From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth African Steel Crisis: US Tariffs, Job Losses, and Plant Closures Threaten Supply

South Africa’s steel industry faces significant headwinds due to US tariffs and domestic challenges. According to “South Africa’s auto sector hit by job losses and company closures,” the automotive sector is experiencing job losses and closures, partly attributed to US tariffs. “US-Zölle in Höhe von 30 Prozent: Südafrika macht Zugeständnisse” highlights the concessions South Africa is making to the US in response to these tariffs. These economic pressures, combined with internal issues, are impacting steel production. “South Africa and ArcelorMittal are negotiating the future of the company’s plants” directly correlates with potential supply disruptions, as ArcelorMittal South Africa (AMSA) negotiates with the government to prevent plant closures. The potential shutdown of AMSA’s long products facilities by September will significantly impact domestic steel supply, though this is not yet directly reflected in satellite observed plant activity.

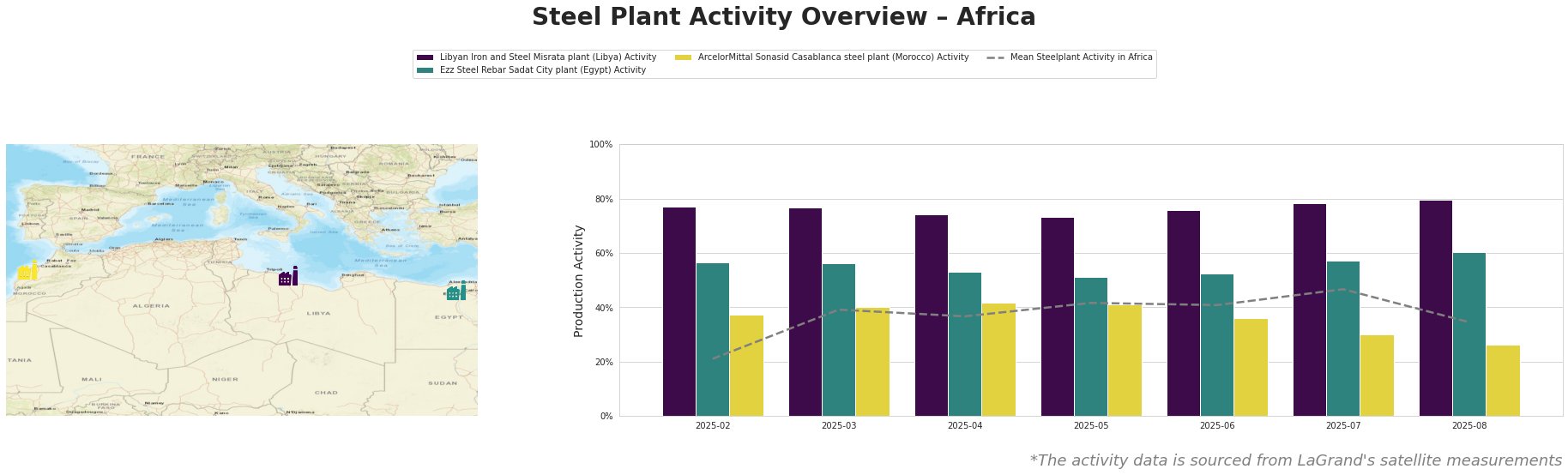

The mean steel plant activity in Africa has fluctuated, reaching a high of 47% in July before dropping to 35% in August. The Libyan Iron and Steel Misrata plant consistently operates at high activity levels, ranging from 73% to 80%, significantly above the African mean. The Ezz Steel Rebar Sadat City plant shows moderate activity, ranging from 51% to 60%, also above the mean. The ArcelorMittal Sonasid Casablanca steel plant presents a contrasting trend, with activity declining from 42% in April to 26% in August, falling well below the mean.

Steel Plant Name: Libyan Iron and Steel Misrata plant

The Libyan Iron and Steel Misrata plant, located in Misrata, Libya, boasts a crude steel production capacity of 1.75 million tonnes per annum (MTPA), utilizing DRI and EAF technologies. It produces crude, semi-finished, and finished rolled products, including bars, rods, and HBI, supported by an on-site power plant with a 507 MW capacity. Despite the regional challenges, the plant has maintained consistently high activity levels between February and August 2025, with a peak of 80% in August. This stable performance, significantly above the African average, suggests a degree of insulation from the immediate pressures affecting South African steel producers. Currently, no direct link can be established between the news articles provided and the plant’s stable activity.

Steel Plant Name: Ezz Steel Rebar Sadat City plant

Ezz Steel Rebar Sadat City plant in Menofia, Egypt, focuses on finished rolled products, specifically rebar, with a crude steel capacity of 1 MTPA, based on EAF technology. Its activity levels have been consistently above the African mean. August 2025 shows the highest activity with 60%.. No direct connection can be established between the provided news articles, focused on South Africa and AMSA, and the plant’s activity.

Steel Plant Name: ArcelorMittal Sonasid Casablanca steel plant

ArcelorMittal Sonasid Casablanca steel plant in Morocco has a crude steel capacity of 0.8 MTPA, relying on EAF technology to produce semi-finished and finished rolled products like rebar and wire rod, serving the building and infrastructure sectors. Its activity has steadily declined from 42% in April to 26% in August. This decline is notable, with the most recent activity being significantly lower than the African average, though no direct link can be established with the news articles provided concerning South Africa and US tariffs.

Evaluated Market Implications

The potential closure of ArcelorMittal South Africa’s (AMSA) long products facilities, as highlighted in “South Africa and ArcelorMittal are negotiating the future of the company’s plants,” poses a significant risk of supply disruption within the South African market. Given the job losses and company closures reported in “South Africa’s auto sector hit by job losses and company closures,” exacerbated by US tariffs (“US-Zölle in Höhe von 30 Prozent: Südafrika macht Zugeständnisse“), steel buyers should anticipate potential price increases and reduced availability of long steel products.

Recommended Procurement Actions:

- South African Steel Buyers: Immediately assess current inventory levels of long steel products and identify alternative suppliers, potentially outside of South Africa. Given the uncertainty surrounding AMSA’s future, securing supply from more stable sources is crucial.

- Market Analysts: Closely monitor the negotiations between AMSA and the South African government. Any further announcements regarding plant closures should be treated as a leading indicator of increased price volatility and supply shortages. Track import/export data for steel products in South Africa to anticipate future market dynamics.