From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMalaysian Steel Market Shows Positive Momentum Despite Regional Volatility: Monitor Import Dynamics

Malaysia’s steel sector exhibits signs of overall positive momentum, even amidst price fluctuations in Europe and shifting trade dynamics. Observed activity at key steel plants provides insight into domestic production levels. The “ArcelorMittal increases northern Europe coil prices again: sources” article highlights rising European coil prices due to import restrictions, while the “EU heavy plate round-up: European heavy plate prices stable on seasonal slowdown” and “European stainless steel prices dip further amid summer lull; distributors cut stocks” articles discuss price stability in heavy plate and price dips in stainless steel, respectively, due to seasonal factors. No direct relationships between these European developments and the observed activity changes at Malaysian steel plants can be explicitly established based on the provided information.

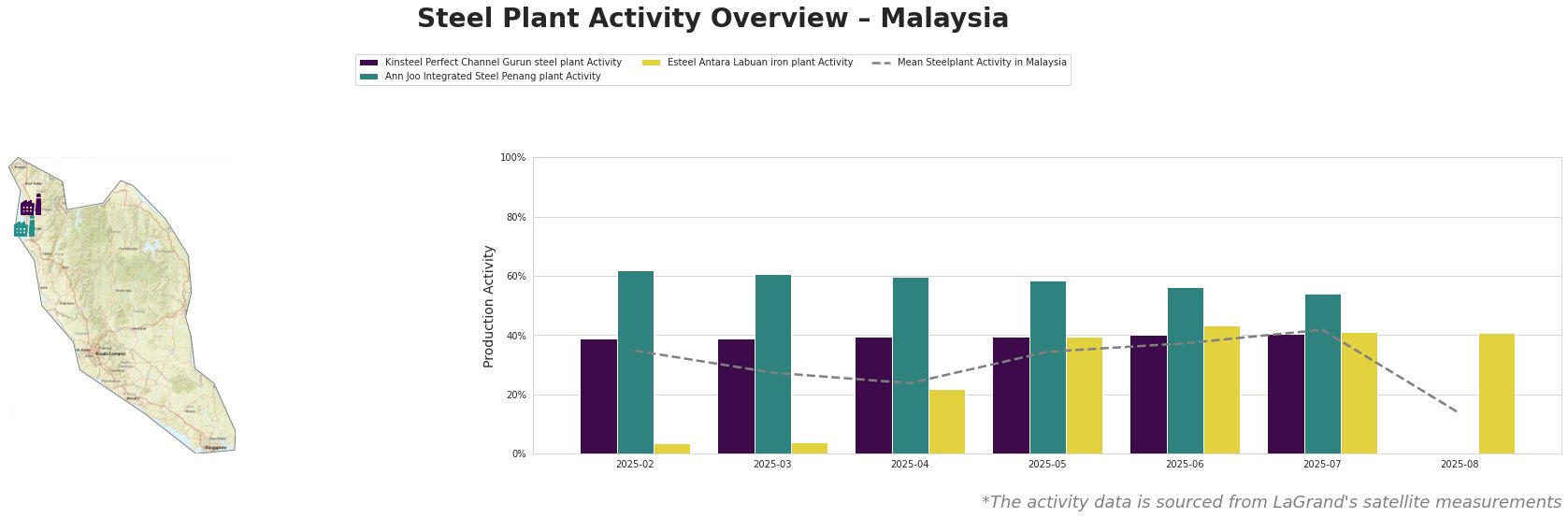

The mean steel plant activity in Malaysia shows a generally increasing trend from February to July 2025, peaking at 42.0%, before a significant drop to 14.0% in August. Kinsteel Perfect Channel Gurun steel plant shows relatively stable activity, hovering around 39-40% throughout the period. Ann Joo Integrated Steel Penang plant activity decreased steadily from 62.0% in February to 54.0% in July, significantly higher than the mean activity. Esteel Antara Labuan iron plant demonstrates a substantial increase from 4.0% in February/March to a peak of 43.0% in June before decreasing slightly to 41.0% in July and remaining stable in August. The substantial drop in overall mean activity during August is primarily driven by the complete lack of data for Kinsteel Perfect Channel Gurun and Ann Joo Integrated Steel Penang plant in the August numbers.

Kinsteel Perfect Channel Gurun steel plant, located in Kedah, primarily utilizes electric arc furnaces (EAF) to produce 500 thousand tonnes per annum (ttpa) of crude steel. Its product range includes semi-finished products like billet and finished rolled products like wire rod and spring steel flat bar. Its activity remained stable near 40% throughout the observed period until August, for which no value is available. As such no direct connection can be made with European market sentiments described in the provided news articles.

Ann Joo Integrated Steel Penang plant, located in Penang, is an integrated steel plant with both blast furnace (BF) and EAF processes, with a crude steel capacity of 500 ttpa and an iron capacity of 500 ttpa. It produces pig iron, hot metal, and billets, primarily for the building and infrastructure sector. Its activity gradually decreased from 62% in February to 54% in July. Again, no direct connection can be established between these numbers and the European news due to the plant’s product and geographical specifics.

Esteel Antara Labuan iron plant, situated on Labuan Island, focuses on ironmaking using Direct Reduced Iron (DRI) technology with a capacity of 900 ttpa. Its primary product is Hot Briquetted Iron (HBI). The plant showed a strong increase in activity from April to June before stabilizing at a high level. The price development in Europe as reported in “ArcelorMittal increases northern Europe coil prices again: sources”, “EU heavy plate round-up: European heavy plate prices stable on seasonal slowdown” and “European stainless steel prices dip further amid summer lull; distributors cut stocks” does not seem to directly influence activity in this plant, but is correlated to a similar dynamic.

Given the European market’s response to import restrictions as highlighted in “ArcelorMittal increases northern Europe coil prices again: sources” and the high production activity at the Esteel Antara Labuan iron plant, Malaysian steel buyers should closely monitor import dynamics from Europe and consider securing HBI supply agreements in advance to mitigate potential price increases driven by rising demand from European markets. Further, the absence of activity values for Kinsteel and Ann Joo plants in August suggests the need to diversify supply to avoid disruptions from localized production issues.