From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: US Tariffs Threaten Supply Chain Stability Amidst Fluctuating Plant Activity

US tariff policies are casting a shadow over the Asian steel market. Heightened concerns are evident following the news that “Trump erhöht Zölle für Brasilien auf 50 Prozent | FAZ,” indicating a potential shift in global trade flows. The articles “Trumps US-Zölle im Liveticker: Außenhandelsverband kritisiert Zollabkommen mit den USA | FAZ,” “Trumps US-Zölle im Liveticker: | FAZ: Merz: Deutsche Wirtschaft wird erheblichen Schaden nehmen durch Zölle,” “Trumps US-Zölle im Liveticker: VCI: „Das Abkommen mit den USA zeigt: Augenhöhe war früher“ | FAZ,” and “Trumps US-Zölle im Liveticker: US-Finanzminister Bessent: Trump hat das „letzte Wort“ | FAZ“ collectively paint a picture of uncertainty and potential economic damage due to US trade policies. However, a direct relationship between these tariffs and observed steel plant activity levels cannot be explicitly established based on the provided information.

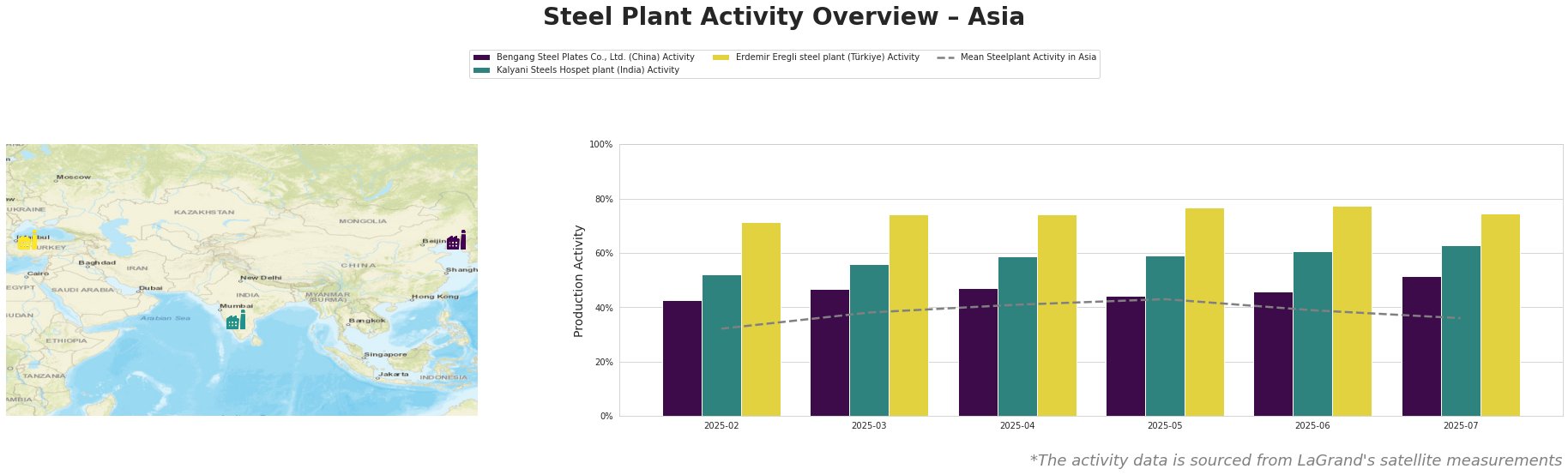

Overall, the mean steel plant activity in Asia decreased from 43% in May to 36% in July, indicating a negative trend. Bengang Steel Plates Co., Ltd. in China, an integrated BF producer with a 12.8 million tonnes crude steel capacity, experienced a drop in activity from 47% in April to 44% in May. However, the plant then reached 51% activity in July. Kalyani Steels Hospet plant in India, an integrated BF and DRI producer with 0.86 million tonnes crude steel capacity, consistently increased its activity to a peak of 63% in July. Erdemir Eregli steel plant in Türkiye, an integrated BF producer with 4 million tonnes crude steel capacity, remained relatively stable at high activity levels, fluctuating between 71% and 77%. No direct connection between these specific activity changes and the news articles regarding US tariffs can be explicitly established.

Bengang Steel Plates Co., Ltd., a major Chinese producer of automotive and home appliance plates, operates primarily using integrated BF production. Its activity saw a slight decrease from April to May. Although the company holds a Responsible Steel Certification, it seems unlikely that its production of products such as container plates is significantly impacted by US tariffs on Brazilian steel due to the geographical distance and different specialisation, although this could change in the future, depending on how international market players will seek to avoid tariffs.

Kalyani Steels Hospet plant, an integrated BF and DRI producer in India, focuses on semi-finished and finished rolled products. The plant’s activity has steadily increased over the observed period. This increase occurs despite the broader negative sentiment fueled by US tariff concerns, for which no direct link can be established.

Erdemir Eregli steel plant in Türkiye is a major producer of flat steel products, including hot and cold-rolled coils and plates. Despite the global uncertainties, its activity remained high and relatively stable. This resilience may be attributed to its focus on regional markets or specific product niches less vulnerable to US tariff policies; however, this conclusion requires further information to validate it.

Considering the news of increasing tariffs by the US, particularly the “Trump erhöht Zölle für Brasilien auf 50 Prozent | FAZ” article, steel buyers should prepare for potential supply chain disruptions. Given the reduced mean activity across Asia, buyers who rely on steel from this region should consider diversifying their sources to mitigate risks associated with potential price increases or supply shortages. Analysts should closely monitor global trade flows and price volatility, as the long-term effects of these tariffs unfold. Specific to Asia, keep a close look at market reactions of the Kalyani Steels Hospet plant (India) with its increasing activity despite a negative market environment.