From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth Africa Steel Sector Faces Closures and US Tariffs; Plant Activity Plummets

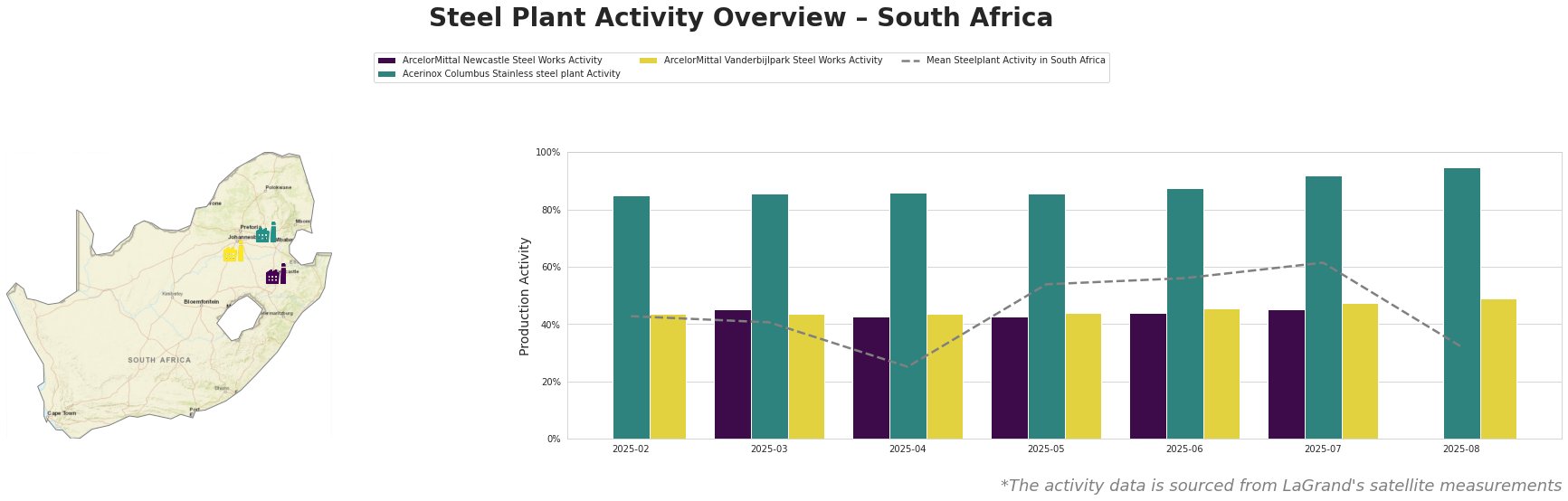

South Africa’s steel industry is under significant pressure due to US tariffs and potential plant closures, as evidenced by recent news and satellite-observed activity. The article “US-Zölle in Höhe von 30 Prozent: Südafrika macht Zugeständnisse” highlights the impact of US tariffs, while “South Africa’s auto sector hit by job losses and company closures” underscores the broader economic consequences and revised trade offer. Furthermore, “South Africa and ArcelorMittal are negotiating the future of the company’s plants” details ongoing negotiations concerning potential plant closures. The most recent satellite data for August 2025 shows a significant drop in the mean steel plant activity in South Africa, possibly reflecting these challenges.

Overall, the mean steel plant activity in South Africa has fluctuated significantly. It began at 43% in February, dropped to a low of 25% in April, and peaked at 61% in July before plummeting to 32% in August. Acerinox Columbus Stainless consistently operated at high activity levels, peaking at 95% in August. ArcelorMittal Vanderbijlpark showed a steady increase in activity from 44% in February to 49% in August. ArcelorMittal Newcastle’s activity was only measured between March and July. The sharp decline in the overall mean activity in August could be linked to the issues raised in the article “South Africa and ArcelorMittal are negotiating the future of the company’s plants,” but a direct correlation cannot be definitively established without plant-specific August activity data.

ArcelorMittal Newcastle Steel Works, an integrated steel plant with a 1.9 million tonne crude steel capacity based on BOF technology, faces potential closure. The plant produces semi-finished and finished rolled products, including rails and wire rod. While the plant activity data between March and July remained relatively stable, the article “South Africa and ArcelorMittal are negotiating the future of the company’s plants” directly threatens the plant’s future due to financial losses. August data is missing, preventing confirmation of this potential shutdown.

Acerinox Columbus Stainless steel plant, an electric arc furnace (EAF) based plant in Mpumalanga producing 750,000 tonnes of crude stainless steel annually, has consistently operated at high levels of activity. Activity climbed steadily from 85% in February to 95% in August. No direct links between this plant’s activity and the provided news articles can be established.

ArcelorMittal Vanderbijlpark Steel Works, an integrated plant with both blast furnace (BF) and direct reduced iron (DRI) production routes, has a crude steel capacity of 4.5 million tonnes. The plant produces a range of flat steel products. Its activity level has shown a slight upward trend, increasing from 44% in February to 49% in August. No direct links between this gradual increase in activity and the provided news articles can be established.

The potential closure of ArcelorMittal Newcastle, as highlighted in “South Africa and ArcelorMittal are negotiating the future of the company’s plants,” combined with the impact of US tariffs detailed in “US-Zölle in Höhe von 30 Prozent: Südafrika macht Zugeständnisse,” poses a significant supply disruption risk, particularly for long steel products like rails and wire rod. Steel buyers should immediately evaluate alternative supply sources for these products and consider increasing inventory levels to mitigate potential shortages. Given the uncertainty surrounding ArcelorMittal’s Newcastle plant, procurement professionals should closely monitor the negotiations between ArcelorMittal and the South African government. Furthermore, given the US tariffs, buyers should assess the potential for increased costs and adjust their budgets accordingly.