From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Robust Despite US Export Dip: Indian Production Surges

Asia’s steel market remains positive, driven by strong Indian production despite a decline in US steel and scrap exports. While the impact of articles like “US iron and steel scrap exports down 19.1 percent in June 2025“, “US steel imports down 9.3 percent in June 2025“, “US steel exports down 2.8 percent in June 2025“, and “US HRC exports down 3.6 percent in June 2025” on Asian markets is likely minimal due to diverse trade relationships. No direct relationship could be established between the US export data and specific plant activity changes observed via satellite in Asia.

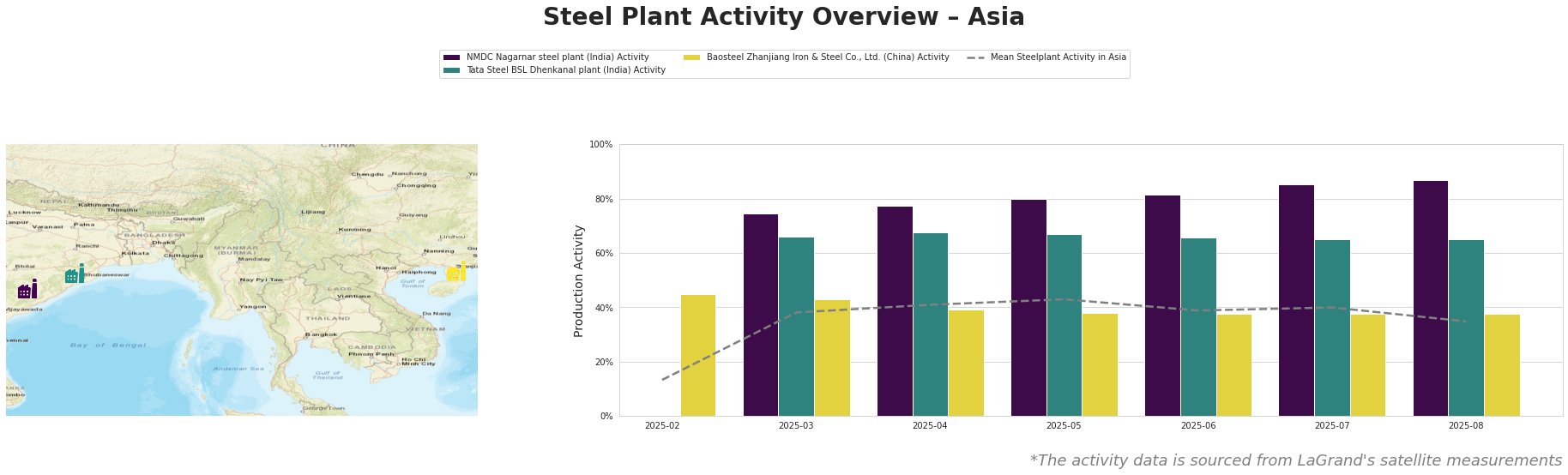

Across Asia, the mean steel plant activity has fluctuated, reaching a peak in May at 43% and then gradually declining to 35% by August. NMDC Nagarnar in India displays a consistently strong upward trend, increasing from 74% in March to 87% in August, significantly exceeding the Asian mean. Tata Steel BSL Dhenkanal exhibits stable activity around 65-67% throughout the observed period, also above the regional average. Baosteel Zhanjiang in China shows a relatively stable, albeit lower, activity level, hovering around 38-45%.

NMDC Nagarnar steel plant, a 3 million tonne integrated (BF-BOF) steel plant in Chhattisgarh, India, produces finished rolled products like hot rolled coils and plates. Its activity has steadily increased to 87% by August, signaling robust production. Tata Steel BSL Dhenkanal plant, a 5.6 million tonne integrated plant in Odisha, India utilizes both BF and DRI processes and produces semi-finished and finished rolled products. The plant has maintained consistent production, with activity remaining around 65% recently. Baosteel Zhanjiang Iron & Steel Co., Ltd., a major 12.5 million tonne integrated BF-BOF steel plant in Guangdong, China, primarily produces finished rolled products. Its activity has remained relatively stable around 38% lately, and below the mean activity in the region.

The strong production at NMDC Nagarnar suggests increased availability of hot rolled coils, sheets, and plates from India. The US export articles do not appear to have a direct influence on these developments.

Evaluated Market Implications:

Based on the observed trend of high and increasing production at NMDC Nagarnar, and the stable production at Tata Steel BSL Dhenkanal in India, steel buyers should explore opportunities to diversify their sourcing and increase procurement from these Indian plants. This could potentially mitigate risks associated with supply chain disruptions elsewhere and leverage competitive pricing from these producers. Given the declining average activity in Asia, steel buyers should closely monitor inventory levels and proactively engage with suppliers to secure favorable terms, especially for hot rolled products. No direct impact of US steel export developments on the Asian market or the mentioned plants could be established.