From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US-China Tariff Delay: Plant Activity Analysis

The Asian steel market is showing positive signs following the delay of US-China tariffs. According to “Marktbericht: Anleger freuen sich über Zoll-Aufschub,” investors are reacting favorably to this development, which is also confirmed by “The US and China have extended the tariff truce for 90 days” and “US-China tariffs delayed by 90 days: Update“. While the news articles suggest a potentially positive impact on the overall steel market, direct connections between these news pieces and observed activity changes in specific steel plants are not immediately apparent from the available data.

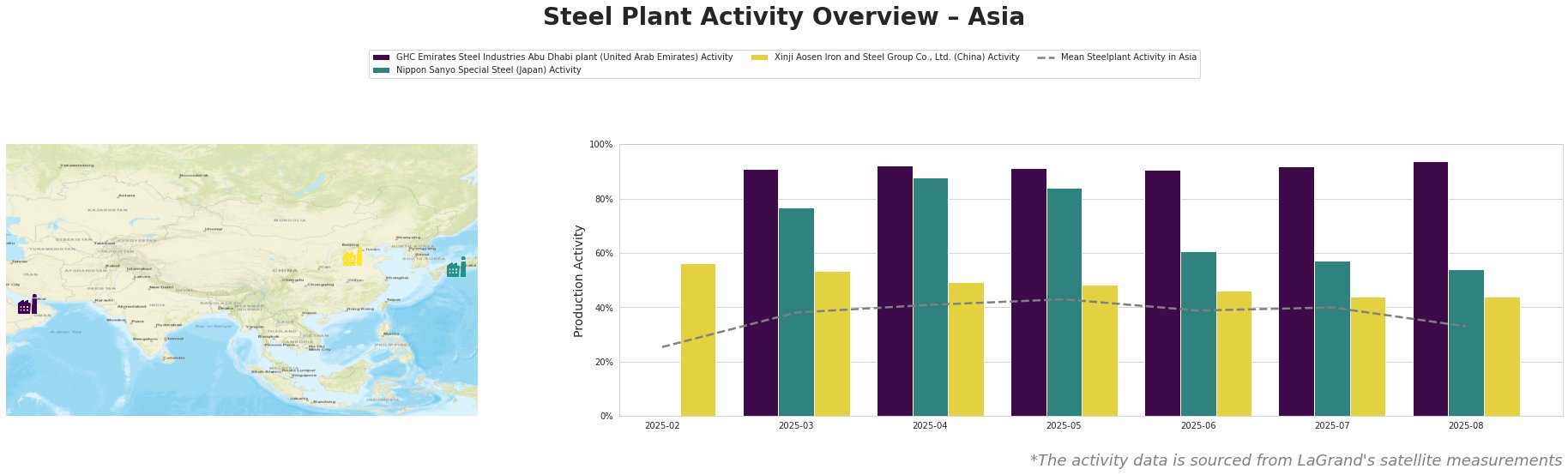

The mean steel plant activity in Asia shows fluctuation, peaking in May at 43% and then decreasing to 33% in August. The GHC Emirates Steel plant in Abu Dhabi consistently operates at high levels, reaching 94% in August. Nippon Sanyo Special Steel experienced a notable decrease in activity from April (88%) to August (54%). Xinji Aosen Iron and Steel Group Co., Ltd. shows a consistent decline from February (56%) to August (44%). The GHC Emirates Steel plant’s activity consistently outperforms the Asian average, while Nippon Sanyo Special Steel’s activity fluctuates around the average. Xinji Aosen Iron and Steel Group Co., Ltd. consistently underperforms the average.

GHC Emirates Steel Industries Abu Dhabi plant, with a capacity of 3.5 million tonnes per annum (ttpa) of crude steel produced via DRI and EAF, and certified by ResponsibleSteelCertification, is focused on semi-finished and finished rolled products. Observed activity remains very high at 94% in August, suggesting stable production. No direct connection to the tariff delay news can be established based on this information.

Nippon Sanyo Special Steel, located in the Kansai region of Japan, has a crude steel capacity of 1.596 million ttpa, produced via EAF. The company manufactures semi-finished and finished rolled products for various sectors, including automotive and infrastructure and also is ResponsibleSteel certified. The plant experienced a significant activity drop, from 88% in April to 54% in August. Without further information, no direct link to the US-China tariff news can be established, potentially signaling domestic demand or supply chain factors at play.

Xinji Aosen Iron and Steel Group Co., Ltd., located in Hebei, China, possesses a crude steel capacity of 3.6 million ttpa using BF and BOF technologies. Its product portfolio includes billets, slabs, high-speed wire rods, and hot-rolled strip products. The plant’s activity level decreased steadily from 56% in February to 44% in August. While news articles mention the delay of US tariffs on Chinese goods, the declining activity at this specific plant may be influenced by domestic Chinese market conditions or internal production adjustments, unrelated to US tariffs. No direct impact of the news can be established.

Evaluated Market Implications:

Given the high and stable activity at GHC Emirates Steel in Abu Dhabi, and considering the tariff delay, potential steel buyers might explore increased procurement from this plant to ensure supply stability. The tariff delay described in “The US and China have extended the tariff truce for 90 days” and “US-China tariffs delayed by 90 days: Update” alleviates immediate upward pressure on steel prices, providing a window for negotiation. The decline in activity at Nippon Sanyo Special Steel warrants caution. Potential buyers should monitor this plant’s output closely as this drop, along with potential fluctuations around the mean in Asia, could lead to supply shortages in specific product categories from Japan, or more broadly throughout the continent. The observed trends necessitate a diversified procurement strategy to mitigate regional supply risks.