From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: Rebar Prices Up in China, Turkish Plant Activity Stable

Asia’s steel market exhibits a very positive sentiment, driven by rising rebar prices in China. According to “NBS: Local Chinese rebar prices up 1.7 percent in mid-July,” local Chinese rebar prices increased significantly. However, no direct relationship between these rising prices and observed plant activity can be established from the provided data. News about US price changes (Nucor lowered prices for hot-rolled coil by $10/t and “American rebar producers have raised prices by $60/t“) does not seem to have a direct impact on the market in Asia.

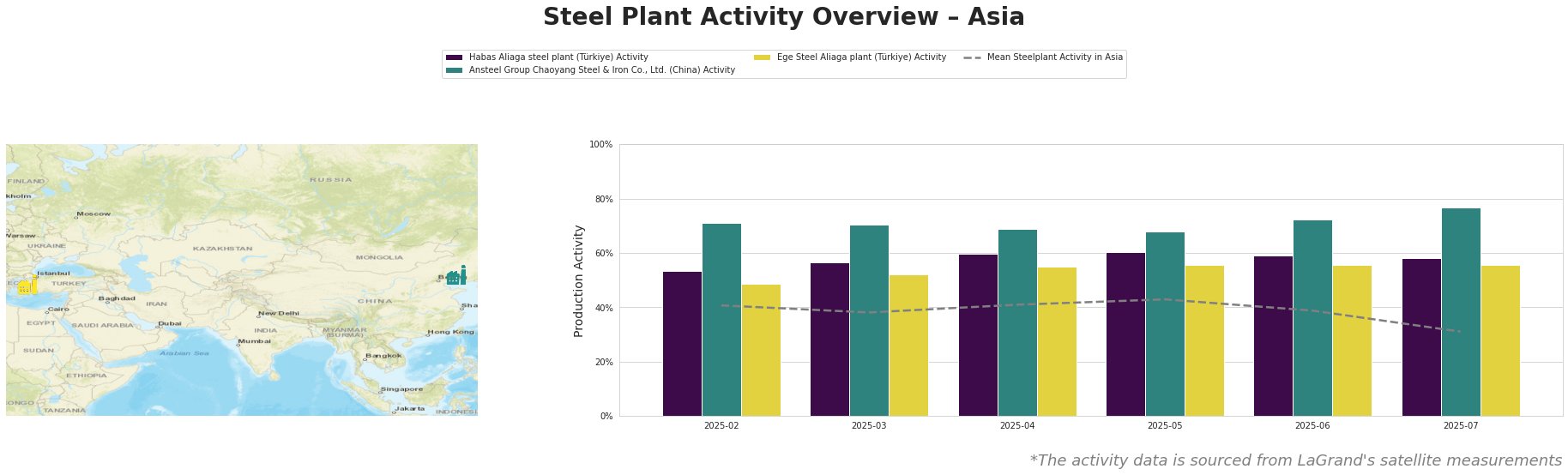

Overall, steel plant activity in Asia saw a significant drop in July to 31%, driven primarily by a drop in activity for all of the Turkish steel plants.

From February to June, the mean steel plant activity in Asia has fluctuated but remained relatively stable.

Habas Aliaga, an EAF-based steel plant located in İzmir, Türkiye, with a 4.5 million tonnes crude steel capacity, focuses on semi-finished and finished rolled products like billets, slabs, rebar, wire rod, and hot rolled coil. The plant’s activity has shown relative stability, ranging from 53% to 60% between February and June, ending with a notable drop to 58% in July. No direct link between this plant’s production and the news articles provided could be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., situated in Liaoning, China, operates as an integrated BF-BOF steel plant with a 2.1 million tonnes crude steel capacity, producing finished rolled products, including steel plate and pipes. This plant has shown a very high and relatively stable activity level, starting at 71% in February, reaching a peak of 77% in July. This high activity level could relate to the reported rise in rebar prices, but no definite connection can be established.

Ege Steel Aliaga, an EAF-based plant in İzmir, Türkiye, produces rebar and wire rod with a capacity of 2 million tonnes of crude steel. Its activity has been gradually increasing from 49% in February to 56% in May and June, stabilizing at 56% in July. This drop in activity in combination with the Habas Aliaga steel plant activity drop, contributes significantly to the overall average activity drop in Asia, however no direct link between this plant’s production and the news articles provided could be established.

Evaluated Market Implications:

The “NBS: Local Chinese rebar prices up 1.7 percent in mid-July” announcement coupled with the sustained high activity at Ansteel Group Chaoyang, despite an overall activity drop, indicates a potentially tighter rebar supply within China.

Recommendation for steel buyers and analysts: Given the rising rebar prices in China, buyers should explore securing rebar supply contracts well in advance to mitigate potential cost increases. Monitor Ansteel Group Chaoyang’s output closely as a key indicator of regional supply dynamics. While Turkish plant activity is stable, the lack of a clear upward trend suggests limited immediate impact on global supply.