From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge: Rising Prices & Ansteel Activity Signal Strong Demand

In Asia, the steel market exhibits very positive momentum. Recent price increases in China, detailed in “MOC: Average steel prices in China move up in July 21-27, 2025” and “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025,” suggest growing demand and inflationary pressure. The satellite-observed increase in activity at Ansteel Group Chaoyang Steel & Iron Co., Ltd. aligns with these price trends. However, the article “Stocks of main finished steel products in China up 1.3 percent in late July 2025,” indicates a potential supply response that could moderate further price increases.

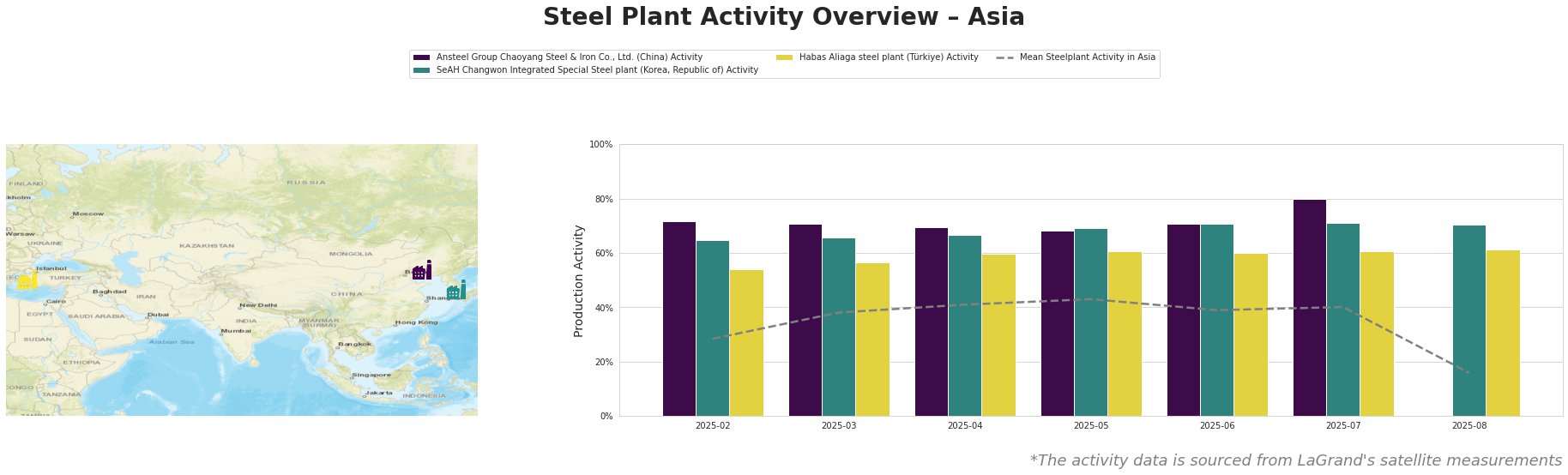

The mean steel plant activity in Asia showed a peak in May (43%) followed by slight declines in June (39%) and July (40%) with a substantial drop in August (16%). Ansteel Group Chaoyang Steel & Iron Co., Ltd. consistently operated above the Asian average. In July, it peaked at 80%, before activity data was unavailable in August. SeAH Changwon Integrated Special Steel plant also operated above the Asian average, remaining stable at 71% in July and August. Habas Aliaga steel plant showed consistent activity around 60%, also above the Asian average, with a value of 61% reported for July and August.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a major integrated steel producer in Liaoning, China, relies on BF and BOF technologies with a crude steel capacity of 2.1 million tonnes. Satellite data reveals a significant increase in activity in July (80%) compared to previous months, peaking at 80%, before missing data in August. This aligns with the price increases reported in “MOC: Average steel prices in China move up in July 21-27, 2025” and “NBS: Local Chinese rebar prices up 4.5 percent in late July 2025,” suggesting the plant may be increasing production to meet demand.

SeAH Changwon Integrated Special Steel plant, located in South Gyeongsang, South Korea, utilizes EAF technology with a crude steel capacity of 1.2 million tonnes, specializing in stainless steel, wire rod, coil, and seamless pipe for various sectors including automotive and energy. Satellite data indicates consistently high activity levels, remaining stable at 71% in both July and August. No direct link can be established between this activity and the Chinese price increases detailed in the provided news articles.

Habas Aliaga steel plant, located in İzmir, Türkiye, operates EAFs with a crude steel capacity of 4.5 million tonnes, producing billets, slabs, deformed bar, wire rod, and hot rolled coil. Satellite-observed activity remained stable at 61% in both July and August. No direct link can be established between this activity and the Chinese price increases detailed in the provided news articles.

The increase in finished steel inventories in China as noted in “Stocks of main finished steel products in China up 1.3 percent in late July 2025” combined with a sharp drop of the mean steel plant activity level in Asia in August suggests a potential supply glut might be developing. Therefore, steel buyers are advised to closely monitor inventory levels and consider negotiating contracts with staggered delivery schedules to mitigate the risk of price corrections in the short term. Given the increased activity at Ansteel and rising prices in China reported for July, procurement professionals may want to consider sourcing steel plate and pipe products from Ansteel, while being aware of data gaps in August.