From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUS Steel Market Reacts to Trump’s Tariffs: Activity Shifts Amid Trade Tensions

The US steel market faces uncertainty following the implementation of tariffs on nearly 70 countries, as reported in “Hohe US-Zölle für knapp 70 Staaten in Kraft getreten“. This is coupled with ongoing trade disputes highlighted in “Trump wird durch die Zölle zum Verlierer” and the Swiss President’s efforts to negotiate, as covered by “Trumps US-Zölle im Liveticker: Schweizer Bundespräsidentin fliegt nach Washington, um Trump umzustimmen“. No direct link to the satellite-observed changes in plant activity levels can be established based on the provided information alone.

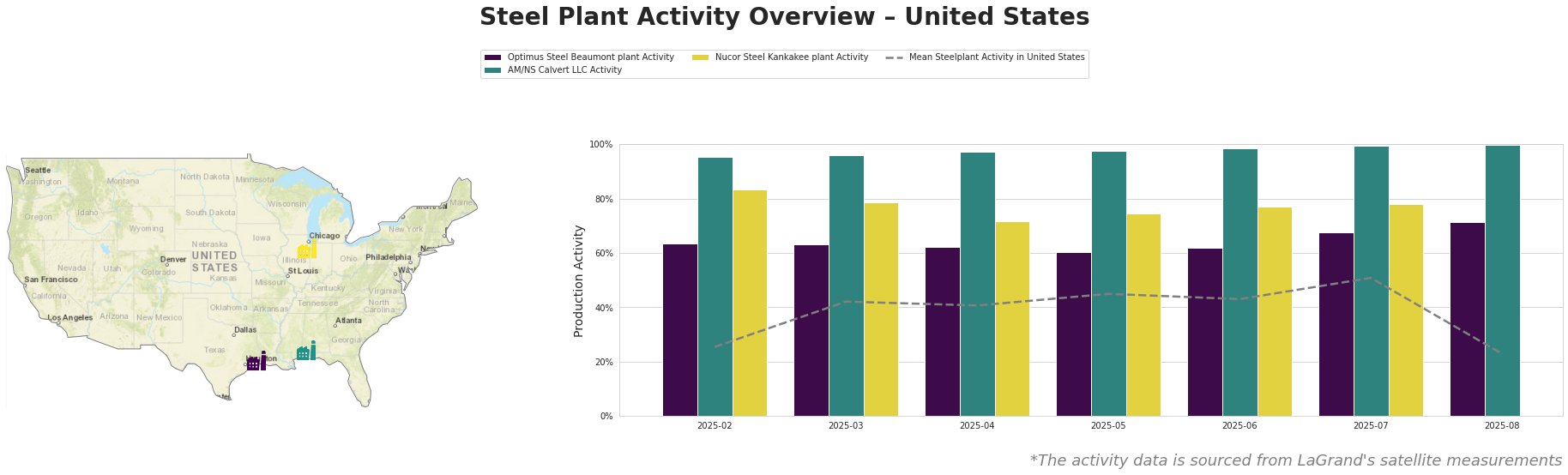

The mean steel plant activity in the United States showed an increasing trend from February to July 2025, peaking at 51.0%, followed by a significant drop to 23.0% in August. Optimus Steel Beaumont plant in Texas, an EAF-based producer of semi-finished and finished rolled products, saw a gradual decrease from February to May (64.0% to 60.0%), followed by a rise to 71.0% in August. Activity at AM/NS Calvert LLC in Alabama, also an EAF-based producer of finished rolled products, steadily increased, reaching its peak activity of 100.0% in August. Nucor Steel Kankakee plant in Illinois, which produces finished rolled bar and grating using EAF technology, experienced a decrease in activity between February and April (84.0% to 72.0%) before increasing slightly to 78.0% in July. The overall mean activity increased until July before a sharp drop in August.

Optimus Steel Beaumont plant, a 700 ttpa EAF-based mill in Texas producing wire rods, coiled rebar, and billets, showed an increase in activity to 71.0% in August despite the overall market downturn. No direct connection to the news articles can be established. AM/NS Calvert LLC, a 1500 ttpa EAF-based plant in Alabama producing hot-rolled, cold-rolled, and coated sheets, reached peak activity (100.0%) in August. The increased tariffs on imported steel, as noted in “Hohe US-Zölle für knapp 70 Staaten in Kraft getreten“, may have contributed to the plant operating at full capacity, but this cannot be definitively confirmed. Nucor Steel Kankakee plant, a 794 ttpa EAF-based mill in Illinois producing bar and grating, has no activity recorded for August.

The implementation of tariffs on steel imports, as reported in “Hohe US-Zölle für knapp 70 Staaten in Kraft getreten“, may lead to supply disruptions and price increases, particularly for steel products from affected countries like Switzerland (“US-Zollstreit: Statt einem Deal gibts für die Schweiz 39 Prozent Zoll“). With AM/NS Calvert LLC operating at full capacity, buyers should expect longer lead times. Steel buyers should immediately assess their supply chains for exposure to the newly imposed tariffs and explore alternative sourcing options within the US, considering the products offered by Optimus Steel Beaumont and Nucor Steel Kankakee. Given that no data for Nucor Steel Kankakee is available for August, steel buyers should contact the plant and check its production capacity. Market analysts should monitor import data and domestic price trends to assess the full impact of the tariffs.