From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in Japanese Steel: Trade Deal Optimism vs. Business Gloom, Plant Activity Varies

Japan’s steel market presents a mixed picture. While the “Businesses deliver gloomy results even as markets celebrate Japan trade deal” article highlights ongoing challenges from trade wars impacting various sectors, including steel, “Easing Trade Tensions Boost Stocks but Chip Stocks Slide” indicates potential relief from the Japan trade deal. Satellite data reveals varied activity levels across steel plants, but a direct link between these levels and the news articles cannot be explicitly established.

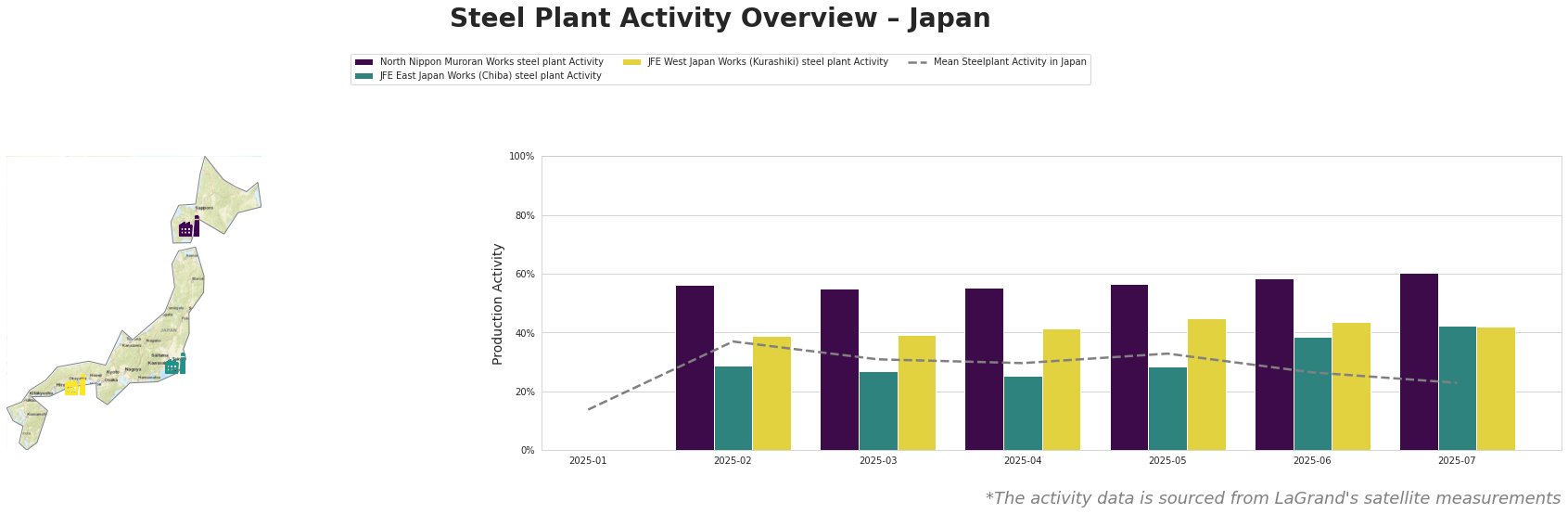

The mean steel plant activity in Japan started at a low of 14% in January, peaking at 37% in February, then gradually declined to 23% by July. North Nippon Muroran Works consistently operated above the national average, increasing steadily from 56% in February to 60% in July, which is a notable high relative to its history. JFE East Japan Works (Chiba) and JFE West Japan Works (Kurashiki) showed fluctuations, with activity peaking in June and May, respectively, but ended at similar levels in July (42%). No direct correlation between these specific plant activity fluctuations and the news articles can be established.

North Nippon Muroran Works, located in Hokkaidō, is an integrated steel plant with a crude steel capacity of 2598ktpa, utilizing both BOF (1448ktpa) and EAF (1149ktpa) technologies. It produces semi-finished and finished rolled products like bars and wires, primarily for the automotive sector. The plant’s activity consistently exceeds the national average and increased to 60% in July, contrasting with the overall decline across Japan. No connection between this high level of activity and the cited news articles could be established.

JFE East Japan Works (Chiba), situated in Kantō, is an integrated BF-BOF steel plant producing 4500ktpa of crude steel. Its product portfolio includes stainless steel, pipes, sheets, and plates for building & infrastructure, automotive, and other sectors. The satellite-observed activity increased to 42% in July, from 29% in February, after a mid-period slump. A direct link to the provided news articles is not evident.

JFE West Japan Works (Kurashiki), located in Chūgoku, is an integrated BF-BOF steel plant with a large crude steel capacity of 10000ktpa. Its product range is diverse, including hot-rolled, cold-rolled, and coated sheets, plates, and structural sections, serving automotive, building, energy, and other industries. The plant’s activity reached 45% in May, and declined to 42% in July. No explicit link between the provided articles and the plant’s activity can be established.

Given the “Businesses deliver gloomy results even as markets celebrate Japan trade deal” article highlighting continued business struggles despite trade deal optimism and the observed overall decline in mean steel plant activity in Japan, steel buyers should:

- Closely monitor North Nippon Muroran Works supply: Its consistent high activity levels could indicate a strategic focus or specific demand for its bar and wire products, but any disruptions could impact automotive sector supply chains. Contact the company to check if the activity observed by satellite is planned and whether it will be sustained in coming months.

- Assess JFE East Japan Works (Chiba) and JFE West Japan Works (Kurashiki) supply chain vulnerabilities: Even with activity in July, continued trade war headwinds and currency fluctuations reported in “Businesses deliver gloomy results even as markets celebrate Japan trade deal” article could pressure output if the problems continue. Ensure contracts have flexibility to cover disruptions.