From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Set for Tariff Overhaul Amid Rising Protectionism: Act Now!

France is leading a push for increased steel import tariffs, impacting market dynamics. Recent activity data shows fluctuating output across key plants. This report analyzes the potential implications of the proposed tariff changes, referencing “France leads push for new EU steel safeguard“, “France has spearheaded an initiative for new European protective measures on steel“, “European Calls to Impose 50% Tariffs on Steel Imports“, and “France is leading the movement to introduce new steel protection measures in the EU“, alongside observed steel plant activity. While the news articles indicate policy changes, there is no immediately clear and direct link between these policy discussions and the observed plant activity data.

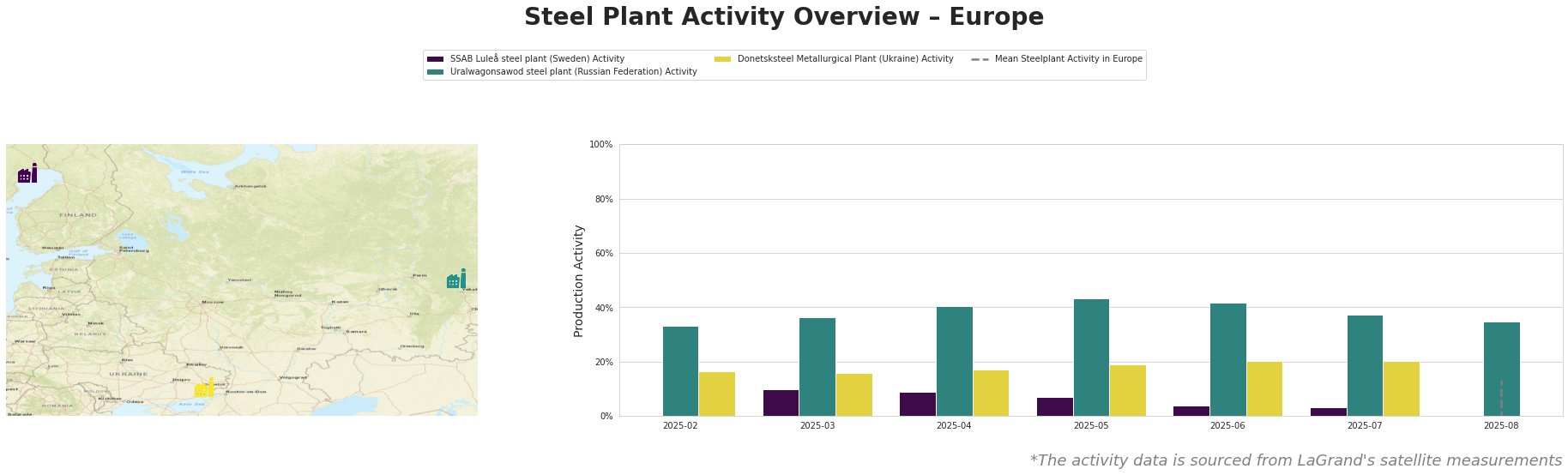

Overall, the Mean Steelplant Activity in Europe fluctuates heavily. SSAB Luleå’s activity shows a continuous decline from March (10.0%) to July (3.0%). Uralwagonsawod’s activity peaked in May at 43.0% before declining. Donetsksteel demonstrates gradually increasing activity over the observed period, reaching 20.0% in June and July.

SSAB Luleå, a Swedish integrated steel plant with a 2.3 million tonne BOF capacity producing crude, semi-finished, and finished rolled products, shows a decreasing trend in activity from March to July. Given the focus of “France leads push for new EU steel safeguard” on protecting the European steel industry, there could be a possible connection between this declining output and anticipation of future safeguard measures, though this cannot be explicitly confirmed from the data.

The Uralwagonsawod steel plant in the Russian Federation, primarily serving the defense sector, exhibited an increase in activity until May, followed by a slight decline. Given that the news articles center on EU protectionist measures, no direct connection to Uralwagonsawod’s activity can be established.

Donetsksteel Metallurgical Plant, a Ukrainian integrated plant producing pig iron, showed gradually increasing activity between February and July. No direct relationship can be established between the news articles and this upward trend, as the articles focus on EU-specific trade policy.

Given the proposed tariff implementations highlighted in “European Calls to Impose 50% Tariffs on Steel Imports” and detailed in “France is leading the movement to introduce new steel protection measures in the EU”, European steel buyers should immediately:

- Accelerate procurement: Secure necessary steel volumes ahead of the proposed January 1, 2026 implementation date to avoid potential tariff impacts.

- Diversify sourcing: Evaluate alternative steel suppliers within the EU or from countries less likely to be affected by the new tariff regime.

- Negotiate contract terms: Renegotiate existing contracts to include clauses that account for potential tariff increases and pass-through mechanisms.

- Monitor policy changes: closely monitor the European Commission’s progress in developing and implementing the new safeguard framework, as referenced in “France has spearheaded an initiative for new European protective measures on steel”. This will enable proactive adjustments to procurement strategies.