From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Rising China Output, Indian Coke Shortages, and Declining Plant Activity

Asia’s steel market is facing headwinds as highlighted by recent developments. According to “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up“, Chinese steel production is increasing, potentially adding to global supply. JSW Steel is facing coke shortages, as reported in “JSW Steel seeks to increase its coke import quotas to cover shortages,” impacting operational efficiency, while satellite data indicates a decline in average regional plant activity. A direct relationship between the CISA news and Indian steel mills cannot be explicitly established.

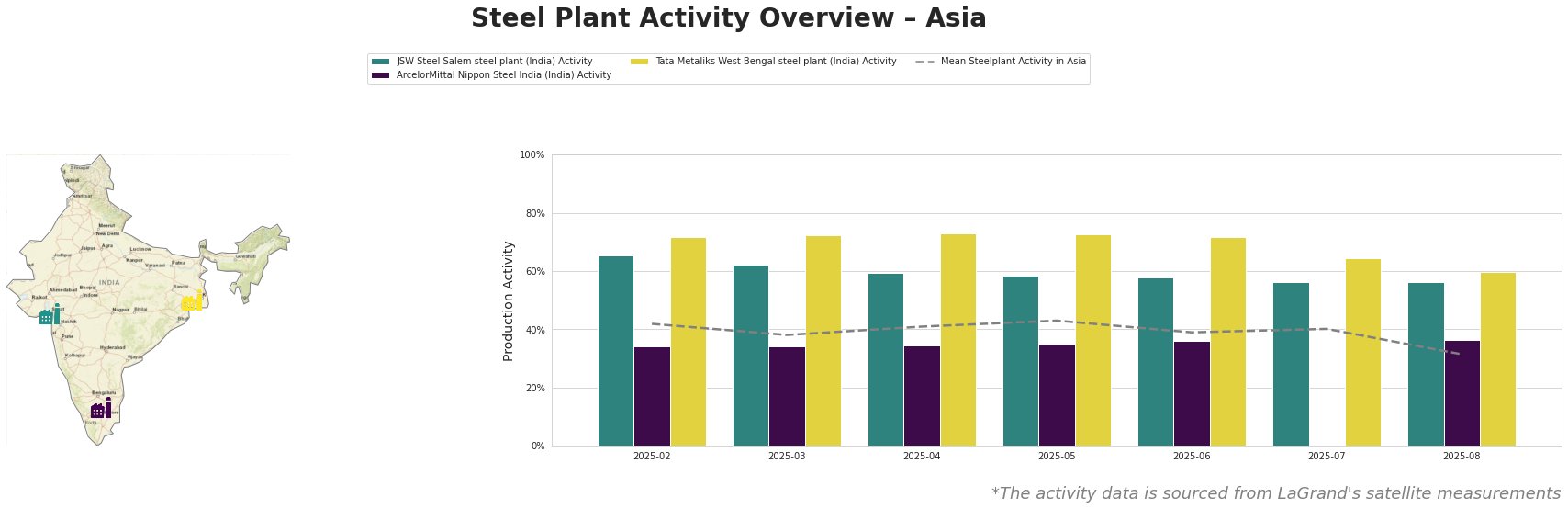

The mean steel plant activity in Asia has declined significantly in August to 31%, the lowest in the reported period, after hovering between 38% and 43% in the preceding months.

JSW Steel Salem, a plant with an integrated BF process and a crude steel capacity of 1.03 million tonnes, has shown a gradual decline in activity from 66% in February to a stable 56% in July and August. While “India’s JSW Steel Limited achieves 19% rise in consolidated crude steel output in July 2025” reports increased overall output for JSW Steel, the Salem plant’s individual decline isn’t directly addressed, and no direct link can be established. However, the simultaneous “JSW Steel seeks to increase its coke import quotas to cover shortages” news suggests potential operational constraints that might explain this local activity level trend.

ArcelorMittal Nippon Steel India, a plant relying on both BF and DRI processes with a crude steel capacity of 9.6 million tonnes, showed a relatively stable activity level around 34-36% throughout the observed period, with a measurement missing for July. No direct connection can be established between the observed activity and the provided news articles.

Tata Metaliks West Bengal, an integrated BF plant with a smaller crude steel capacity of 255,000 tonnes, exhibited the highest activity levels among the monitored plants, initially stable at 72-73%, but experienced a notable drop to 64% in July and a further decrease to 60% in August. No direct connection can be established between this plant’s activity and the provided news articles.

Given the reported rise in Chinese steel output and the coke shortage affecting JSW Steel, procurement professionals should:

- Carefully monitor coke prices and availability: The potential coke shortage at JSW Steel, as reported in “JSW Steel seeks to increase its coke import quotas to cover shortages,” could impact their production and potentially lead to price increases or supply disruptions for specific steel products. Buyers relying on JSW Steel should closely track coke market dynamics.

- Assess inventory strategies: With a decrease in the mean activity observed, steel buyers should assess their inventory levels and consider building up stock to buffer against potential supply side disruptions.

- Evaluate alternative suppliers: Given that coke shortages might affect JSW Steel’s production, steel buyers should explore diversifying their supply base. The Indian government’s consideration of increasing coke import quotas may ease the situation, however, it’s best to prepare for various outcomes.