From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineFrench Steel Market Bolstered by EU Protectionism: Plant Activity Stable Amidst Trade Initiatives

France’s steel market shows positive signs, driven by protectionist measures and generally stable plant activity. The news articles “France leads push for new EU steel safeguard“, “France has spearheaded an initiative for new European protective measures on steel“, and “France is leading the movement to introduce new steel protection measures in the EU“ highlight France’s efforts to shield its steel industry from global overcapacity. While these policy initiatives indicate a proactive stance to secure domestic steel production, direct links between these initiatives and recent observed plant activity levels are currently not discernible from the provided data.

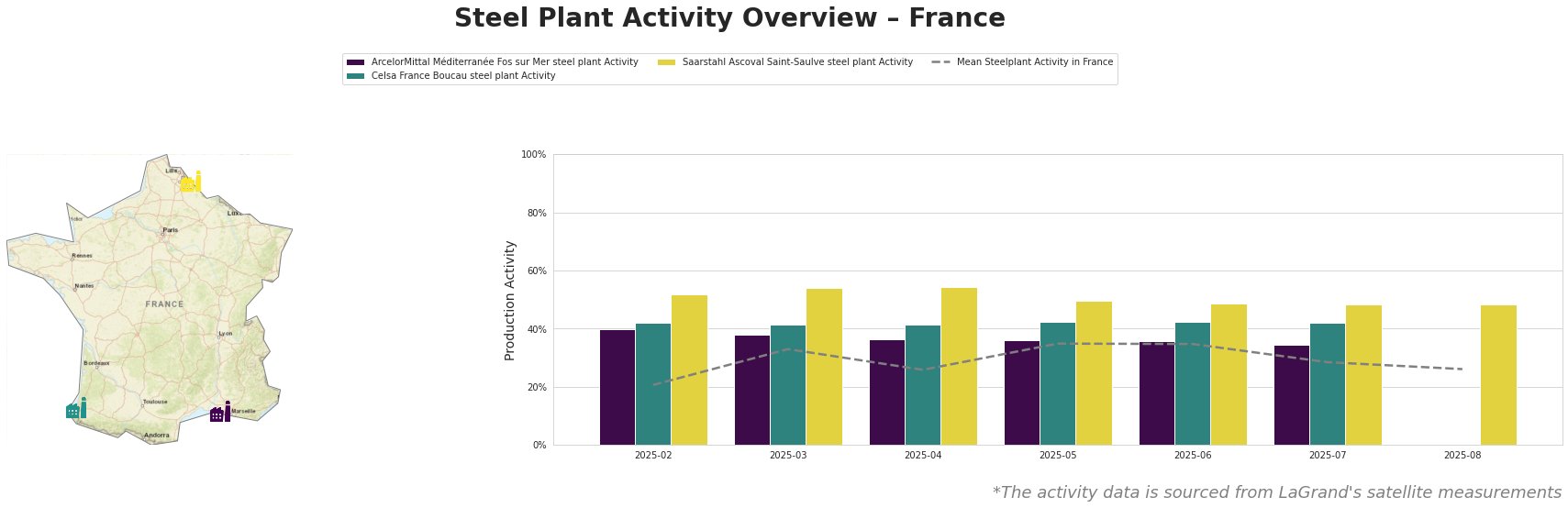

The mean steel plant activity in France has fluctuated, reaching a peak of 35% in May and June before declining to 26% in August. Saarstahl Ascoval Saint-Saulve steel plant consistently shows the highest activity levels among the observed plants, remaining above the national average. Celsa France Boucau steel plant has also maintained relatively stable activity. The most pronounced activity drop occurred at ArcelorMittal Méditerranée Fos sur Mer steel plant which operates with BOF technology and has a capacity of 4000 ttpa (crude steel & Iron) , experiencing a decrease from 40% in February to 34% in July. No direct connection can be established between this drop and the news articles about EU steel safeguards.

ArcelorMittal Méditerranée Fos sur Mer, an integrated BF-BOF plant with a 4000 ttpa crude steel capacity, focuses on semi-finished and finished rolled products for sectors like automotive and construction. Activity at this plant saw a drop from 40% in February to 34% in July. While the news articles discuss broader market protection, no specific events explained the activity drop can be explicitly tied to these announcements.

Celsa France Boucau, an EAF-based plant with a 1200 ttpa crude steel capacity, maintains a stable activity level around 42% throughout the observed period. The plant produces billets and rolled products for automotive, building, energy, and transport industries. No significant deviations are observed, and no direct connection can be established between its activity and the proposed EU steel safeguard measures.

Saarstahl Ascoval Saint-Saulve, an EAF-based plant with a 730 ttpa crude steel capacity, shows relatively stable activity, fluctuating between 54% in April to 48% in August. The plant produces continuous cast round bars, forged products, and billets. While exceeding the mean national activity, no clear connection can be established between the high activity levels or slight decline and the proposed EU safeguards.

Evaluated Market Implications:

The French initiative for new EU steel safeguards, as reported in “France leads push for new EU steel safeguard”, “France has spearheaded an initiative for new European protective measures on steel”, and “France is leading the movement to introduce new steel protection measures in the EU”, signals a potential reduction in import quotas starting January 1, 2026. This may impact steel availability from third countries.

- Procurement Action: Steel buyers relying on imports from outside the EU should proactively assess their supply chains and consider securing agreements with EU-based steel producers to mitigate potential disruptions. Given the stable activity observed at Celsa France Boucau and Saarstahl Ascoval Saint-Saulve, these plants could be potential alternative suppliers.