From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Positive Despite China Production Dip: India Rises, Emissions Concerns Emerge

Asia’s steel market shows a positive sentiment despite a nuanced landscape. Overall crude steel output in Asia decreased by 6.2%, as reported in “World crude steel output down 5.8 percent in June 2025,” largely influenced by a 9.2% drop in China’s production. This contrasts with India, which saw a significant 13.3% increase, as mentioned in the same article. While “Emissions in China’s steel sector rose by 17.3% y/y in June” details rising emissions in China, no direct link can be established with observed plant activity levels based on the provided data.

Measured Activity Overview:

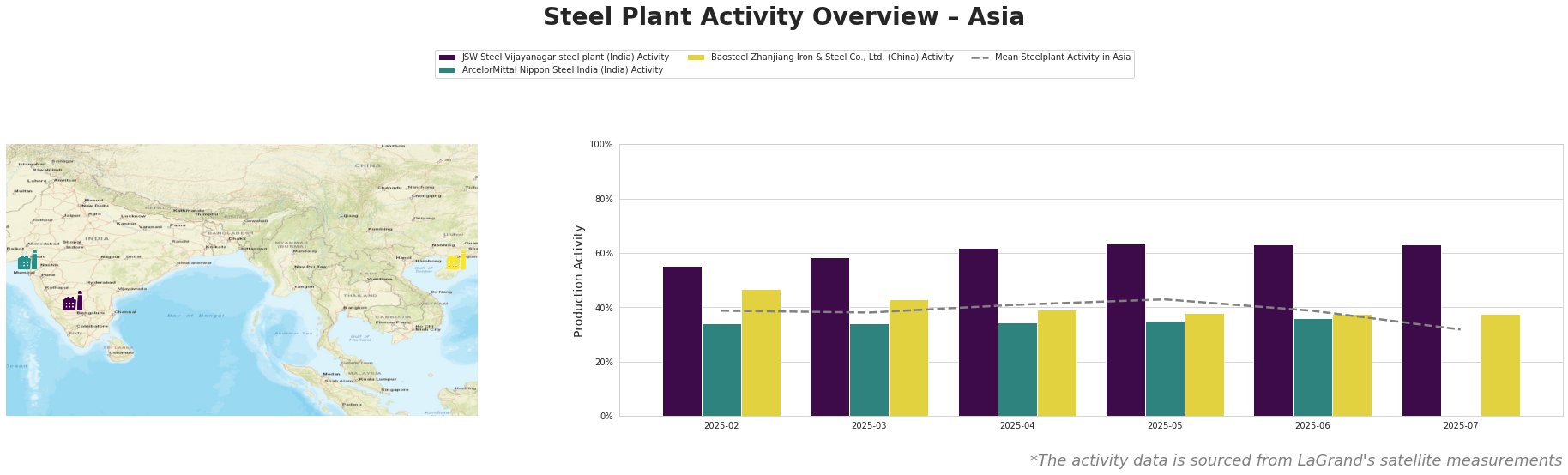

The mean steel plant activity in Asia has fluctuated, peaking at 43% in May 2025 before dropping to 32% in July 2025. JSW Steel Vijayanagar steel plant consistently operated above the mean, reaching a high of 64% in May and remaining at 63% in June and July, indicating strong performance. ArcelorMittal Nippon Steel India showed relatively stable activity around the 34-36% range. Baosteel Zhanjiang Iron & Steel Co., Ltd. exhibited a gradual decrease from 47% in February to a stable 38% from May onwards.

JSW Steel Vijayanagar, an integrated steel plant in Karnataka, India, with a 12 MTPA crude steel capacity utilizing BF, BOF, DRI and EAF technologies, has consistently outperformed the average Asian steel plant activity. Its activity level has remained high at 63% in June and July. This suggests a robust operational tempo, potentially buffering against broader regional declines reported in “World crude steel output down 5.8 percent in June 2025”.

ArcelorMittal Nippon Steel India, located in Gujarat, India, with a 9.6 MTPA crude steel capacity primarily using DRI and EAF technologies, showed stable activity levels. Observed activity remained relatively constant around 34-36%. No direct correlation can be established between its stable activity and specific news events based on the provided articles.

Baosteel Zhanjiang Iron & Steel Co., Ltd., an integrated BF-based plant in Guangdong, China, with a 12.5 MTPA crude steel capacity, saw a gradual decrease in activity from 47% in February to a stable 38% from May onwards. While “Emissions in China’s steel sector rose by 17.3% y/y in June” highlights emissions concerns in China, no direct link can be established between these emissions and Baosteel’s activity levels based on the provided data. The “World crude steel output down 5.8 percent in June 2025” reported crude steel decrease in Asia, and it is possible the observed activity is part of that trend.

Evaluated Market Implications:

The 9.2% decrease in China’s steel production reported in “World crude steel output down 5.8 percent in June 2025”, combined with the observed stabilized activity at Baosteel Zhanjiang at 38%, could indicate potential supply constraints from Chinese producers. Simultaneously, JSW Steel Vijayanagar’s consistently high activity, well above the Asian average, signifies a reliable alternative supply source within India.

Procurement Actions:

Given the potential for supply disruptions from China, steel buyers should:

- Diversify sourcing: Proactively engage with Indian suppliers like JSW Steel Vijayanagar, which demonstrates consistent high activity, to mitigate risks associated with relying solely on Chinese steel.

- Monitor Indian DRI Pricing: As ArcelorMittal Nippon Steel India is a major DRI producer, monitor the price movements of DRI-based products due to their stable steel production, as an alternative to blast furnace-produced steel, especially considering the “Global DRI output up 1.7 percent in June 2025” report.

- Negotiate contracts: Given the overall positive trend and the need to diversify sourcing options, buyers should seek competitive contracts and explore a broader set of suppliers within the Asian steel market.