From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Poised for Growth: Metinvest Investments Drive Optimism Despite Regional Variations

Ukraine’s steel sector shows promising signs of recovery and modernization, evidenced by significant investment plans and increasing plant activity. “Ukraine’s Interpipe to invest $120 million in wheel production by 2032” signals long-term confidence in domestic manufacturing. “Metinvest has attracted €24 million in foreign capital to modernize Northern Mining” highlights ongoing efforts to improve operational efficiency and environmental sustainability, although a direct link to the recent activity observations cannot be definitively established.

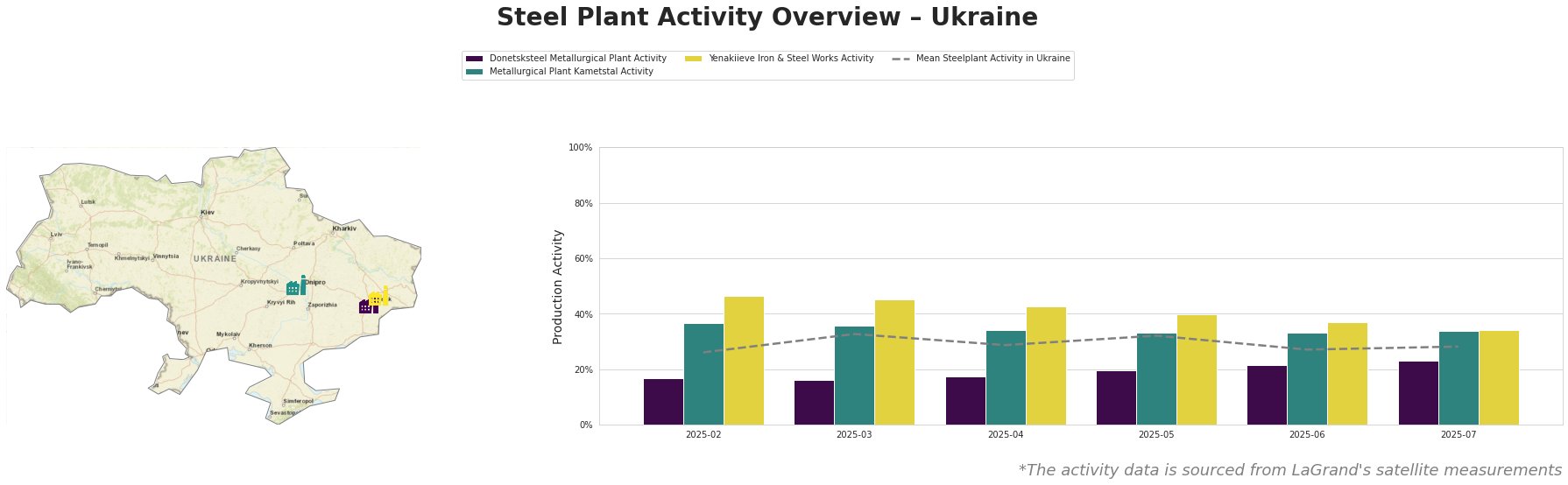

The following table outlines the monthly aggregated activity percentages for key Ukrainian steel plants:

The overall mean steel plant activity in Ukraine fluctuated between 26% and 33% from February to July 2025. Donetsksteel Metallurgical Plant consistently operated below the national average, peaking at 23% activity in July. Metallurgical Plant Kametstal, a major integrated producer with a 4.2 million tonne crude steel capacity, generally operated above the average, remaining relatively stable between 33% and 37% activity levels during the period. Yenakiieve Iron & Steel Works, another integrated plant, showed the highest activity levels, starting at 46% in February and gradually declining to 34% by July. The observed increase of Donetsksteel Metallurgical Plant in July, combined with recent news of “Metinvest has become the leading business investor in education in Ukraine“, may signal renewed investment in the region, though a direct operational link is speculative.

Donetsksteel Metallurgical Plant, primarily a pig iron producer with a 1.5 million tonne capacity, has consistently shown the lowest activity levels compared to other plants in Ukraine. Despite a slight increase to 23% in July 2025, its activity remains significantly below the national average. This could be attributed to its location in the Donetsk region, potentially impacting operations, however, no direct connection can be drawn with any of the named news items. The plant features integrated (BF) production and has an EAF that is currently mothballed.

Metallurgical Plant Kametstal, situated in Dnipropetrovsk, is a major integrated steel producer with a crude steel capacity of 4.2 million tonnes. The plant’s activity levels have remained relatively stable, averaging around 35% during the observed period. Kametstal’s consistent activity, above the national average, reflects its importance in producing semi-finished and finished rolled products for the energy and transport sectors, including square billets, wire rods, and rails. No direct link can be established with any of the named news items, although Metinvest’s investment may relate to the plant’s continued operations.

Yenakiieve Iron & Steel Works, also located in the Donetsk region with a 3.3 million tonne crude steel capacity, initially displayed the highest activity among the monitored plants but experienced a consistent decline from 46% in February to 34% in July. The observed decrease might indicate operational challenges or adjustments in production strategy, but there is no direct relationship that can be established with the named news articles. This integrated plant produces semi-finished and finished rolled products such as rebar, wire rods, and structural sections.

Given the ongoing modernization efforts at Northern Mining reported in “Metinvest has attracted €24 million in foreign capital to modernize Northern Mining”, steel buyers should anticipate potential temporary disruptions in iron ore supply during the implementation phase. While Kametstal’s activity is stable, procurement professionals should closely monitor Yenakiieve Iron & Steel Works’ production trends and regional developments, considering diversifying their supply sources or negotiating flexible delivery schedules to mitigate potential risks arising from the observed activity decline. The investment plans of Interpipe detailed in “Ukraine’s Interpipe to invest $120 million in wheel production by 2032” also indicates that there could be a higher demand for steel products suitable for wheel production, this might lead to a slight price increase in the long run for these specific steel products.