From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Electrical Steel Expansion Drives Optimism Despite JFE’s Profit Dip

Asia’s steel market shows mixed signals: Indian electrical steel capacity is expanding rapidly, while JFE Steel faces profit declines. “Regarding the Expansion of Electrical Steel Manufacturing Capacity in India” and “JSW and JFE invest $669 million to expand electrical steel production in India” directly relate to observed activity levels in India. Conversely, “JFE Steel reports lower net profit and sales for Q1 FY 2024-25” provides context for Japanese steel production. No direct relationship between the activity levels in the Japanese plant and the news article could be established from the data.

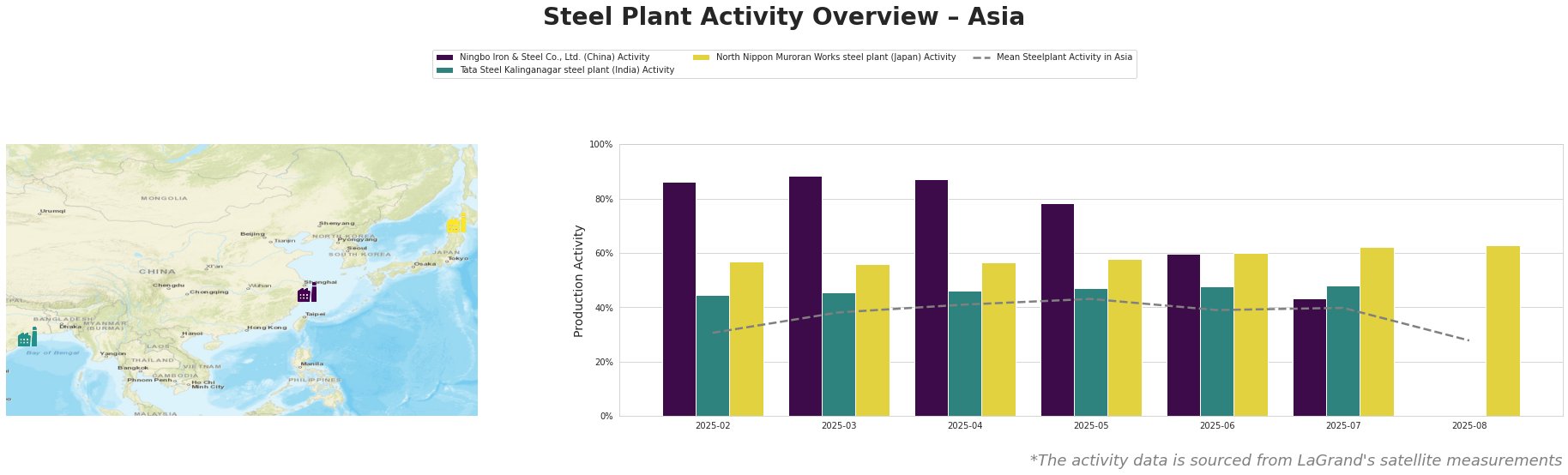

The mean steel plant activity in Asia showed an upward trend from February to May 2025, peaking at 43%, before decreasing to 28% in August. Ningbo Iron & Steel Co., Ltd. started with very high activity (86%), significantly above the Asian mean, but experienced a sharp decline, falling to 43% by July. Tata Steel Kalinganagar maintained a relatively stable activity level between 45% and 48%, consistently around the overall Asian average. North Nippon Muroran Works showed a steady increase in activity, from 57% in February to 63% in August, and performed above the Asian average.

Ningbo Iron & Steel Co., Ltd., a BF/BOF-based integrated steel plant in Zhejiang, China, producing 4 million tonnes of crude steel annually with a focus on finished rolled products including electrical steel, experienced a significant activity drop from 88% in March to 43% in July. This decline cannot be directly linked to any of the provided news articles.

Tata Steel Kalinganagar steel plant, an integrated BF/BOF plant in Odisha, India, with a 3 million tonne crude steel capacity, primarily serving the automotive sector, maintained a stable activity level. This steady activity, above the Asian average in later months, could reflect the increasing demand for automotive steel in India, possibly due to the factors mentioned in “Regarding the Expansion of Electrical Steel Manufacturing Capacity in India”.

North Nippon Muroran Works, an integrated BF/BOF/EAF steel plant in Hokkaidō, Japan, producing 2.598 million tonnes of crude steel per year, showed consistently increasing activity. While “JFE Steel reports lower net profit and sales for Q1 FY 2024-25” highlights challenges for JFE, no direct relationship can be established between the news and the plant’s rising activity levels from the given data.

Evaluated Market Implications:

The expansion of electrical steel production in India, as reported in “Regarding the Expansion of Electrical Steel Manufacturing Capacity in India” and “JSW and JFE invest $669 million to expand electrical steel production in India”, suggests a potential tightening of the market for electrical steel in the short term as new capacity comes online.

- Procurement Action: Steel buyers should consider securing long-term contracts with Indian electrical steel producers to mitigate potential supply disruptions as domestic demand increases.

- Procurement Action: Given JFE’s reported challenges (“JFE Steel reports lower net profit and sales for Q1 FY 2024-25”) and their investment in India, buyers should carefully monitor JFE’s pricing strategy and consider diversifying their sources for standard steel grades to avoid over-reliance on a potentially strained supplier.