From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukraine War Talks Weigh on Activity, Procurement Risks Rise

In Europe, steel market sentiment is negative, primarily driven by uncertainty surrounding the ongoing war in Ukraine. This uncertainty is highlighted in the news articles “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” “Gold Wavers as Traders Look to Jackson Hole and Ukraine Talks,” and “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?” While these articles discuss the potential for peace talks, no direct relationship to recent observed changes in plant activity levels in Europe can be immediately established, further complicating the outlook.

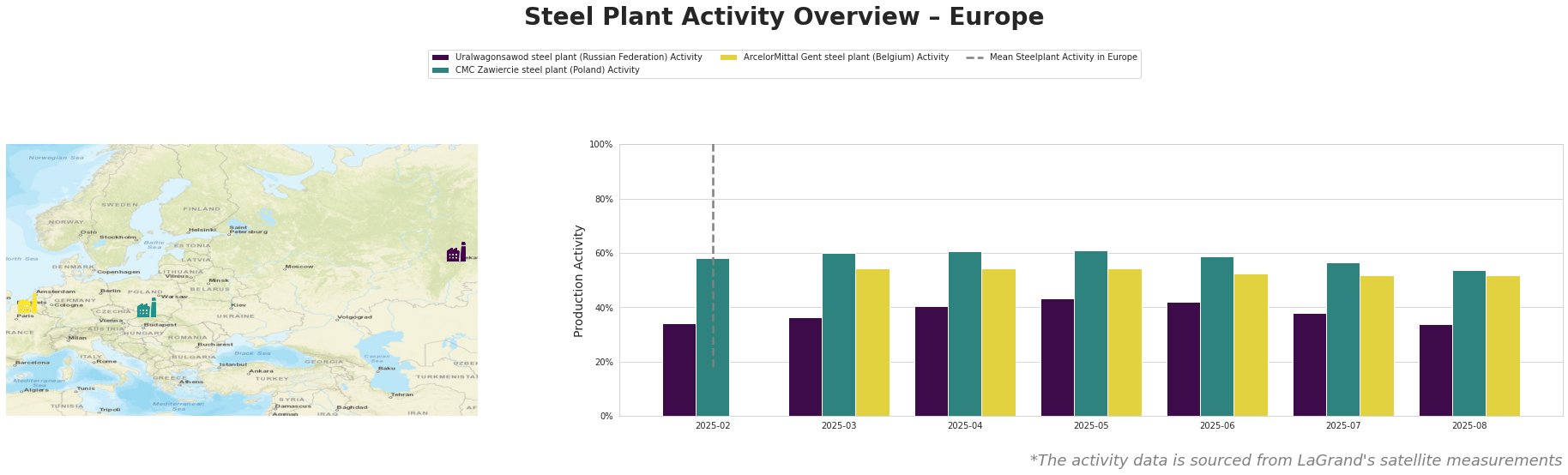

The table reveals diverging trends. The “Mean Steelplant Activity in Europe” metric is useless due to corrupt values. Uralwagonsawod, located in Russia, shows a declining trend in activity, from 43.0 in May to 34.0 in August. CMC Zawiercie in Poland shows a consistent decline from 61.0 in May to 54.0 in August. ArcelorMittal Gent, operating at 52-54, is relatively stable.

Uralwagonsawod, a Russian steel plant primarily serving the defense sector, has shown a decrease in activity from 43.0 in May to 34.0 in August. The news articles report on foreign policy discussions and the potential for peace talks involving Ukraine, but direct connection to plant activity levels is not explicitly stated. This downtrend may be related to uncertainty in Russia’s production needs contingent on Trump’s negotiations, but this is speculative and a direct causal link cannot be confirmed based solely on the provided data.

CMC Zawiercie, a Polish EAF steel plant with a 1.7 million tonne crude steel capacity, supplies multiple sectors including automotive and construction. Its activity has gradually decreased from 61.0 in May to 54.0 in August. No explicit connection between this decline and the provided news articles can be established. While the overall European market sentiment is negative due to the war in Ukraine, there is no explicit link in the news to justify this specific decline.

ArcelorMittal Gent, an integrated BF-BOF steel plant in Belgium, shows relatively stable activity, ranging from 52.0 to 54.0. This plant has a crude steel capacity of 5 million tonnes and produces semi-finished and finished rolled products. The steadiness in activity contrasts with the fluctuations observed at Uralwagonsawod and CMC Zawiercie. No direct influence from the Ukraine war talks, as mentioned in the news articles, can be established for this plant’s stable activity level.

Evaluated Market Implications:

The observed decline in activity at Uralwagonsawod, if linked to the ongoing geopolitical negotiations discussed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” “Gold Wavers as Traders Look to Jackson Hole and Ukraine Talks,” and “Zelenskyy agrees to Trump-Putin meeting without cease-fire, but will Kremlin dictator go along?“, could suggest potential future supply disruptions from this plant. Given its specialization in supplying the defense sector, a protracted negotiation timeline or escalation of the conflict could increase demand and strain capacity down the line. Steel buyers exposed to Eastern European markets, and relying on niche products from manufacturers using Eastern European Steel, should assess and diversify their supply chains proactively.

The gradual decline at CMC Zawiercie, while not directly linkable to the news, warrants careful monitoring. Since this EAF plant supplies crucial sectors such as automotive and construction, any further decrease in activity could signal weakening demand within the EU or challenges related to input costs (scrap, energy). Steel buyers should prioritize securing short-term supply contracts to mitigate immediate risks and carefully evaluate longer-term agreements until the factors affecting CMC Zawiercie’s activity become clearer.