From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Production Plunges: Demand Slump and Production Cuts Impact Market

China’s steel sector faces significant headwinds, with production cuts driven by weak domestic demand and government policies. “China reduced steel production by 9.2% y/y in June” and “China’s crude steel output in June lowest so far this year, down 3% in H1″ directly reflect the observed declines in plant activity. However, the news article stating “China’s steel exports up 9.2 percent in H1, but June volume below 10 million mt” is related to satellite-observed changes in activity in a complex way, since export increases may buffer against drops but decreased export volumes in June may worsen activity decline.

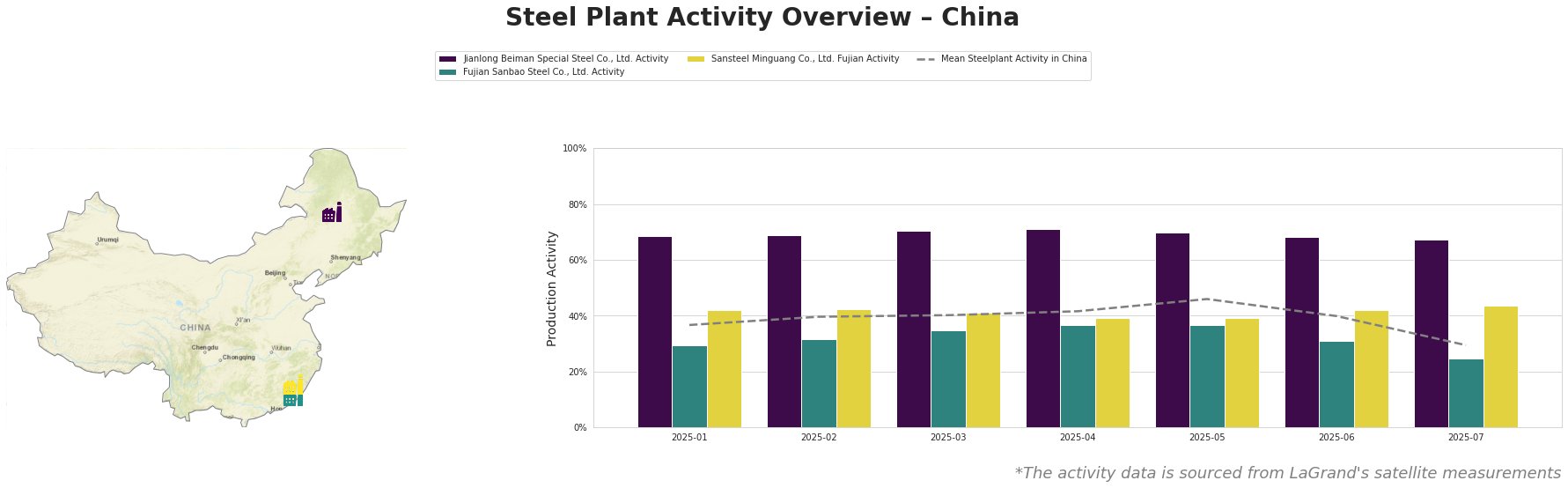

Observed monthly activity trends are shown in the table:

The mean steel plant activity in China shows a clear downward trend, falling from a high of 46.0 in May to 29.0 in July. This significant drop aligns with the reports of production cuts in “China reduced steel production by 9.2% y/y in June”. Jianlong Beiman Special Steel Co., Ltd. shows relatively high activity compared to the mean, but has also declined from 71.0 in April to 67.0 in July. Fujian Sanbao Steel Co., Ltd. Activity experienced a sharp drop to 25.0 in July, mirroring the overall negative trend. Sansteel Minguang Co., Ltd. Fujian Activity is showing higher activity in July, going up to 44.0.

Jianlong Beiman Special Steel Co., Ltd., located in Heilongjiang, is an integrated steel plant with a crude steel capacity of 2.2 million tons, producing semi-finished and finished rolled products like stainless heat-resistant steel and bearing steel. The plant’s activity has remained relatively stable but decreased from 71.0 in April to 67.0 in July. While a definitive link cannot be established, this decrease could be partially attributed to the wider production declines outlined in “China reduced steel production by 9.2% y/y in June”.

Fujian Sanbao Steel Co., Ltd., situated in Fujian, is an integrated steel plant with a crude steel capacity of 4.62 million tons, manufacturing products including corrosion-resistant hot-rolled coils and steel strands. Its activity has decreased to 25.0 in July after a peak in April (37.0). This drop in activity potentially relates to production cuts impacted by weak local demand mentioned in “China’s crude steel output in June lowest so far this year, down 3% in H1“.

Sansteel Minguang Co., Ltd. Fujian, another integrated steel plant in Fujian with a large crude steel capacity of 6.8 million tons focused on finished rolled products, has seen an increase in activity in July, going up to 44.0, counter to the trend of the other plants observed. No direct connection to news articles can be established to explain this diverging development.

The observed drop in activity, coupled with the news of production cuts and export fluctuations, suggests potential supply disruptions, particularly impacting regions where activity has declined sharply, such as Fujian Sanbao Steel Co., Ltd.

Recommended Procurement Actions:

- For steel buyers heavily reliant on supply from Fujian Sanbao Steel Co., Ltd.: Given the sharp decline in activity at Fujian Sanbao Steel Co., Ltd. and the general reduction in China’s steel production (as reported in “China reduced steel production by 9.2% y/y in June”), buyers should proactively secure alternative supply sources. This is to mitigate potential delays or shortages.

- For analysts monitoring export trends: Closely track Vietnam’s tariff policies on Chinese steel, as highlighted in “China’s steel exports up 9.2 percent in H1, but June volume below 10 million mt”. Any increase in protectionist measures could further impact export volumes and exacerbate domestic market pressures, leading to additional production adjustments.

- Buyers should track domestic production policies: Government policies aimed at curbing overproduction and reducing reliance on heavy industry, as mentioned in “China reduced steel production by 9.2% y/y in June”, are impacting steel production in China, so continued tracking of policies is recommended.