From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrance Steel Market: Trade Weakens, Metal Output Edges Up, Plant Activity Mixed

France’s steel sector faces a mixed outlook. Declining trade figures contrast with a slight increase in metal industry output, as highlighted in “France’s steel trade weakens in early 2025, while metal industry output edges up in June“. Satellite data reveals varied plant activity levels, but no direct correlation to this news article could be established. The impact of “France’s metal industry output up 0.2 percent in June 2025 from May” on specific plant activity remains unclear based on the data.

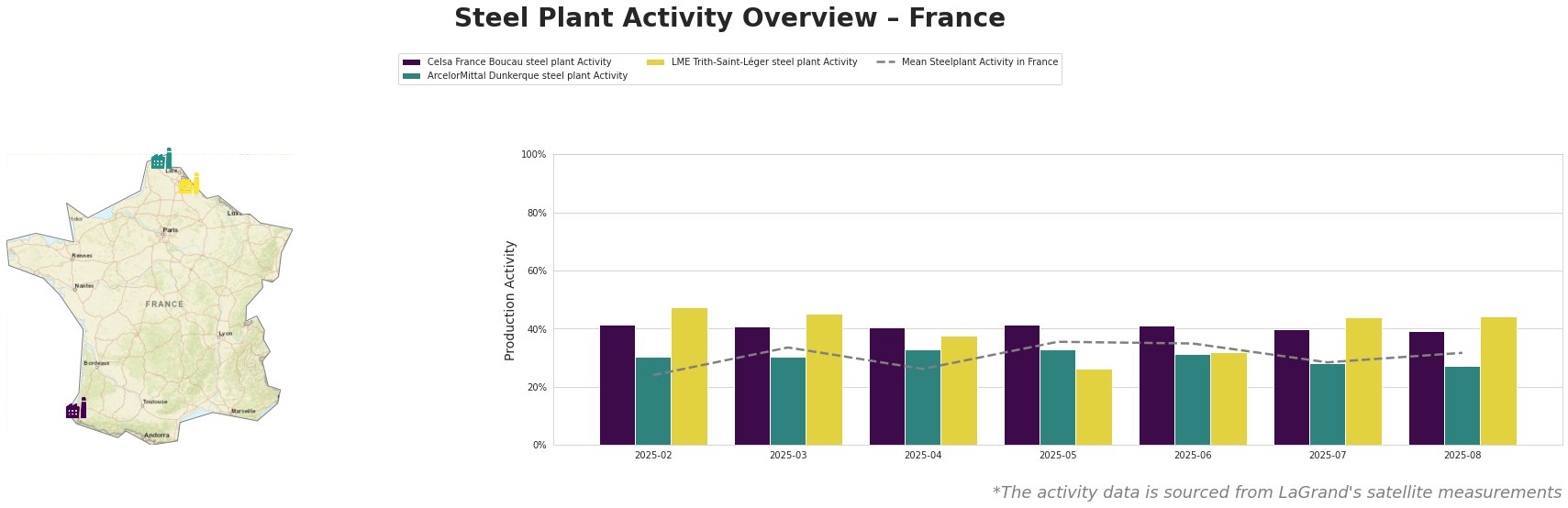

The mean steel plant activity in France fluctuated, peaking at 36% in May and dropping to 28% in July before recovering to 32% in August. Celsa France Boucau showed relatively stable activity around 40-41%, with a slight decrease to 39% in August. ArcelorMittal Dunkerque’s activity remained consistently lower than the mean, decreasing from 33% in April-May to 27% in August. LME Trith-Saint-Léger saw a significant drop to 26% in May, followed by a recovery, reaching 44% in July and August, significantly above the national average.

Celsa France Boucau, located in Nouvelle-Aquitaine, operates an EAF with a capacity of 1.2 million tonnes of crude steel annually, focusing on semi-finished and finished rolled products for sectors including automotive and construction. The plant maintained a relatively consistent activity level from February to July 2025, then experiences a minor drop in activity in August. The stability in production does not show a clear correlation with the trade data reported in “France’s steel trade weakens in early 2025, while metal industry output edges up in June”.

ArcelorMittal Dunkerque, situated in Haus-de-France, is an integrated BF-BOF plant with a substantial crude steel capacity of 6.75 million tonnes, producing slabs and hot-rolled coil. The plant’s activity consistently remained below the national average and experiences a reduction from 33% to 27% between May and August. Given that “France’s steel trade weakens in early 2025, while metal industry output edges up in June” indicates weakening trade, the lower activity level may be connected to reduced export demand but there is no explicit supporting evidence from the provided news articles.

LME Trith-Saint-Léger, an EAF-based plant in Hauts-de-France with 850,000 tonnes of crude steel capacity, experienced fluctuating activity. While the plant saw a drop in activity in May, it has since significantly increased to 44% in July and August, significantly above the national average. The increase has no direct correlation with the news article “France’s metal industry output up 0.2 percent in June 2025 from May”, but it is possible that the slight increase in metal production is tied to the increased activity observed in this specific plant.

The observed decrease in activity at ArcelorMittal Dunkerque combined with weakening trade reported in “France’s steel trade weakens in early 2025, while metal industry output edges up in June” suggests potential supply constraints in hot-rolled coil. Steel buyers should consider diversifying their supply base and explore alternative sources for hot-rolled coil to mitigate risks associated with potential production slowdowns at ArcelorMittal Dunkerque. Given the stable production at Celsa France Boucau and the product details, it could be an alternative supplier for billets and rolled products.