From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Import Policies Shift Amidst Coke Shortages and Anti-Dumping Actions

Asia’s steel market faces potential shifts driven by evolving Indian import policies and raw material constraints. Specifically, “JSW Steel seeks to increase its coke import quotas to cover shortages” highlights challenges in India, while “India exempts 72 steel plants from new import rules” signals adjustments in trade regulations. While satellite activity data shows some fluctuations across key plants, a direct, immediate link to these policy changes cannot be definitively established at this time.

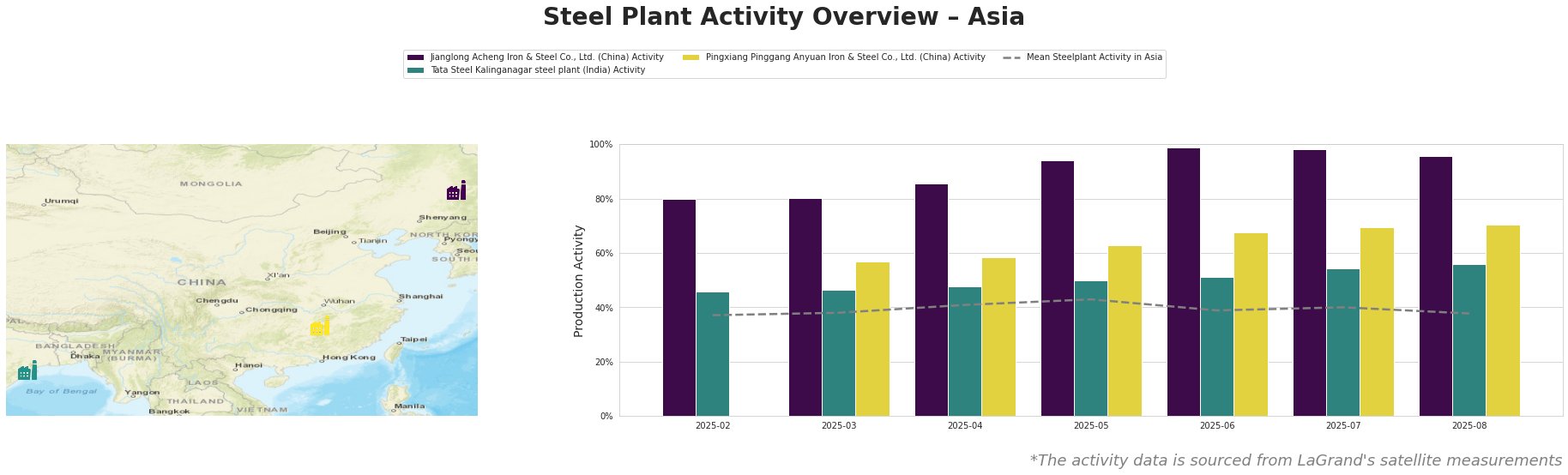

The following table summarizes the steel plant activity over the last few months, based on satellite observations:

The mean steel plant activity in Asia remained relatively stable, fluctuating between 37% and 43% from February to August, with a slight dip to 38% in August.

Jianglong Acheng Iron & Steel, a Chinese integrated BF steel plant with an 1,100 ktpa BOF crude steel capacity, exhibited significantly higher activity than the Asian average, consistently operating above 80% and peaking at 99% in June before decreasing slightly to 96% in August. No direct connection to the provided news articles could be established.

Tata Steel’s Kalinganagar plant in India, with a 3,000 ktpa BOF crude steel capacity, showed a steady increase in activity from 46% in February to 56% in August. The “JSW Steel seeks to increase its coke import quotas to cover shortages” article suggests potential constraints for other Indian steelmakers; however, Kalinganagar’s observed activity increase does not immediately reflect this.

Pingxiang Pinggang Anyuan Iron & Steel, a Chinese integrated BF steel plant, showed a continuous activity increase from March to July, reaching 70% and maintaining this level in August. No direct link to the news articles could be established.

Evaluated Market Implications:

The developments described in “JSW Steel seeks to increase its coke import quotas to cover shortages” and “India exempts 72 steel plants from new import rules” could lead to supply adjustments within the Indian market. The exemption of 72 overseas plants, including major producers from Japan, South Korea, and Russia, may alleviate some supply pressure. However, the article “Indian anti-dumping petition” suggests potential import restrictions on Chinese alloy steel, and “Indian stainless steel producers seek antidumping levy on imports” signals further trade actions, potentially shifting supply dynamics and affecting the availability of specific steel grades.

Given JSW Steel’s coke shortage and the potential for anti-dumping duties impacting various import sources, steel buyers are advised to:

* Diversify Sourcing: Expand the supplier base beyond traditional sources, considering the impact of anti-dumping duties on specific countries.

* Monitor Policy Changes: Closely track Indian import policies and regulations, particularly those related to anti-dumping investigations, as highlighted in “Indian anti-dumping petition” and “Indian stainless steel producers seek antidumping levy on imports“.

* Evaluate Inventory Levels: Assess current inventory levels of critical steel grades, anticipating potential supply chain disruptions resulting from import restrictions or raw material shortages. Focus on materials used in the automotive, tools and machinery, building and infrastructure, and transport sectors, as these are the sectors to which the three plants supply products.