From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAfrican Steel Market Faces Downturn Amidst EU Anti-Dumping Measures and Plant Activity Fluctuations

The African steel market is facing headwinds due to recent EU anti-dumping duties and fluctuating plant activity. Specifically, the impact of the “EU lowers AD duties on HRC from Egypt’s Ezz Steel and Japan’s Nippon Steel“ and related articles regarding hot-rolled coil (HRC) imports could impact regional steel trade flows. While the news articles outline changes in EU import duties, no direct relationship to the satellite-observed changes in the African steel plant activity levels can be established.

Measured Activity Overview:

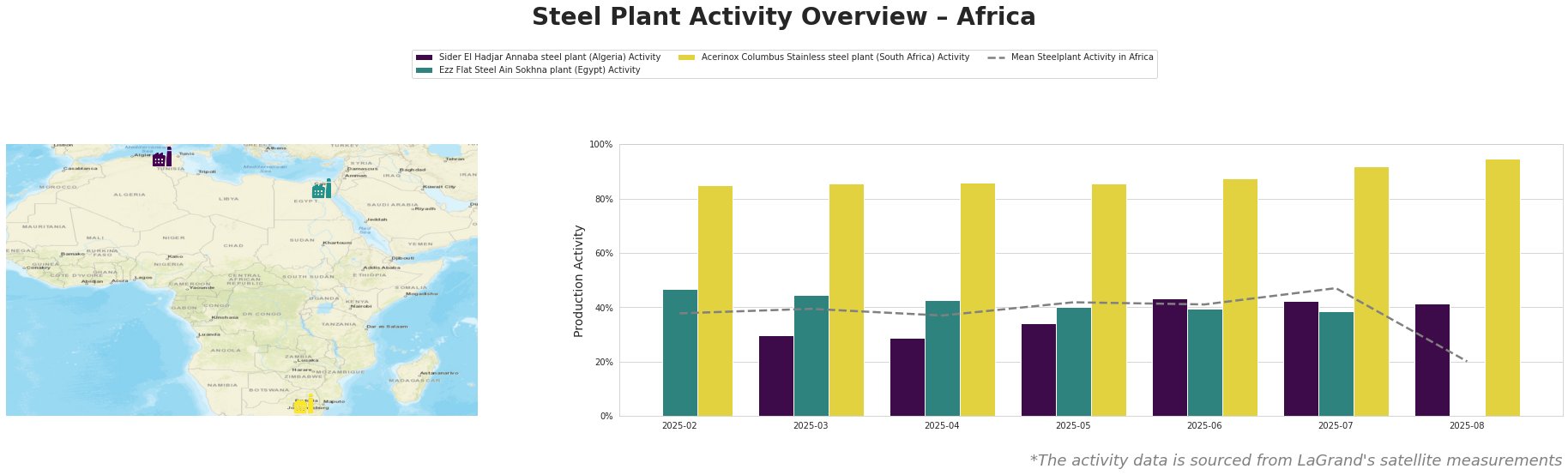

The mean steel plant activity in Africa shows a significant drop in August 2025, falling to 20% after a peak of 47% in July. Sider El Hadjar Annaba steel plant (Algeria) saw its activity fluctuate, peaking in June (43%) and remaining relatively stable around 41-42% for the subsequent months. Ezz Flat Steel Ain Sokhna plant (Egypt) experienced a decrease in activity from February (47%) to July (39%), but no data is available for August. Acerinox Columbus Stainless steel plant (South Africa) showed a consistent upward trend, reaching 95% activity in August, significantly above the African mean.

Sider El Hadjar Annaba, an integrated steel plant in Algeria utilizing BF and EAF technologies with a crude steel capacity of 1.8 million tonnes per annum (ttpa), showed fluctuating activity. The plant’s activity increased to 43% in June, then decreased to 41% in August. The plant produces semi-finished and finished rolled products, including hot-rolled coils and rebar. No direct connection between the activity levels and the news articles regarding EU anti-dumping duties can be established.

Ezz Flat Steel Ain Sokhna, a DRI-based integrated steel plant in Egypt with a crude steel capacity of 2.3 million ttpa, experienced a gradual decrease in activity from 47% in February to 39% in July. The plant produces billets, rebar, and HRC. Given the “EU lowers AD duties on HRC from Egypt’s Ezz Steel and Japan’s Nippon Steel” articles, the decreased plant activity might reflect anticipation of changing trade dynamics in the European market or strategic adjustments to production in response to the duty changes; however, no direct link can be explicitly confirmed.

Acerinox Columbus Stainless, an EAF-based stainless steel plant in South Africa with a crude steel capacity of 0.75 million ttpa, showed a consistent increase in activity, reaching 95% in August. The plant produces stainless steel slabs, coils, plates, and sheets. No direct connection between this plant’s activity and the news articles concerning HRC duties can be established, given its focus on stainless steel production.

Evaluated Market Implications:

The significant drop in the mean African steel plant activity in August, coupled with the “EU lowers AD duties on HRC from Egypt’s Ezz Steel and Japan’s Nippon Steel”, suggests potential shifts in regional supply dynamics. While Acerinox Columbus Stainless is operating at near full capacity, the reduced activity at Ezz Flat Steel Ain Sokhna (potentially linked to EU duty changes) and the overall August downturn indicate possible supply disruptions.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor the HRC supply from North Africa, especially Egyptian sources. Consider diversifying suppliers to mitigate potential risks arising from fluctuating production at Ezz Flat Steel Ain Sokhna and potential trade flow diversions due to the EU’s revised anti-dumping duties.

- Market Analysts: Track the correlation between EU HRC import data and North African HRC export volumes to assess the full impact of the duty adjustments. Further investigate the reasons behind the sharp decline in mean African steel plant activity in August to identify other potential factors influencing supply.