From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Heats Up: JSW Expansion & Production Surge Signal Opportunity Amidst Potential Supply Shifts

India’s steel sector exhibits strong positive momentum, fueled by significant capacity expansions and production increases. JSW Steel’s ambitious investment plans, detailed in “JSW and JFE invest $669 million to expand electrical steel production in India” and “India’s JSW Steel and JFE of Japan commit additional $669 million investments to ramp up CRGO production capacities,” directly correlate with expectations of increased activity at their Vijayanagar plant, though the actual impact won’t be seen until fiscal year 2028 when new capacity is slated to come online. “India’s JSW Steel Limited achieves 19% rise in consolidated crude steel output in July 2025” confirms a broader positive trend in JSW’s production. However, recent satellite-observed activity levels show a sharp dip across the industry in July and August 2025, suggesting potential near-term supply volatility.

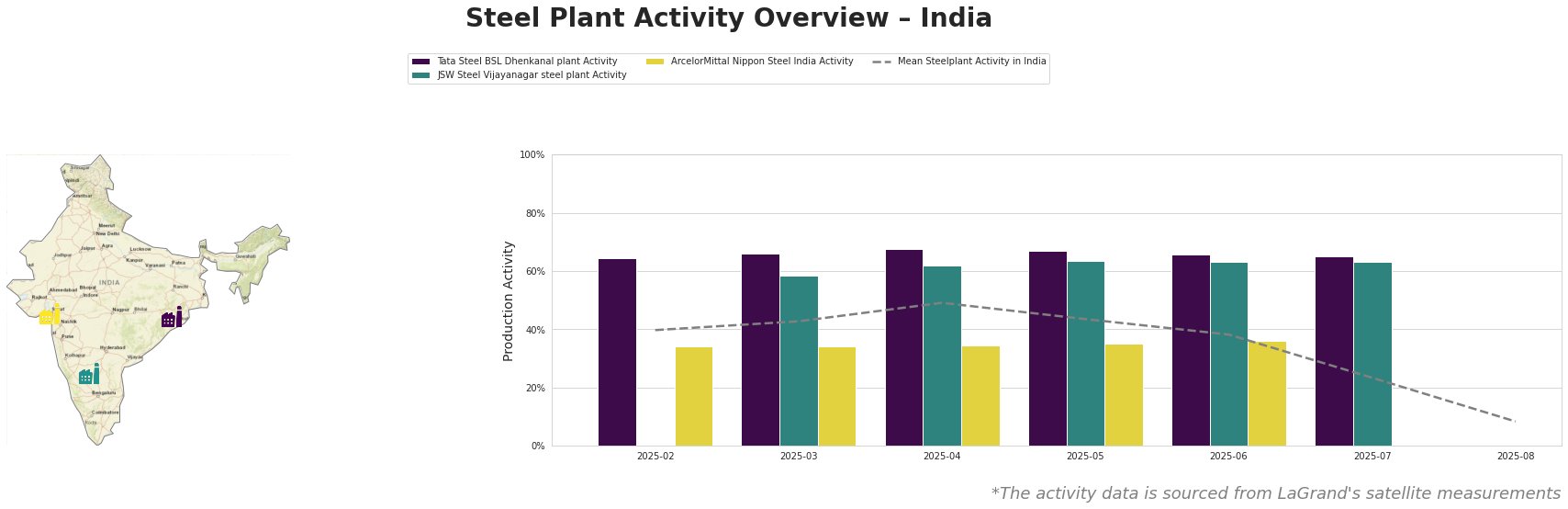

The mean steel plant activity in India shows a fluctuating trend from February to June 2025, peaking at 49% in April. However, a significant drop is observed in July (23%) and August (8%), indicating a sharp decline in overall steel production activity. Tata Steel BSL Dhenkanal plant consistently operated above the national average, with activity levels remaining relatively stable around 66% throughout the observed period. JSW Steel Vijayanagar steel plant showed strong activity, peaking at 64% in May before joining the overall decline in July. ArcelorMittal Nippon Steel India shows relatively low but stable activity levels between February and June, though no data is available for July and August. The sharp decline in the national average in July and August, which is also visible at JSW, warrants attention despite the news of capacity expansion.

Tata Steel BSL Dhenkanal plant: This plant in Odisha, boasting a crude steel capacity of 5.6 million tonnes and relying on integrated BF and DRI processes, consistently outperforms the national average in observed activity. Its stable activity around 65% suggests consistent production despite broader market fluctuations. The ResponsibleSteel certification indicates a commitment to sustainable practices. The observed stability doesn’t directly correlate with any specific news events provided, suggesting steady-state operation independent of immediate market announcements.

JSW Steel Vijayanagar steel plant: Located in Karnataka, this plant has a significant crude steel capacity of 12 million tonnes, utilizing both BF/BOF and EAF technologies. The plant’s activity peaked in May at 64% before declining to 63% in July, mirroring the overall market downturn. While the news articles detail a substantial investment in expanding electrical steel production at Vijayanagar, this expansion is not expected to impact production until fiscal year 2028. Therefore, the current activity decline isn’t directly linked to these expansion plans, but could indicate preparatory adjustments.

ArcelorMittal Nippon Steel India: Based in Gujarat, this plant has a crude steel capacity of 9.6 million tonnes, primarily using EAF technology with DRI. Its activity levels were consistently lower than the other two plants, remaining around 35% between February and June. No activity data is available for July and August. No direct connection between activity levels and the provided news can be established.

Given the significant drop in overall steel plant activity observed in July and August, despite positive news regarding capacity expansions and production increases at JSW Steel, steel buyers should:

- Diversify Procurement Sources: Reduce reliance on single suppliers in specific regions. The decline in average activity suggests potential bottlenecks that may impact steel availability.

- Monitor Supplier Performance Closely: Increase communication with current suppliers, particularly those showing a dip in activity (like JSW Vijayanagar), to understand the reasons for the decline and assess their ability to meet contractual obligations in the short term.

- Secure Long-Term Contracts Strategically: While expansions are promising for the long term, immediate supply risks exist. Secure longer-term contracts with stable suppliers, like Tata Steel BSL Dhenkanal, to mitigate short-term volatility.

These actions will help mitigate potential supply disruptions arising from recent market fluctuations and capitalize on future capacity increases.