From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Investments Signal Strong European Steel Demand: Activity Trends Mixed

In Europe, positive investment news from Ukraine contrasts with mixed steel plant activity levels, indicating a complex market dynamic. “Ukraine’s Interpipe to invest $120 million in wheel production by 2032” and “Metinvest has attracted €24 million in foreign capital to modernize Northern Mining” signal confidence in the region’s long-term steel demand, despite the ongoing conflict. However, direct links between these investments and specific satellite-observed activity changes at Western European steel plants cannot be explicitly established from the provided data.

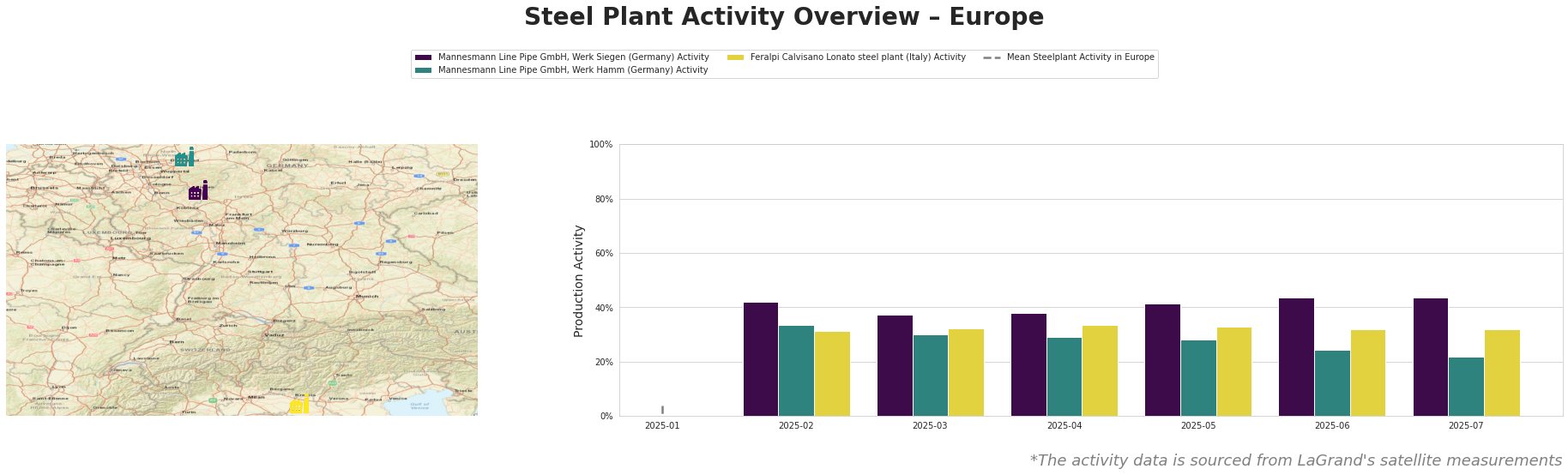

The reported mean steel plant activity in Europe exhibits irregularities and therefore does not allow for any reliable trend analysis. Mannesmann Line Pipe GmbH, Werk Siegen, an EAF-based pipe producer, shows a generally stable activity level with a peak at 44% in June and July. Mannesmann Line Pipe GmbH, Werk Hamm, also an EAF-based pipe producer, reveals a declining trend, falling from 34% in February to 22% in July. Feralpi Calvisano Lonato, an EAF-based billet producer, maintained a relatively steady activity around 32-33% throughout the observed period. No direct link between the observed activity levels and the Ukrainian investment news can be established.

Mannesmann Line Pipe GmbH, Werk Siegen, specializes in pipes using EAF technology. Activity at this plant has been relatively stable, reaching 44% in June and July. There is no apparent connection between this plant’s activity and the Ukrainian investment announcements.

Mannesmann Line Pipe GmbH, Werk Hamm, produces pipes using EAF technology. The plant’s activity has shown a declining trend, from 34% in February to 22% in July. No direct correlation between this decline and the Ukrainian investment news is evident.

Feralpi Calvisano Lonato, an EAF-based billet producer with a capacity of 600,000 tons of crude steel, has maintained a stable activity level around 32-33%. Feralpi’s ResponsibleSteel certification underscores its commitment to sustainable practices. No direct link can be made between the Ukrainian investment and the plant’s activity trends.

The news that “Metinvest has become the leading business investor in education in Ukraine” underscores the company’s commitment to the region despite ongoing challenges. While positive for the long-term economic outlook, this investment in education has no directly observable impact on current steel production activity at the plants observed here.

Given the planned investments by Interpipe and Metinvest in Ukraine, procurement professionals should closely monitor steel and wheel markets for potential medium-term supply shifts as Ukrainian production capacity modernizes and expands. While the observed activity declines at Mannesmann Line Pipe GmbH, Werk Hamm, could potentially indicate capacity adjustments, the lack of a direct, explicitly established connection to the Ukrainian investments requires a cautious approach. Diversifying suppliers and closely tracking developments in Ukrainian steel production will be crucial for mitigating potential supply chain risks. The steady activity at Feralpi Calvisano Lonato, coupled with its ResponsibleSteel certification, could represent a stable, sustainably conscious supply option.