From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Optimistic Despite Trade Uncertainty: Nucor Activity Divergence Signals Regional Supply Dynamics

North America’s steel market shows positive sentiment amid broader economic developments. The overall optimism, reflected in the article “World shares mostly gain after Wall Street logs a 3rd straight winning week,” contrasts with uncertainties introduced by protectionist trade measures mentioned in “Wall St futures rise on trade hope; earnings kick into high gear” and “Stocks Set to Open Higher as Investors Await U.S. Economic Data and Tech Earnings, Trade Talks in Focus“. Observed activity changes show a regional divergence, but no immediate link to the stock market situation.

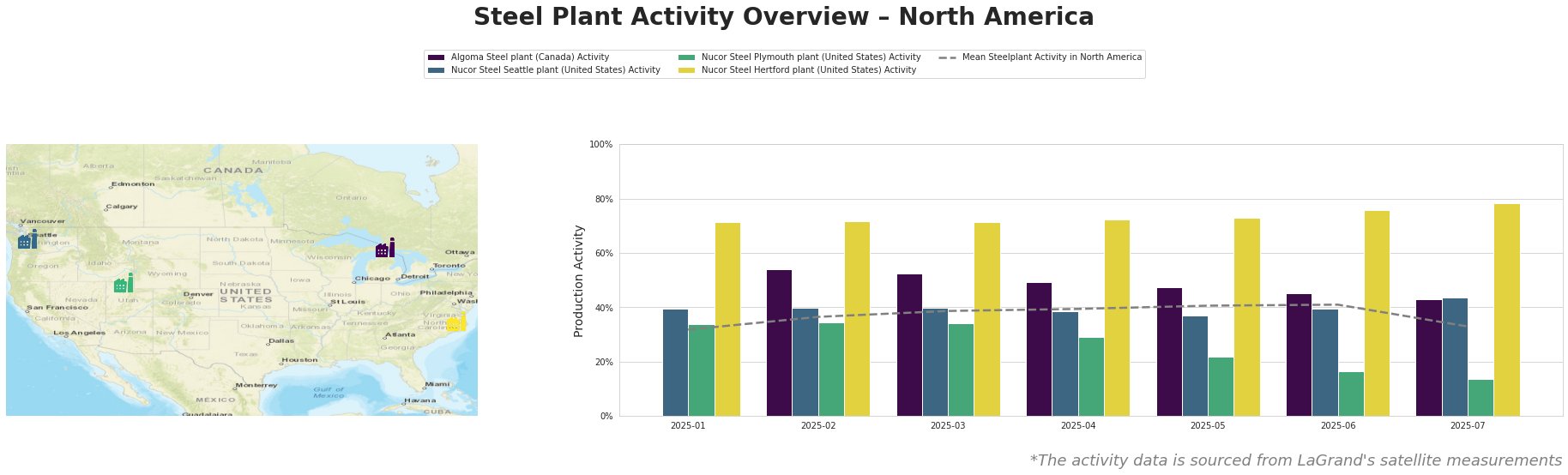

The table shows a decline in the average steel plant activity in North America during July. Algoma Steel, Nucor Seattle, and Nucor Plymouth plants all experienced a decrease in activity, while Nucor Hertford increased. The average North American steel plant activity peaked in May/June (41.0%) before dropping to 33.0% in July. Nucor Hertford consistently operated well above the average, while Nucor Plymouth operated consistently below the average.

Algoma Steel, located in Ontario, Canada, is an integrated steel producer with a crude steel capacity of 2800 ttpa, primarily using basic oxygen furnace (BOF) technology. The plant’s activity has decreased steadily from 54.0% in February to 43.0% in July. No explicit connection can be established between Algoma Steel’s declining activity and the news articles, though the article “Wall St futures rise on trade hope; earnings kick into high gear” mentions potential tariffs from President Trump targeting countries like Canada, which could indirectly affect the plant’s operations.

Nucor Steel Seattle, an EAF-based plant in Washington, United States, focuses on finished rolled bar products with a crude steel capacity of 855 ttpa. Its activity fluctuated, dropping from 40.0% in March to 37.0% in May, rising to 44.0% in July. While this suggests a potential localized upswing, no direct link to specific news events can be clearly established.

Nucor Steel Plymouth, located in Utah, United States, produces finished rolled bar products using EAF technology and has a crude steel capacity of 908 ttpa. The plant’s activity has decreased significantly and consistently from 35.0% in February to 14.0% in July, considerably below the average. The timing of the production cutbacks at the Nucor Steel Plymouth plant cannot be tied to the provided news headlines.

Nucor Steel Hertford, an EAF-based plant in North Carolina, United States, specializes in semi-finished plate products with a crude steel capacity of 1542 ttpa. Its activity has consistently been the highest among the observed plants and continues to climb. Its activity rose from 72.0% in January to 78.0% in July, indicating strong output, with no clear connection to the news articles.

The observed activity decreases at Algoma Steel and, more significantly, at Nucor Steel Plymouth, coupled with trade uncertainties described in “Stocks Set to Open Higher as Investors Await U.S. Economic Data and Tech Earnings, Trade Talks in Focus,” suggest potential regional supply constraints, particularly in bar products.

Procurement Recommendations: Steel buyers should closely monitor spot market pricing and lead times for bar products, especially in the Western United States, due to the continued activity decline at Nucor Steel Plymouth. Consider diversifying suppliers to mitigate potential supply disruptions, and proactively negotiate contract terms to account for potential tariff-related price volatility.