From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTangshan Steel Cuts Trigger China Output Dip: Monitor Regional Price Volatility

China’s steel sector faces downward pressure due to production cuts, particularly in Tangshan, as evidenced by the news articles “Output cuts in Tangshan in August to be much bigger than in July” and “Метallurgists in Tangshan will suspend production in August–September“. While the former article details production halts at 35 independent steel rolling companies due to a military parade impacting daily steel production, the latter highlights the air quality-driven suspensions, also in Tangshan. According to “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July,” the July output decline is partly attributable to these cuts, suggesting a possible trend. We examine satellite-observed activity data to assess the situation’s impact on specific plants, although a direct, real-time relationship cannot always be established due to reporting lags and the limited number of plants observed.

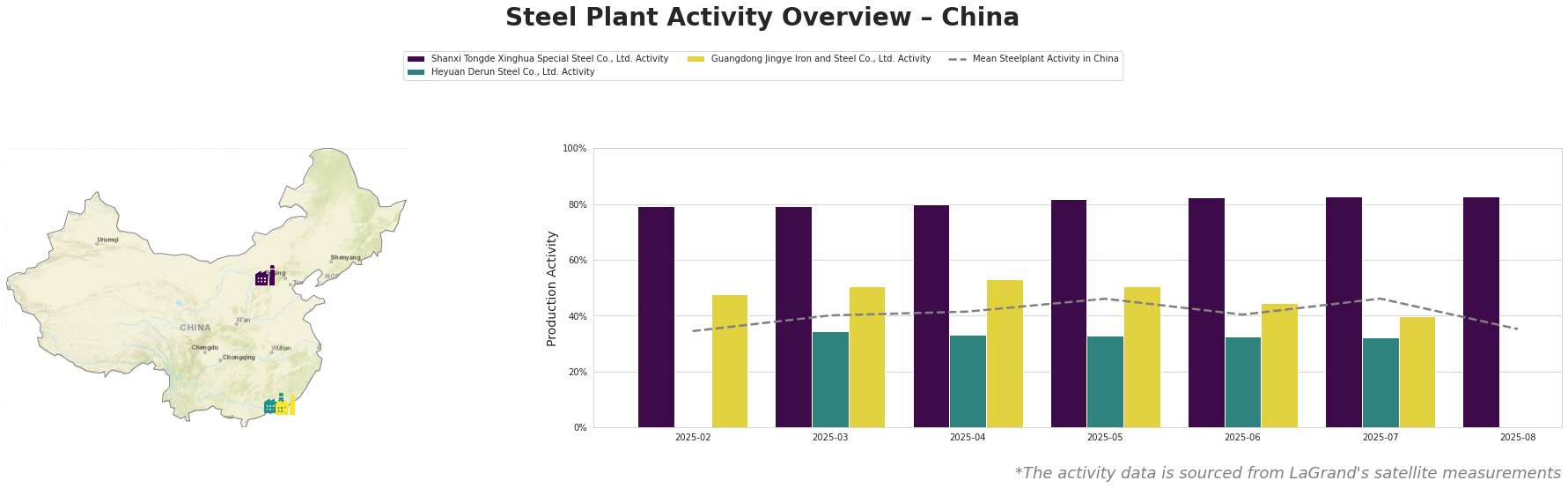

Here’s a summary of steel plant activity based on satellite observations:

Overall, mean steel plant activity in China peaked in May and July at 46% but dropped sharply to 35% in August, aligning with the production cuts discussed in the news articles. Shanxi Tongde Xinghua Special Steel Co., Ltd. maintained high activity levels, peaking at 83% in July and August, significantly above the national mean. Heyuan Derun Steel Co., Ltd. showed a consistent, low activity level in the low 30s percentage range, while Guangdong Jingye Iron and Steel Co., Ltd. fluctuated, with a peak in April at 53% and a drop to 40% in July; data for these last two plants is unavailable for August. No immediate connection between these fluctuations at Heyuan Derun and Guangdong Jingye and the cited news articles can be explicitly established.

Plant Information:

Shanxi Tongde Xinghua Special Steel Co., Ltd., a Shanxi-based integrated steel plant with a 2500 TTPA capacity focused on crude steel via BOF, primarily produces billet and rebar. Activity levels remained consistently high from February to August, peaking at 83% in July and August. This sustained high activity does not immediately reflect the general downward trend indicated in the news, and a direct relationship cannot be established.

Heyuan Derun Steel Co., Ltd., located in Guangdong, operates an electric arc furnace (EAF) with a 1200 TTPA capacity, producing hot-rolled rebar and billet. The plant’s activity remained relatively stable and low, fluctuating slightly between 32% and 34% from March to July. Without August data, it is hard to find a connection with the news about production cuts in the Tangshan region.

Guangdong Jingye Iron and Steel Co., Ltd. in Guangdong, utilizes integrated BF/BOF processes with a 1200 TTPA capacity to produce rebar and steel billet for the building, infrastructure, and transport sectors. Activity fluctuated between 40% and 53% from February to July. As with Heyuan Derun, a direct link to the Tangshan-focused news cannot be explicitly confirmed.

Evaluated Market Implications:

The production cuts in Tangshan, detailed in “Output cuts in Tangshan in August to be much bigger than in July” and “Метallurgists in Tangshan will suspend production in August–September,” combined with the observed drop in overall Chinese steel plant activity in August, as seen in the satellite data, indicate potential supply disruptions, particularly in billet and rebar, the main products of the affected Tangshan steelmakers. The article “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” supports this potential reduction in supply.

Recommended Procurement Actions:

- Monitor Regional Price Volatility: Steel buyers focused on rebar and billet should closely monitor price fluctuations in the Beijing-Tianjin-Hebei region, especially Tangshan, given the demonstrated impact of production cuts on local pricing as noted in the articles.

- Diversify Supply Sources: Given the potential for disruptions, procurement professionals should actively diversify their supply base beyond the Tangshan region to mitigate risks associated with concentrated production halts. Consider increasing purchases from plants outside of the affected regions.

- Evaluate Inventory Levels: Steel buyers should carefully evaluate their current inventory levels of rebar and billet, ensuring sufficient stock to buffer against potential supply shortages caused by the Tangshan production cuts. Consider increasing inventory if storage and capital allow.

- Negotiate Contractual Flexibility: When negotiating new contracts, incorporate clauses that allow for flexibility in delivery schedules and pricing, given the uncertainty surrounding production levels in key steelmaking regions like Tangshan.

These recommendations are based on the explicit connections between reported production cuts in Tangshan, the observed decrease in overall steel plant activity, and the focus of these production cuts on rebar and billet production.