From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePoland Steel Market Mixed: Production Rises Amidst ArcelorMittal Furnace Shutdown – Monitor Import Dynamics

Poland’s steel market presents a mixed landscape. While overall production saw a significant year-on-year increase in June, as reported in “Poland increased steel production by 25.7% y/y in June,” ArcelorMittal’s decision to temporarily shut down a blast furnace, detailed in both “ArcelorMittal temporarily shuts down blast furnace in Poland due to import pressure” and “ArcelorMittal Poland to idle BF No. 3 amid deteriorating market,” introduces complexities for steel buyers. The observed activity levels do not immediately reflect this upcoming shutdown, as the satellite data represents past activity.

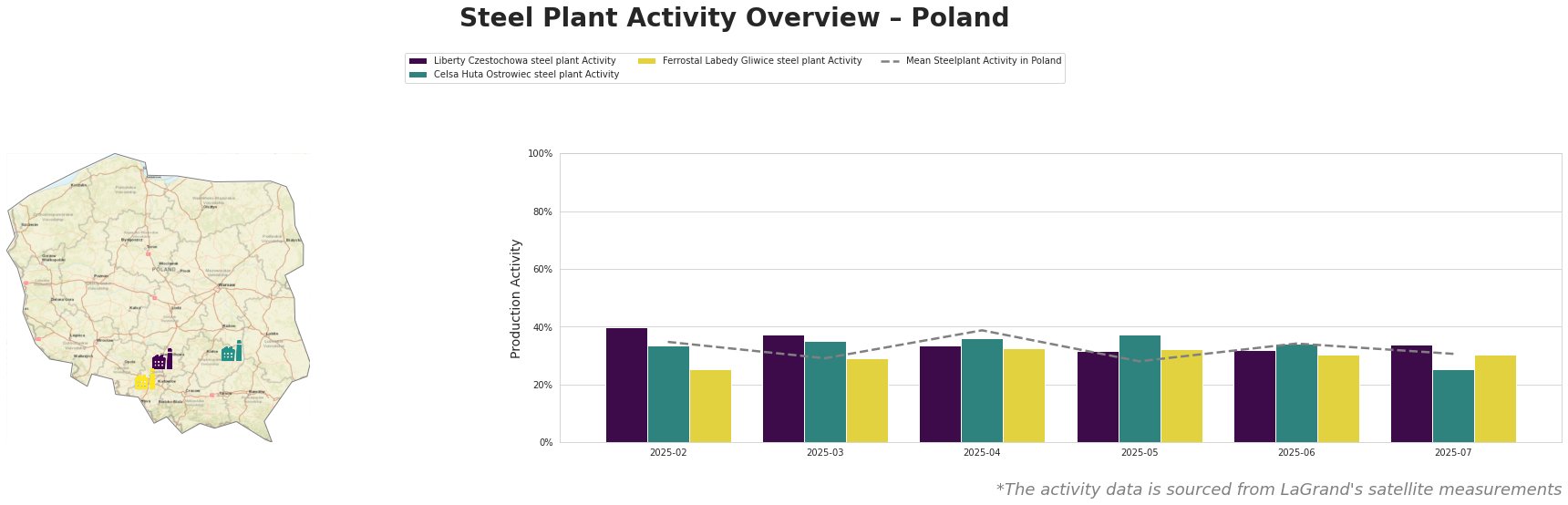

Here’s a table summarizing monthly steel plant activity in Poland:

The mean steel plant activity in Poland fluctuated between 28% and 39% from February to July 2025, with a peak in April. Celsa Huta Ostrowiec consistently showed activity levels at or above the mean, while Ferrostal Łabędy Gliwice generally operated below the average. Liberty Częstochowa steel plant also saw fluctuations, peaking in February and March before declining.

Liberty Czestochowa steel plant: This plant, located in Silesia, relies solely on EAF technology for its 840ktpa crude steel production, specializing in semi-finished products like plates. The plant holds ResponsibleSteel certification. Activity levels have declined since February (40%) to 34% in July. Despite the plant’s ResponsibleSteel certification, there is no direct evidence to link the “ArcelorMittal temporarily shuts down blast furnace in Poland due to import pressure” article to Liberty Czestochowa.

Celsa Huta Ostrowiec steel plant: Located in Świętokrzyskie, this EAF-based plant boasts a 900ktpa crude steel capacity, focusing on finished rolled products like bars and rebar for the building and infrastructure sector. Certified with ISO14001 and ResponsibleSteel, its activity reached a peak of 37% in May, then dropped to 25% in July, the lowest relative activity during the measured time frame. This drop cannot be directly connected to any of the provided news articles.

Ferrostal Labedy Gliwice steel plant: Situated in Śląskie, this plant uses EAF technology for its 500ktpa crude steel production, creating crude, semi-finished, and finished rolled products, including ingots and flat/round bars, serving diverse sectors like automotive and energy. Holding ResponsibleSteel certification, its activity remained relatively stable, between 25% and 33%, indicating a consistent operational tempo. There is no direct evidence to link the “ArcelorMittal temporarily shuts down blast furnace in Poland due to import pressure” article to Ferrostal Labedy Gliwice.

Given the planned ArcelorMittal blast furnace shutdown announced in “ArcelorMittal Poland to idle BF No. 3 amid deteriorating market,” and the fact that “Poland increased steel production by 25.7% y/y in June” highlights the rising import pressure, steel buyers should:

- Prioritize securing supply: Given that imports already constitute 80% of Poland’s steel consumption, the ArcelorMittal shutdown may further tighten domestic supply, particularly for flat steel products. Buyers should proactively engage with existing suppliers and explore alternative sourcing options to mitigate potential disruptions.

- Monitor import prices closely: The articles highlight the impact of cheap imports on ArcelorMittal’s profitability. Buyers should continuously monitor import prices from Ukraine, Serbia, and other Eastern countries to identify potential cost-saving opportunities, while remaining aware of potential trade policy changes impacting import dynamics.

- Evaluate inventory levels: Based on the shutdown announcement, procurement professionals should evaluate their existing inventory levels and adjust their purchasing strategies accordingly to ensure sufficient stock during the shutdown period and its immediate aftermath.