From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Rebar Prices Surge Amid High Demand, Plant Activity Fluctuations

Italy’s rebar market faces rising prices and potential supply constraints as demand surges before summer shutdowns, detailed in news articles “Prices for Italian rebar are rising amid rising demand and limited supply,” “Italian domestic rebar prices continue to rise ahead of summer closures,” and “Domestic rebar prices in Italy continue to rise ahead of the summer holidays.” These price increases may be influenced by observed fluctuations in steel plant activity, as construction sites stockpile materials prior to maintenance closures, although direct causality cannot be definitively established with the available data.

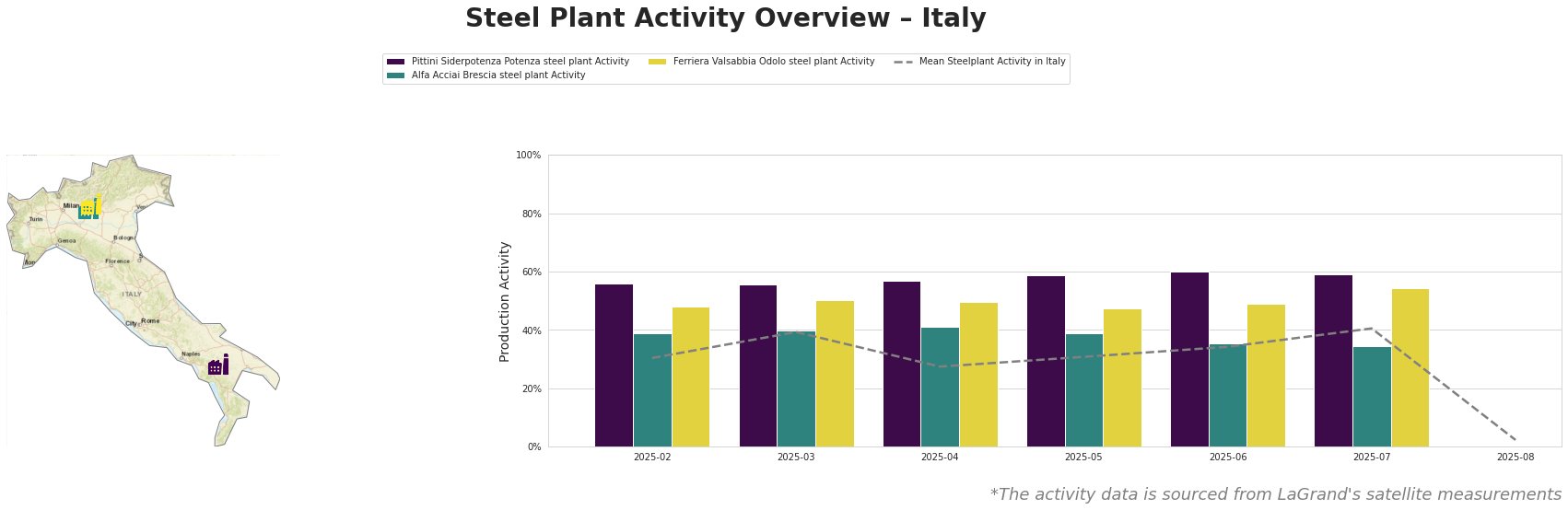

Recent activity trends across Italian steel plants:

The mean steel plant activity in Italy peaked in July at 41.0%, before plummeting to 2.0% in August, likely due to planned summer shutdowns. Pittini Siderpotenza Potenza steel plant consistently operated above the mean, peaking at 60.0% in June. Alfa Acciai Brescia steel plant showed relative stability, with a peak of 41.0% in April and a value of 35.0% in July. Ferriera Valsabbia Odolo steel plant had its highest activity in July at 54.0%. The sharp decline observed in August, according to “Italian domestic rebar prices continue to rise ahead of summer closures” and “Domestic rebar prices in Italy continue to rise ahead of the summer holidays“, is likely linked to the rush to purchase materials before mill closures.

Pittini Siderpotenza Potenza steel plant, located in the Province of Potenza, has a crude steel capacity of 700ktpa via EAF technology, focusing on rebar production for the building and infrastructure sectors. Activity at Pittini Siderpotenza Potenza remained consistently high compared to the Italian mean, reaching 60.0% in June before dropping to 59.0% in July. While production remained above the Italian mean production, no direct connection between this activity and the recent news articles regarding price increases can be explicitly established.

Alfa Acciai Brescia steel plant, situated in the Province of Brescia, has a larger crude steel capacity of 1700ktpa, also utilizing EAF technology, and produces both billets and rebar. Activity at Alfa Acciai Brescia fluctuated slightly, from 41.0% in April to 35.0% in July. No direct connection can be explicitly established between the activity levels at Alfa Acciai Brescia and the news-reported increases in rebar prices.

Ferriera Valsabbia Odolo steel plant, also located in the Province of Brescia, has a crude steel capacity of 900ktpa using EAF technology for billet and rebar production. The plant experienced an increase in activity to 54.0% in July. The increase in plant activity might reflect efforts to meet demand, as discussed in “Prices for Italian rebar are rising amid rising demand and limited supply,” but explicit causality cannot be confirmed based on available data.

The news articles “Prices for Italian rebar are rising amid rising demand and limited supply,” “Italian domestic rebar prices continue to rise ahead of summer closures,” and “Domestic rebar prices in Italy continue to rise ahead of the summer holidays” indicate potential supply disruptions due to planned summer maintenance closures and low stock levels, further exacerbated by the significant drop in mean steel plant activity in August.

Given the reported low stock levels and rising prices, steel buyers should prioritize securing rebar supply now, particularly from plants that maintained relatively higher activity levels through July, like Pittini Siderpotenza Potenza. Closely monitor price fluctuations, particularly in the Southern region where prices are already elevated.