From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Braces for Turmoil: US Tariffs Trigger Production Slowdown

Asia’s steel market faces increasing headwinds due to escalating US trade protectionism. Specifically, the impact of the “Trump ordnet neue Zölle für 67 Länder an” is potentially linked to a significant drop in regional steel plant activity observed in August. While direct links are difficult to establish for all plants, the general market sentiment is very negative amid news such as “US-Zollpolitik für die EU: “Es könnte eine weitere Runde von Zöllen geben”“.

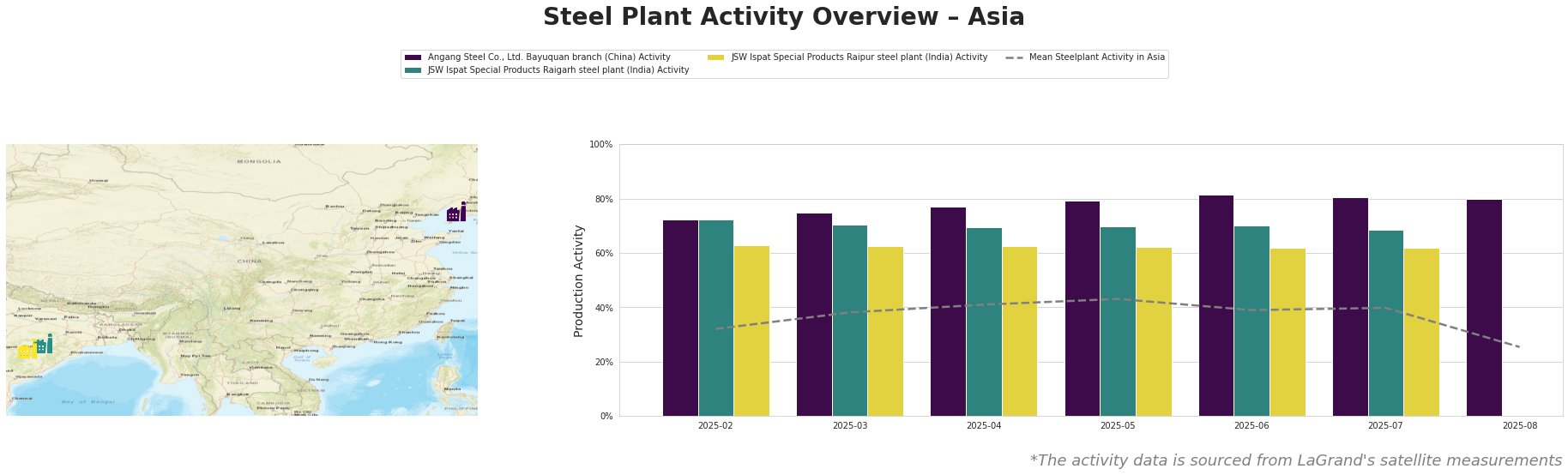

Here’s a breakdown of recent monthly activity trends:

The mean steel plant activity across Asia shows a marked decline in August, dropping from 40% in July to 25%.

Angang Steel Co., Ltd. Bayuquan branch, a major integrated BF steel producer in Liaoning, China, with a crude steel capacity of 6.5 million tonnes and responsibleSteelCertification maintained relatively high activity levels, hovering around 80% throughout the observed period. This stability contrasts with the overall market decline, but its potential exposure to tariffs imposed by the US, as outlined in “Trump ordnet neue Zölle für 67 Länder an”, may impact future production and export dynamics.

JSW Ispat Special Products Raigarh steel plant in Chhattisgarh, India, an integrated (BF/DRI) steel plant with 1.5 million tonnes of crude steel production capacity and a responsibleSteelCertification, experienced a slight decrease in activity, from 72% in February to 69% in July. The plant’s reliance on both BF and DRI production routes makes it potentially vulnerable to fluctuations in the availability and cost of iron ore and met coal. The absence of August activity data complicates the assessment of the plant’s immediate response to the recent tariff announcements, though no direct connection can be explicitly established

JSW Ispat Special Products Raipur steel plant in Chhattisgarh, India, also an integrated plant but relying on DRI, and having 1.5 million tons of crude steel capacity showed rather stable activity between 62% and 63% throughout the period. As with the Raigarh plant, no August data is available. No direct connection between recent tariff-related news and its activity level can be established

Given the decline in overall activity, particularly highlighted by the mean activity plunge in August, potentially linked to the “Trump ordnet neue Zölle für 67 Länder an” report, steel buyers should prepare for potential supply disruptions and price volatility.

Procurement Actions:

- Monitor Angang Steel’s export pricing: Given the stability of Angang Steel’s production levels while the regional market is in decline, closely monitor its export pricing, especially for container steel, pipeline steel, and ship plate, as it could be strategically positioned to fill supply gaps resulting from reduced output elsewhere.

- Seek alternative suppliers for HR plates and rebars: Considering the absence of August data for JSW Ispat Special Products plants, explore alternative suppliers for HR plates and rebars, particularly those less exposed to US tariffs, to mitigate potential supply disruptions.

- Assess inventory levels: Steel buyers should assess current inventory levels and consider increasing them strategically to buffer against potential price increases and supply chain disruptions stemming from the tariffs.