From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: Energy Cost Concerns and Automotive Transition Impact Activity

Europe’s steel market faces uncertainty driven by energy cost anxieties and the evolving automotive landscape. Recent activity data presents a mixed picture, potentially influenced by concerns highlighted in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten“. While a direct, immediate causal link between this article and observed activity levels is difficult to establish definitively, the long-term implications for energy-intensive industries like steel are apparent. There is no explicitly supported connection to observed activity levels from the other named news articles.

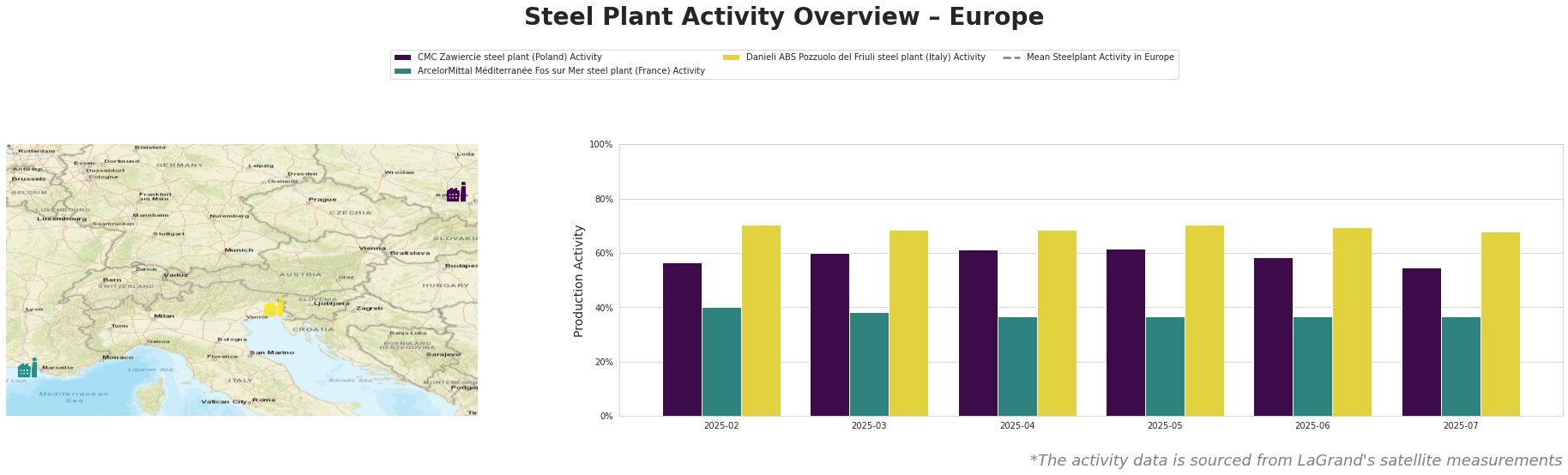

Mean steel plant activity in Europe is reported as negative values, likely indicating a data processing error, and is therefore not further considered.

CMC Zawiercie, a Polish steel plant relying on EAF technology and producing steel for diverse sectors, saw a gradual increase in activity from February to May, peaking at 62%, followed by a decline to 55% by July. The most recent activity drop may reflect market adjustments potentially related to the energy cost concerns mentioned in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten“, but a definitive connection cannot be confirmed.

ArcelorMittal Méditerranée Fos sur Mer, an integrated BF/BOF steel plant in France, showed a consistently stable, but lower, activity level fluctuating slightly between 37% and 40% throughout the observed period. This stability offers some predictability, but the plant’s reliance on BOF technology, which is slated for shutdown by 2030, suggests potential long-term supply adjustments. There’s no discernible link between the observed activity and the provided news articles.

Danieli ABS Pozzuolo del Friuli, an Italian EAF-based steel plant, maintained a consistently high activity level between 68% and 70%. This suggests stable operations, potentially due to efficient EAF technology. No direct correlation between its activity levels and the provided news articles can be established.

Evaluated Market Implications:

The gradual decline in activity at CMC Zawiercie, coupled with widespread energy cost concerns as reported in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten“, raises potential supply risk for steel buyers sourcing from Polish EAF-based mills.

Procurement Action: Buyers relying on CMC Zawiercie, or similar EAF-based mills in regions with high energy costs, should proactively:

- Diversify supply: Establish relationships with alternative steel suppliers, particularly those utilizing more energy-efficient technologies or operating in regions with more stable energy costs. Prioritize suppliers with ResponsibleSteel Certification.

- Negotiate contract terms: Review and potentially renegotiate existing contracts to include clauses that address potential energy cost fluctuations and their impact on steel prices.

- Monitor energy market developments: Closely monitor energy market trends, particularly in Poland, to anticipate potential cost increases and adjust procurement strategies accordingly.