From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: PMI Rise Fuels Optimism Despite Typhoon Threat; Iron Ore Surge Impacting Prices

In Asia, recent developments point towards a complex interplay of factors affecting the steel market. Specifically in China, activity changes are happening simultaneously as reported by “CISA: Steel prices in China soften in June, rebound in July due to talk of curbing excessive competition” and “China’s steel sector PMI increases to 50.5 percent in July 2025“. These articles report on steel prices in China and an increase of the steel sector PMI in July, suggesting an upward trend in finished steel prices. We will analyze plant activity levels alongside these reports.

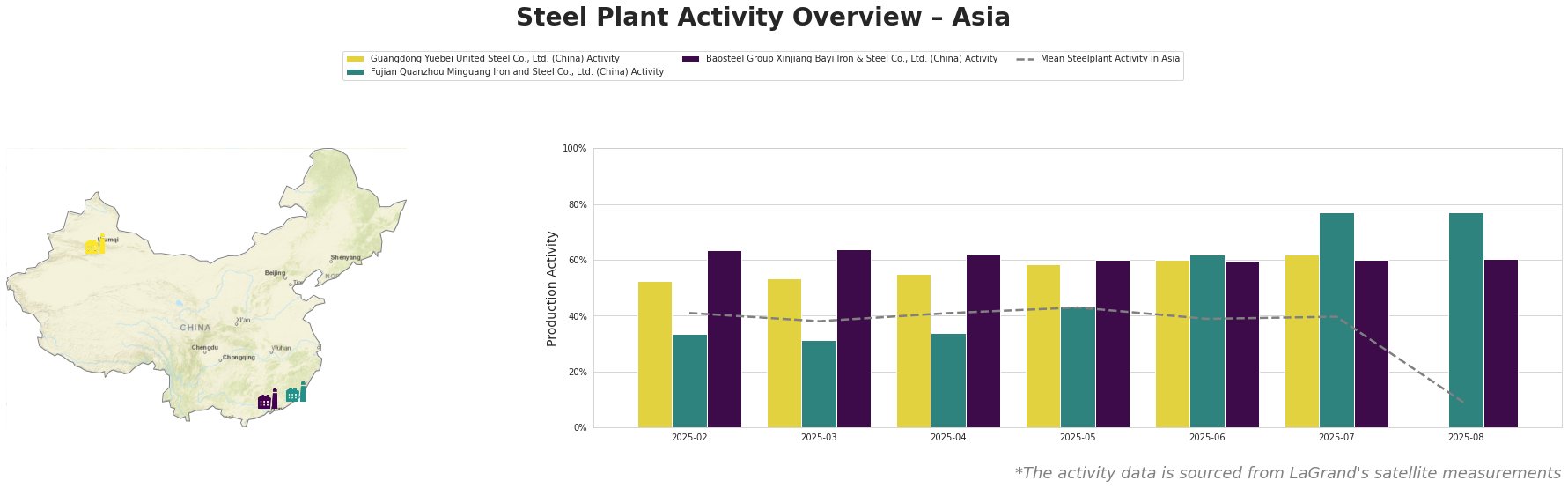

The mean steel plant activity in Asia shows a significant drop in August to 8.0%, compared to an average of around 40% in the prior months.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF-based producer of rebar for building and infrastructure, shows a steady increase in activity from February (53.0%) to July (62.0%). This increase aligns with the rebound in steel prices mentioned in “CISA: Steel prices in China soften in June, rebound in July due to talk of curbing excessive competition“, which suggests increased production in response to market demand. However, there is no activity data available for August.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., another integrated BF-based steelmaker producing round bar, high-speed bar, coiled rebar and wire rod, exhibits more significant growth, from 34.0% in February to 77.0% in July and is at the same level in August. This substantial increase suggests that this plant is capitalizing on the price rebound noted in “CISA: Steel prices in China soften in June, rebound in July due to talk of curbing excessive competition” and the rising PMI reported in “China’s steel sector PMI increases to 50.5 percent in July 2025“, indicating strong production to meet growing demand. The surge of activity could also be explained through government stimulus, as discussed in “Iron ore prices have risen by more than 10% since the beginning of July“, possibly driving demand for their products.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd., an integrated BF-based steel plant, shows a stable activity level, fluctuating between 60.0% and 64.0% from February to July. There is a reduction in activity to 60% in August. No direct connection can be established between this plant’s activity and the provided news articles, however there is a slight reduction to 60% in August.

The increased iron ore prices reported in “Iron ore prices have risen by more than 10% since the beginning of July” will likely impact all steel producers, but especially those using the BF/BOF process like Fujian Quanzhou Minguang Iron and Steel, given the high BF activity. Rising raw material costs are also mentioned in “China’s steel sector PMI increases to 50.5 percent in July 2025” suggesting an upward trend in steel prices during August.

Evaluated Market Implications:

The satellite data, in conjunction with the news articles, reveals a complex market situation. The overall average activity drop in August suggests a broad regional downturn.

- Potential Supply Disruptions: Typhoon threats as mentioned in “CISA: Steel prices in China soften in June, rebound in July due to talk of curbing excessive competition” are expected to dampen steel demand and potentially weaken prices, might be impacting production in the month of August. Buyers should be prepared for potential delivery delays from plants in affected regions.

- Procurement Actions: Given the rising iron ore prices and PMI increase, steel buyers should consider securing contracts at current prices to mitigate potential price increases in the short term. Steel buyers should closely monitor the price volatility and keep an eye on the new upcoming government policies mentioned in “Iron ore prices have risen by more than 10% since the beginning of July” that could spur infrastructure projects and further drive up steel demand.