plant Activity

Oceania’s steel market exhibits a complex interplay of rising prices and variable plant activity. “Steel rebar prices strengthen in Northern Europe as mills revise extras” and “Steel rebar prices in Northern Europe are rising as factories review additional prices” highlight a general trend of increased rebar pricing, although these articles do not directly reference Oceania. “European HRC prices steady amid muted trading; mills keep pushing for higher offers” shows a similar pressure on HRC prices, but again no direct Oceania connection is made within the provided text. There is no explicit evidence in the provided articles to link the news with the satellite-observed changes in plant activity.

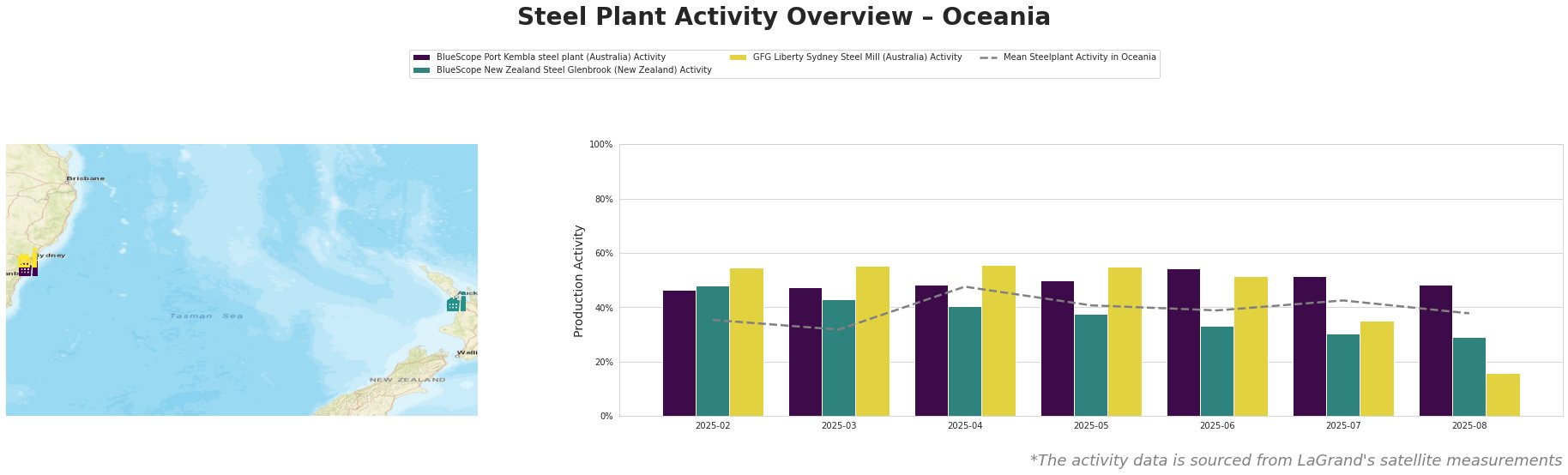

The mean steel plant activity in Oceania fluctuated, peaking at 48% in April and decreasing to 38% by August.

BlueScope Port Kembla, an integrated BF-BOF steel plant in New South Wales with a 3.2 million tonne crude steel capacity focused on slabs, hot-rolled coil, and plate for building and infrastructure, saw activity fluctuate, peaking in June at 54% before declining to 48% in August. There is no direct connection to “Steel rebar prices strengthen in Northern Europe as mills revise extras”, “European HRC prices steady amid muted trading; mills keep pushing for higher offers” or “Steel rebar prices in Northern Europe are rising as factories review additional prices” news articles to explain these changes in activity.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF plant in South Auckland with a 650,000 tonne crude steel capacity produces slabs, hot and cold-rolled products primarily for building, infrastructure, packaging, tools, and machinery. The plant’s activity decreased significantly from 48% in February to 29% in August. Again, no direct connection to “Steel rebar prices strengthen in Northern Europe as mills revise extras”, “European HRC prices steady amid muted trading; mills keep pushing for higher offers” or “Steel rebar prices in Northern Europe are rising as factories review additional prices” can be established.

GFG Liberty Sydney Steel Mill, an EAF-based plant in New South Wales with a 750,000 tonne crude steel capacity focused on long products like rebar, mesh, and sections for building, infrastructure, energy, packaging, tools, machinery, and transport, experienced a sharp decline in activity, plummeting from 55% in May to 16% in August. As with the other plants, no direct connection to “Steel rebar prices strengthen in Northern Europe as mills revise extras”, “European HRC prices steady amid muted trading; mills keep pushing for higher offers” or “Steel rebar prices in Northern Europe are rising as factories review additional prices” can be established with this decline.

The significant drop in activity at GFG Liberty Sydney Steel Mill, combined with fluctuations at BlueScope plants, indicates potential localized supply constraints in long products within Oceania. Considering the overall trend of rising rebar prices as noted in “Steel rebar prices strengthen in Northern Europe as mills revise extras” and “Steel rebar prices in Northern Europe are rising as factories review additional prices” (although not directly referencing Oceania), steel buyers procuring long products, especially rebar, in the New South Wales region should actively monitor inventory levels and consider diversifying suppliers to mitigate potential price increases and supply disruptions related to the GFG Liberty Sydney Steel Mill. Buyers should also closely watch the BlueScope plants output to anticipate for any further price volatility. The Northern European HRC and Rebar price trends reported in “European HRC prices steady amid muted trading; mills keep pushing for higher offers”, “Steel rebar prices strengthen in Northern Europe as mills revise extras” and “Steel rebar prices in Northern Europe are rising as factories review additional prices” do not provide clear indication of Oceania HRC supply disruptions, so actions are not recommended.