From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Surges Despite Global Tariff Concerns: Activity Analysis & Procurement Strategies

Asia’s steel market shows robust activity, although tempered by global trade uncertainties. ArcelorMittal’s focus on adapting to tariff pressures, as mentioned in “ArcelorMittal expects $150 million in financial losses from US tariffs,” influences regional dynamics. Satellite data provides insights into specific plant activity levels. While the news articles “ArcelorMittal produced 29.2 million tons of steel in 1H2025“ and “ArcelorMittal’s net profit rises sharply in H1 2025, growth expected despite tariff pressure” highlight increased production and profit, no immediate connection to the activity levels of the three observed steel plants can be established.

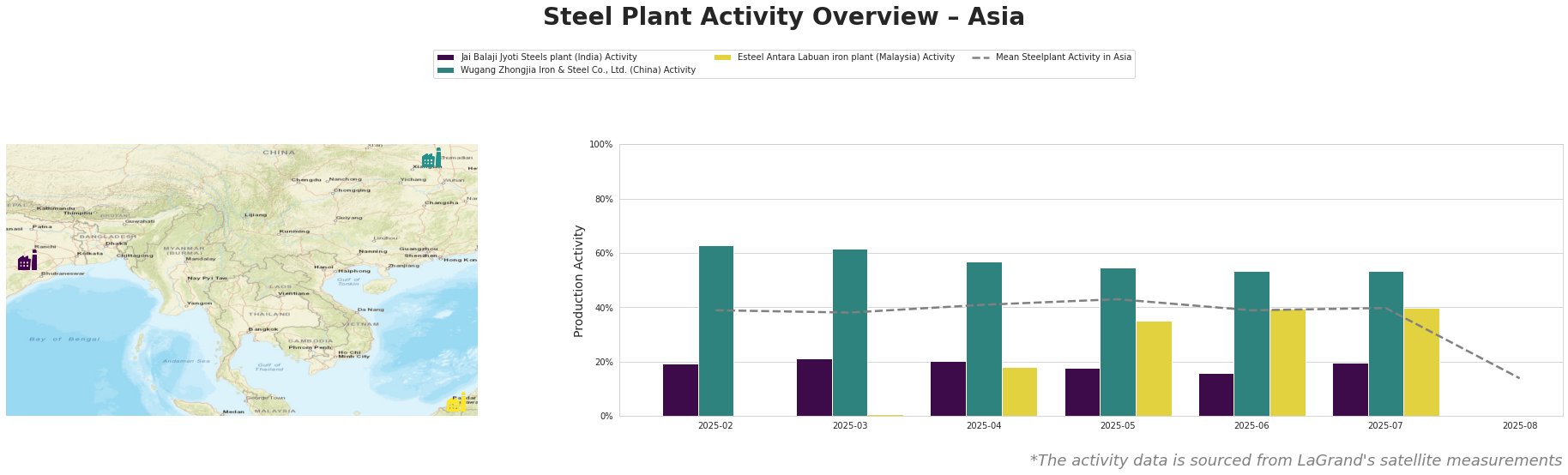

The mean steel plant activity in Asia showed a slight increase from February (39.0%) to May (43.0%), before dropping back to 39.0% and 40.0% in June and July respectively, and then experiencing a large drop to 14.0% in August.

Jai Balaji Jyoti Steels plant in India, a DRI and EAF-based plant with a 92ktpa EAF capacity and 120ktpa DRI capacity producing billets, bars, and wire rods, consistently operated below the Asian average. Activity declined from 21.0% in March to 16.0% in June, followed by a rise to 20.0% in July. No direct correlation can be established between the plant’s activity and the news articles provided.

Wugang Zhongjia Iron & Steel Co., Ltd. in China, an ironmaking facility with a 1220ktpa BF capacity, maintained a consistently high activity level above the Asian average, starting at 63.0% in February and gradually decreasing to 53.0% in July. No direct correlation can be established between the plant’s activity and the news articles provided.

Esteel Antara Labuan iron plant in Malaysia, a DRI-based plant producing HBI with a 900ktpa DRI capacity, showed a significant increase in activity, rising from 0.0% in February to 40.0% by June and remaining stable in July, approaching the overall average. No direct correlation can be established between the plant’s activity and the news articles provided.

The significant drop in average steel plant activity in August, based on the limited plants sampled, potentially indicates a broader regional slowdown, although further data is needed. Given ArcelorMittal’s strategies to mitigate tariff impacts by shifting production and potentially impacting raw material demand as described in “ArcelorMittal expects $150 million in financial losses from US tariffs,” steel buyers should:

- Monitor DRI Price Volatility: The fluctuating activity at Jai Balaji Jyoti Steels (DRI-based) and the sharp increase at Esteel Antara Labuan (DRI-based) coupled with potential shifts in ArcelorMittal’s raw material needs could indicate price shifts in DRI. Procurement professionals should closely monitor DRI pricing indices and consider hedging strategies.

- Assess Regional Supply Chains: The observed overall drop in Asian steel plant activity in August and ArcelorMittal’s strategies to realign global production present a risk of supply chain disruptions. Buyers should diversify their supplier base and evaluate alternative sourcing options within Asia.

- Evaluate Wugang Zhongjia Iron & Steel Co., Ltd. as an iron ore source: The above-average activity level between February and July (never dipping below 53%) relative to other observed steel plants coupled with iron ore demand and production raises important questions. Potential customers should make efforts to investigate them as an iron source for steel production.