From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: US Tariffs Threaten Supply Chains Amidst Fluctuating Plant Activity

Asia’s steel market is facing increasing downward pressure due to escalating US tariffs and their impact on global trade flows. The concerns raised in the “Trumps US-Zölle im Liveticker: Außenhandelsverband kritisiert Zollabkommen mit den USA | FAZ,” “Trumps US-Zölle im Liveticker: | FAZ: Merz: Deutsche Wirtschaft wird erheblichen Schaden nehmen durch Zölle,” and “Trumps US-Zölle im Liveticker: VCI: „Das Abkommen mit den USA zeigt: Augenhöhe war früher“ | FAZ“ suggest potential disruptions in steel demand and trade routes, yet a direct relationship to satellite-observed plant activities remains unclear. This is further exacerbated by the imposition of new tariffs as highlighted in “Trumps US-Zölle im Liveticker: Trump erhöht Zölle für Brasilien auf 50 Prozent | FAZ.” No direct evidence suggests the tariffs have impacted the satellite-observed plant activity.

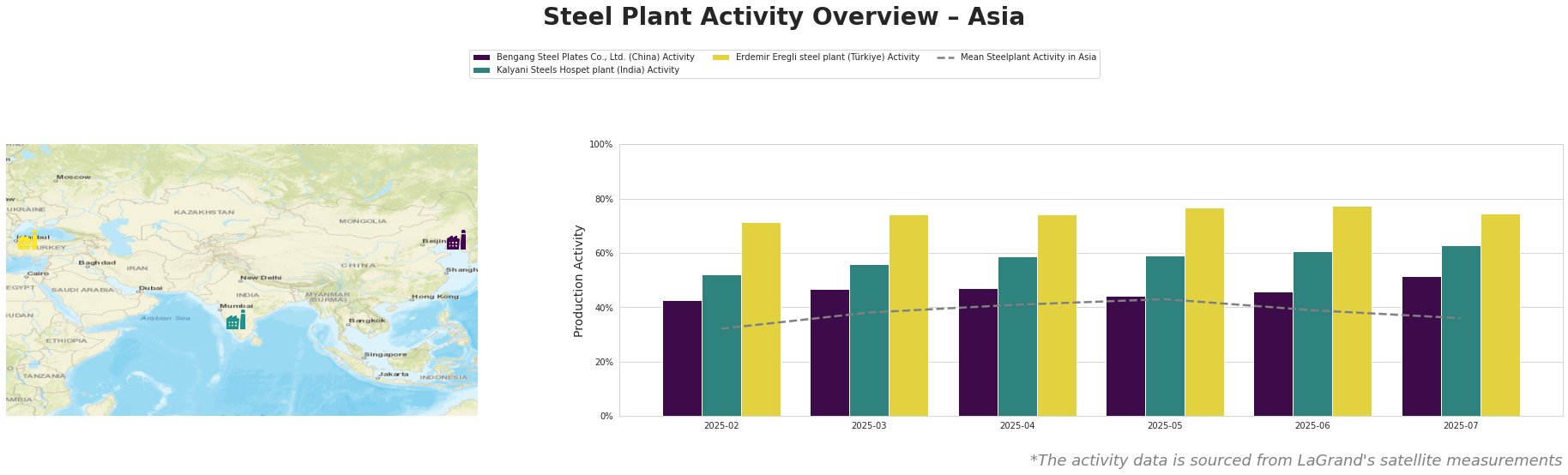

The mean steel plant activity in Asia shows a decline from 43% in May to 36% in July.

Bengang Steel Plates Co., Ltd., a major integrated BF steel producer in Liaoning, China, focusing on finished rolled products for the automotive, building, and energy sectors, experienced a decrease in activity from 47% between March and April down to 44% in May, followed by an increase to 51% in July. No direct connection between this fluctuation and the named news articles regarding US tariffs could be established based on the data available.

Kalyani Steels Hospet plant, an integrated BF and DRI-based steel plant in Karnataka, India, producing semi-finished and finished rolled products for the automotive and building sectors, showed a steady increase in activity levels, peaking at 63% in July. No direct link can be established between this activity increase and the news articles concerning US tariffs.

Erdemir Eregli steel plant, a major integrated BF steel producer in Zonguldak, Türkiye, specializing in flat steel products for various sectors, maintained relatively high activity levels, fluctuating between 71% and 77% between February and June. The activity declined to 75% in July. Similar to the other plants, no direct correlation can be identified between these fluctuations and the cited news articles.

Given the overall negative market sentiment driven by escalating US tariffs as reported in “Trumps US-Zölle im Liveticker: US-Finanzminister Bessent: Trump hat das „letzte Wort“ | FAZ,” and the observed decline in average regional steel plant activity, steel buyers should:

- Closely monitor US trade policy developments, as outlined in the FAZ live blogs, and their potential impact on steel supply chains originating from or passing through affected regions. The tariffs imposed on Brazil (“Trumps US-Zölle im Liveticker: Trump erhöht Zölle für Brasilien auf 50 Prozent | FAZ”) serve as a clear example of the unpredictable nature of these policies.

- While the satellite data do not yet show a direct impact on the selected plants, proactively diversify steel sourcing to mitigate potential supply disruptions.

- Negotiate contracts with clauses that allow for price adjustments based on tariff changes to protect against unforeseen cost increases.

- Actively monitor steel prices and market dynamics to identify potential opportunities for cost savings or alternative sourcing options.