From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Supply Risks Amidst Chinese Output Fluctuations

In Asia, the steel market faces uncertainty due to fluctuating Chinese production levels. The recent increase in daily crude steel output reported in “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” contrasts with the overall decline highlighted in “China’s Crude Steel Output Falls Below 80 Million mt in July, down 3.1% in Jan-July” and “China reduces steel output for the third month in a row“. It remains unclear if the production uptick in early August can offset the overall downtrend. Currently no direct relationship can be established with the satellite data.

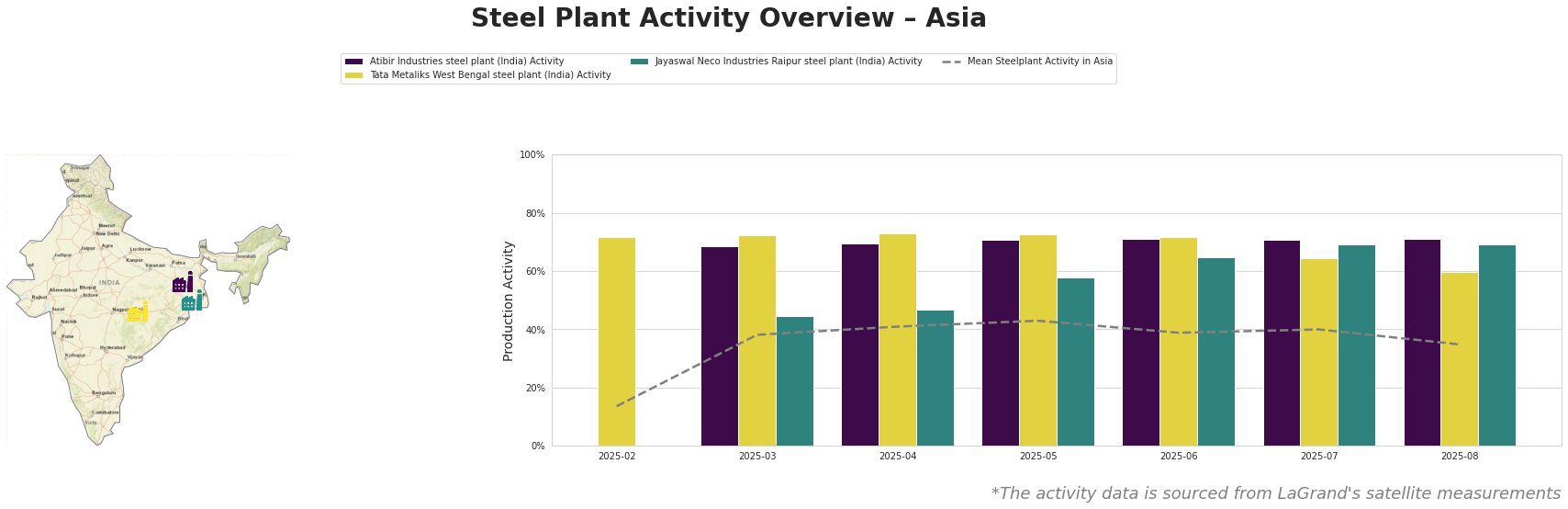

Overall, the mean steel plant activity in Asia has declined from a high of 43.0% in May to 35.0% in August. Atibir Industries in India has maintained a consistently high activity level around 71% from May to August, showing resilience compared to the Asian mean. Tata Metaliks in West Bengal saw a decrease in activity from 73% in May to 60% in August. Jayaswal Neco Industries in Raipur steadily increased activity to a high of 69% in July and has maintained this level in August, significantly outperforming the average trend in Asia since March.

Atibir Industries steel plant, located in Jharkhand, India, possesses an integrated BF-BOF production route with a crude steel capacity of 600 ttpa and is ResponsibleSteel certified. Its activity has remained stable at approximately 71% from May to August, significantly above the Asian mean. No direct connection to news articles could be established.

Tata Metaliks West Bengal steel plant, an integrated BF-BOF producer with 255 ttpa crude steel capacity and ResponsibleSteel certification, experienced a decrease in activity from 73% in May to 60% in August. This decline contrasts with the CISA mills’ early August output increase reported in “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up“, suggesting localized factors may be affecting production.

Jayaswal Neco Industries Raipur steel plant in Chhattisgarh, India, utilizes both BF and DRI production routes with a crude steel capacity of 1200 ttpa. Its activity has increased to and remained stable at 69% in July and August, significantly outperforming the Asian mean. No direct connection to news articles could be established.

The drop in overall activity across Asia, alongside increased Chinese production reported in “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” and the subsequent planned production cuts mentioned in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July,” creates supply uncertainties. Given the reduced activity at Tata Metaliks, steel buyers should closely monitor pig iron prices, as they are a key product for this plant. Procurement professionals should prioritize diversifying supply chains beyond mainland China to mitigate risks associated with production cuts and aim for longer term contracts with producers like Atibir Industries and Jayaswal Neco Industries with demonstrated stable activity levels to ensure supply security, especially for rolled products and bright bars.